Revenues Not Telling The Story For ApicHope Pharmaceutical Co., Ltd (SZSE:300723) After Shares Rise 38%

ApicHope Pharmaceutical Co., Ltd (SZSE:300723) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

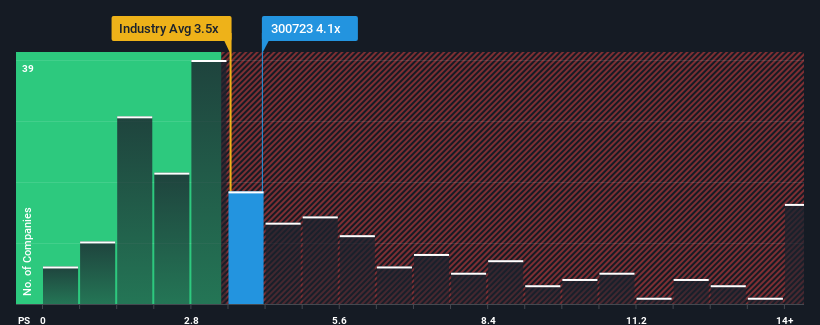

In spite of the firm bounce in price, there still wouldn't be many who think ApicHope Pharmaceutical's price-to-sales (or "P/S") ratio of 4.1x is worth a mention when the median P/S in China's Pharmaceuticals industry is similar at about 3.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for ApicHope Pharmaceutical

How ApicHope Pharmaceutical Has Been Performing

ApicHope Pharmaceutical hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think ApicHope Pharmaceutical's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For ApicHope Pharmaceutical?

ApicHope Pharmaceutical's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 19%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.7% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 34% as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 141% growth forecast for the broader industry.

With this in mind, we find it intriguing that ApicHope Pharmaceutical's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From ApicHope Pharmaceutical's P/S?

ApicHope Pharmaceutical appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that ApicHope Pharmaceutical's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 4 warning signs for ApicHope Pharmaceutical (1 is potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on ApicHope Pharmaceutical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300723

ApicHope Pharmaceutical Group

Engages in the research and development, production, and sale of pharmaceutical drugs.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives