It's Down 27% But Hainan Poly Pharm. Co., Ltd (SZSE:300630) Could Be Riskier Than It Looks

Hainan Poly Pharm. Co., Ltd (SZSE:300630) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

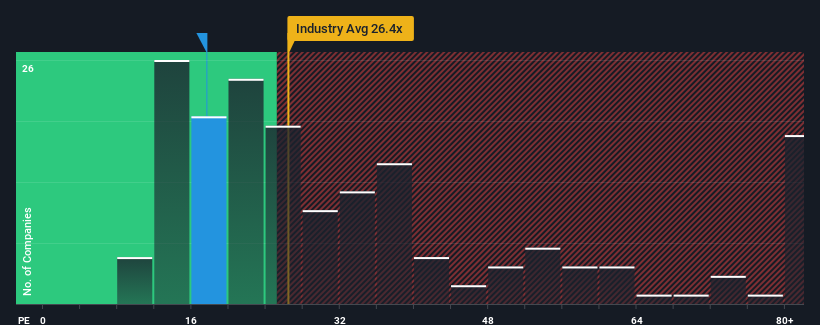

In spite of the heavy fall in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Hainan Poly Pharm as an attractive investment with its 17.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Hainan Poly Pharm could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Hainan Poly Pharm

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Hainan Poly Pharm's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. The last three years don't look nice either as the company has shrunk EPS by 5.2% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 41% as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 35%, which is noticeably less attractive.

With this information, we find it odd that Hainan Poly Pharm is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The softening of Hainan Poly Pharm's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hainan Poly Pharm currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Hainan Poly Pharm (1 doesn't sit too well with us!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Poly Pharm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300630

Hainan Poly Pharm

Engages in research, development, production, and sale of pharmaceutical drugs in China and internationally.

Medium-low and slightly overvalued.

Market Insights

Community Narratives