- Japan

- /

- Auto Components

- /

- TSE:6209

Undiscovered Gems With Promising Potential For February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and near-record highs in major U.S. stock indexes, small-cap stocks have been trailing behind their larger counterparts, as evidenced by the Russell 2000 Index's recent performance. In this environment, uncovering undiscovered gems requires a keen eye for companies with strong fundamentals and the potential to thrive amid economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yunnan Nantian Electronics InformationLtd (SZSE:000948)

Simply Wall St Value Rating: ★★★★☆☆

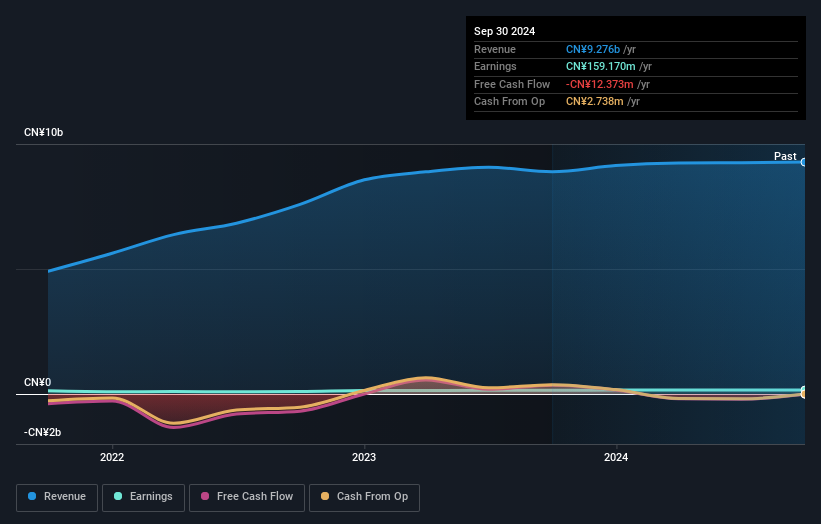

Overview: Yunnan Nantian Electronics Information Co., Ltd. operates in the software and information technology services sector with a market capitalization of approximately CN¥8.69 billion.

Operations: Nantian Electronics generates revenue primarily from its software and information technology services segment, amounting to approximately CN¥9.28 billion. The company's financial performance is characterized by a focus on this core revenue stream.

Yunnan Nantian Electronics, a relatively small player in the IT sector, has shown promising growth with earnings increasing by 7.9% over the past year, outperforming the industry average of -8.1%. Despite a satisfactory net debt to equity ratio of 10.5%, it's worth noting that this ratio has risen from 47% to 60.6% over five years. The price-to-earnings ratio stands at 54.6x, which is attractive compared to the industry average of 86.8x, suggesting potential value for investors seeking opportunities in undervalued stocks within this space. Recent board changes and share repurchase plans may further influence its strategic direction moving forward.

Medicalsystem Biotechnology (SZSE:300439)

Simply Wall St Value Rating: ★★★★★★

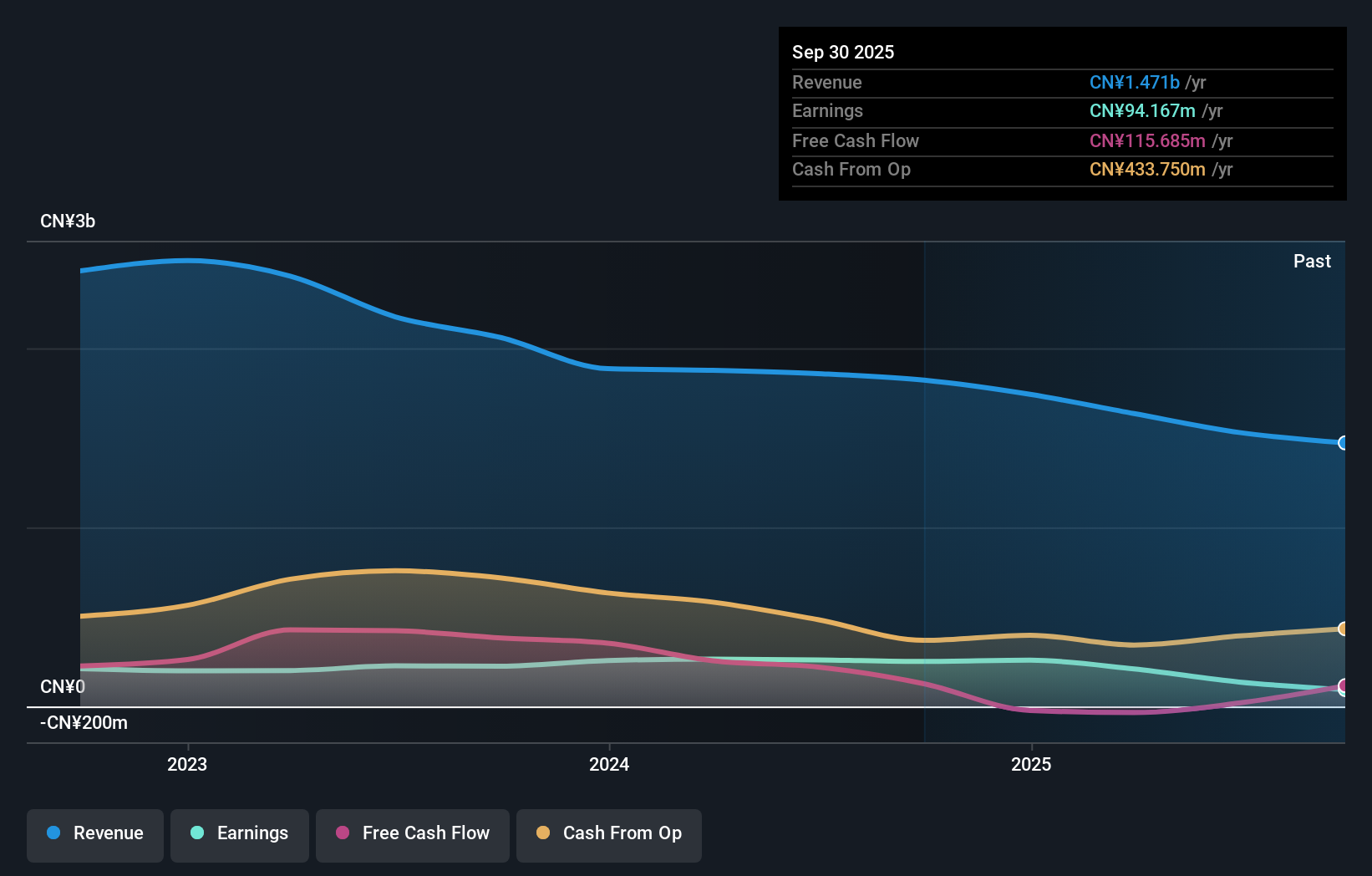

Overview: Medicalsystem Biotechnology Co., Ltd. specializes in providing clinical diagnostics reagents and instruments in China, with a market capitalization of approximately CN¥4.41 billion.

Operations: The company generates revenue primarily from the medical machinery industry, amounting to CN¥1.82 billion.

In the biotech space, Medicalsystem Biotechnology stands out with its robust earnings growth of 11.5% over the past year, outpacing the industry average of 1.3%. This smaller player boasts a favorable price-to-earnings ratio of 17.6x, significantly below the CN market average of 36.6x, suggesting potential value for investors. The company's financial health is underscored by a debt-to-equity ratio reduction from 72.8% to just 1.4% in five years and having more cash than total debt, indicating strong fiscal management and positioning it well for future endeavors in an evolving sector.

NPR-Riken (TSE:6209)

Simply Wall St Value Rating: ★★★★★☆

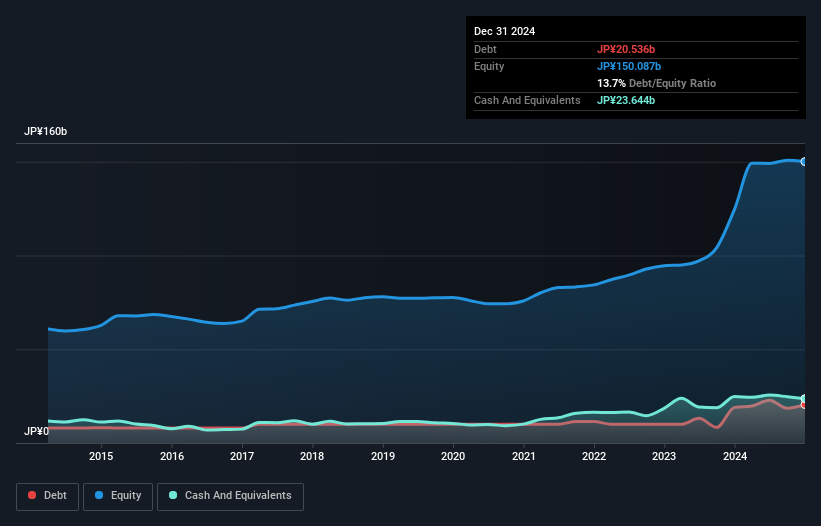

Overview: NPR-Riken Corporation, with a market cap of ¥70.40 billion, operates in the manufacturing and sales of automobile and marine engine parts both domestically in Japan and internationally.

Operations: NPR-Riken generates revenue primarily from the manufacturing and sales of automobile and marine engine parts. The company has a market cap of ¥70.40 billion, reflecting its significant presence in both domestic and international markets.

NPR-Riken, a player in the auto components sector, recently showcased an impressive earnings growth of 155%, outpacing the industry average of -9.3%. This surge was partly influenced by a ¥15 billion one-off gain, which is not part of regular operations. Despite an increase in its debt to equity ratio from 12.9% to 13.7% over five years, the company remains financially healthy with more cash than total debt and adequate interest coverage. Trading at 73% below estimated fair value suggests potential undervaluation, making it a compelling consideration for those seeking undiscovered opportunities in this space.

- Navigate through the intricacies of NPR-Riken with our comprehensive health report here.

Gain insights into NPR-Riken's historical performance by reviewing our past performance report.

Seize The Opportunity

- Discover the full array of 4725 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NPR-Riken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6209

NPR-Riken

Manufactures and sells automobile engine parts, marine engine parts, and other products in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion