- China

- /

- Consumer Services

- /

- SZSE:002607

Three High Growth Chinese Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

China's recent announcement of robust stimulus measures has significantly lifted market sentiment, with the Shanghai Composite Index climbing 12.8% and the blue chip CSI 300 soaring 15.7%. This renewed optimism provides a fertile backdrop for investors seeking high-growth opportunities. In this environment, companies with substantial insider ownership often signal strong confidence from those who know the business best. Here are three high-growth Chinese stocks where insiders have significant stakes, aligning their interests closely with shareholders.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 21.5% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 25.2% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's review some notable picks from our screened stocks.

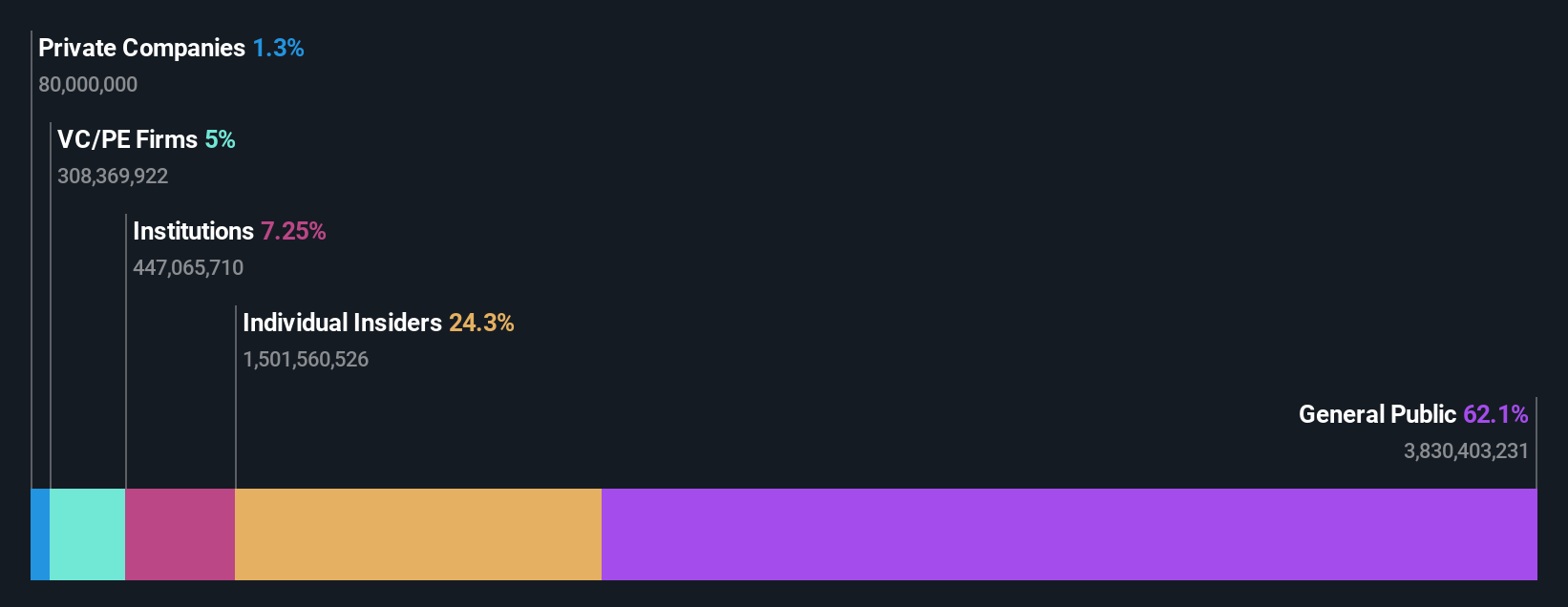

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★★★

Overview: Offcn Education Technology Co., Ltd. operates as a multi-category vocational education institution in China with a market cap of CN¥15.42 billion.

Operations: Offcn Education Technology Co., Ltd. generates revenue primarily from its education and training segment, which amounts to CN¥2.76 billion.

Insider Ownership: 25.1%

Earnings Growth Forecast: 75.7% p.a.

Offcn Education Technology reported a net income of CNY 115.9 million for H1 2024, up from CNY 81.98 million a year ago, despite a decline in sales and revenue. The company is forecast to achieve high returns on equity (40.6%) within three years and expects annual revenue growth of 20.8%, surpassing the market average of 13.1%. However, interest payments are not well covered by earnings, and its share price has been highly volatile recently.

- Click here to discover the nuances of Offcn Education Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Offcn Education Technology implies its share price may be lower than expected.

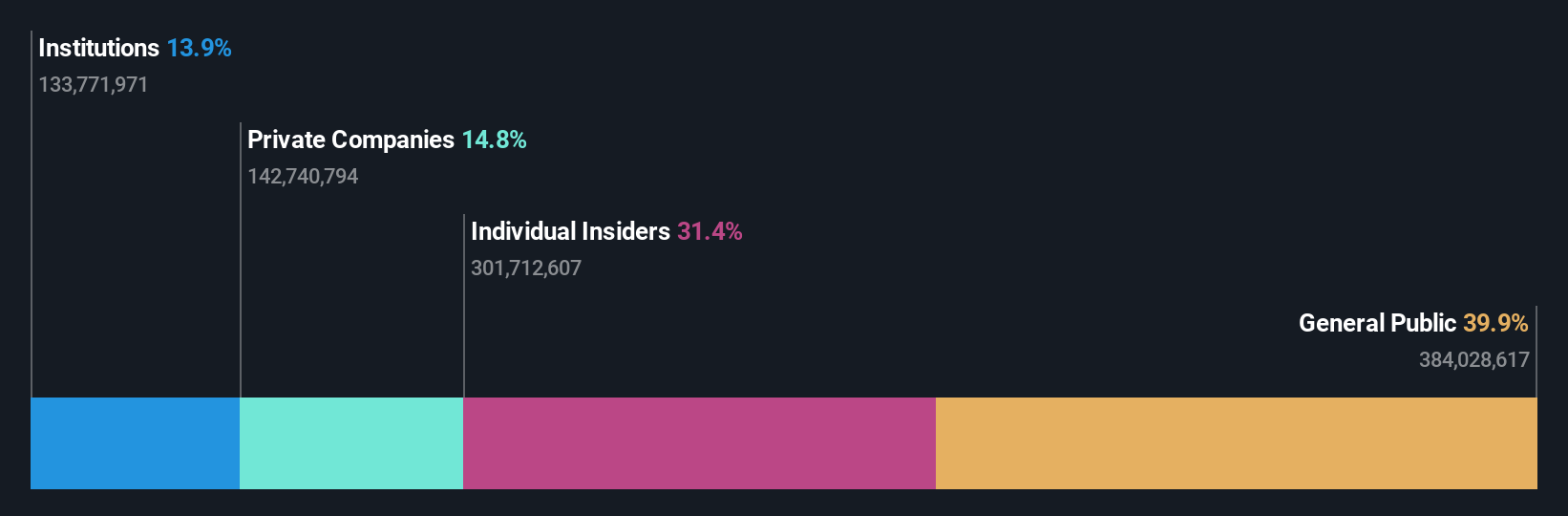

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, provides film products both domestically and internationally and has a market cap of CN¥30.17 billion.

Operations: The company's revenue segments include film products offered both domestically and internationally.

Insider Ownership: 30.5%

Earnings Growth Forecast: 28.8% p.a.

Yunnan Energy New Material's earnings are forecast to grow 28.82% annually, outpacing the Chinese market average of 23%. Despite a recent decline in sales and net income for H1 2024, the company trades at a favorable P/E ratio (21.3x) compared to the CN market (30x). However, profit margins have decreased significantly from last year. The company recently completed a share buyback program worth CNY 200 million and plans to amend its registered capital and articles of association.

- Navigate through the intricacies of Yunnan Energy New Material with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Yunnan Energy New Material is trading behind its estimated value.

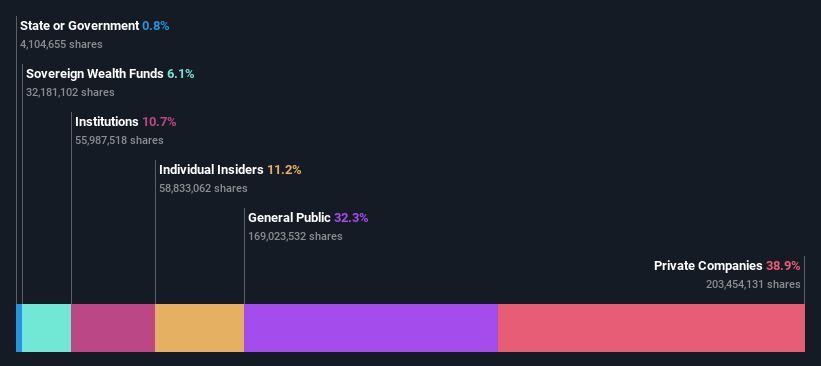

Zhejiang Wolwo Bio-Pharmaceutical (SZSE:300357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Wolwo Bio-Pharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, production, and sale of pharmaceutical products for diagnosing and treating allergic diseases in China and internationally, with a market cap of CN¥10.75 billion.

Operations: Revenue from research, development, production, and sales of pharmaceuticals for Zhejiang Wolwo Bio-Pharmaceutical Co., Ltd. amounted to CN¥891.15 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 23.8% p.a.

Zhejiang Wolwo Bio-Pharmaceutical reported H1 2024 earnings with sales of CNY 427.07 million, up from CNY 386.04 million a year ago, and net income of CNY 149.23 million, slightly higher than last year's CNY 148.6 million. The company's revenue is forecast to grow at 21.3% annually, outpacing the Chinese market's average growth rate of 13.1%. Trading at a significant discount to its estimated fair value, it has no recent insider trading activity and an unstable dividend track record.

- Dive into the specifics of Zhejiang Wolwo Bio-Pharmaceutical here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Zhejiang Wolwo Bio-Pharmaceutical's share price might be too optimistic.

Key Takeaways

- Unlock our comprehensive list of 384 Fast Growing Chinese Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Offcn Education Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002607

Offcn Education Technology

Operates as a multi-category vocational education institution in China.

Exceptional growth potential minimal.

Market Insights

Community Narratives