- China

- /

- Life Sciences

- /

- SZSE:300347

Hangzhou Tigermed Consulting Co., Ltd (SZSE:300347) Stock Catapults 27% Though Its Price And Business Still Lag The Market

Hangzhou Tigermed Consulting Co., Ltd (SZSE:300347) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

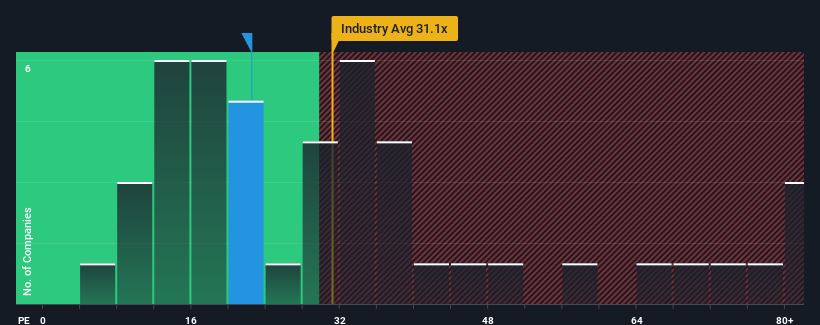

Even after such a large jump in price, Hangzhou Tigermed Consulting's price-to-earnings (or "P/E") ratio of 22.5x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 58x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Hangzhou Tigermed Consulting's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Check out our latest analysis for Hangzhou Tigermed Consulting

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hangzhou Tigermed Consulting's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 6.4% overall rise in EPS. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 20% per annum growth forecast for the broader market.

With this information, we can see why Hangzhou Tigermed Consulting is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite Hangzhou Tigermed Consulting's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hangzhou Tigermed Consulting maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Hangzhou Tigermed Consulting with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Hangzhou Tigermed Consulting, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hangzhou Tigermed Consulting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300347

Hangzhou Tigermed Consulting

Provides contract research organization services in the People’s Republic of China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives