- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Discovering Guoquan Food (Shanghai) And 2 Other Promising Asian Penny Stocks

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly turning their attention to potential opportunities in various regions, including Asia. Penny stocks, a term that may seem outdated but still signifies small or emerging companies, can offer intriguing prospects for those willing to explore beyond the traditional market giants. By focusing on firms with solid financial foundations and clear growth paths, investors can uncover promising opportunities among Asian penny stocks like Guoquan Food (Shanghai) and others that combine stability with potential upside.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.57 | HK$971.08M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.62 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.30 | SGD526.88M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.70 | THB2.82B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.10 | SGD52.35M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.20 | SGD12.59B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.07 | HK$3.09B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.40 | THB8.89B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 952 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in Mainland China with a market cap of HK$9.22 billion.

Operations: The company's revenue is primarily generated from its retail grocery stores segment, which accounts for CN¥7.04 billion.

Market Cap: HK$9.22B

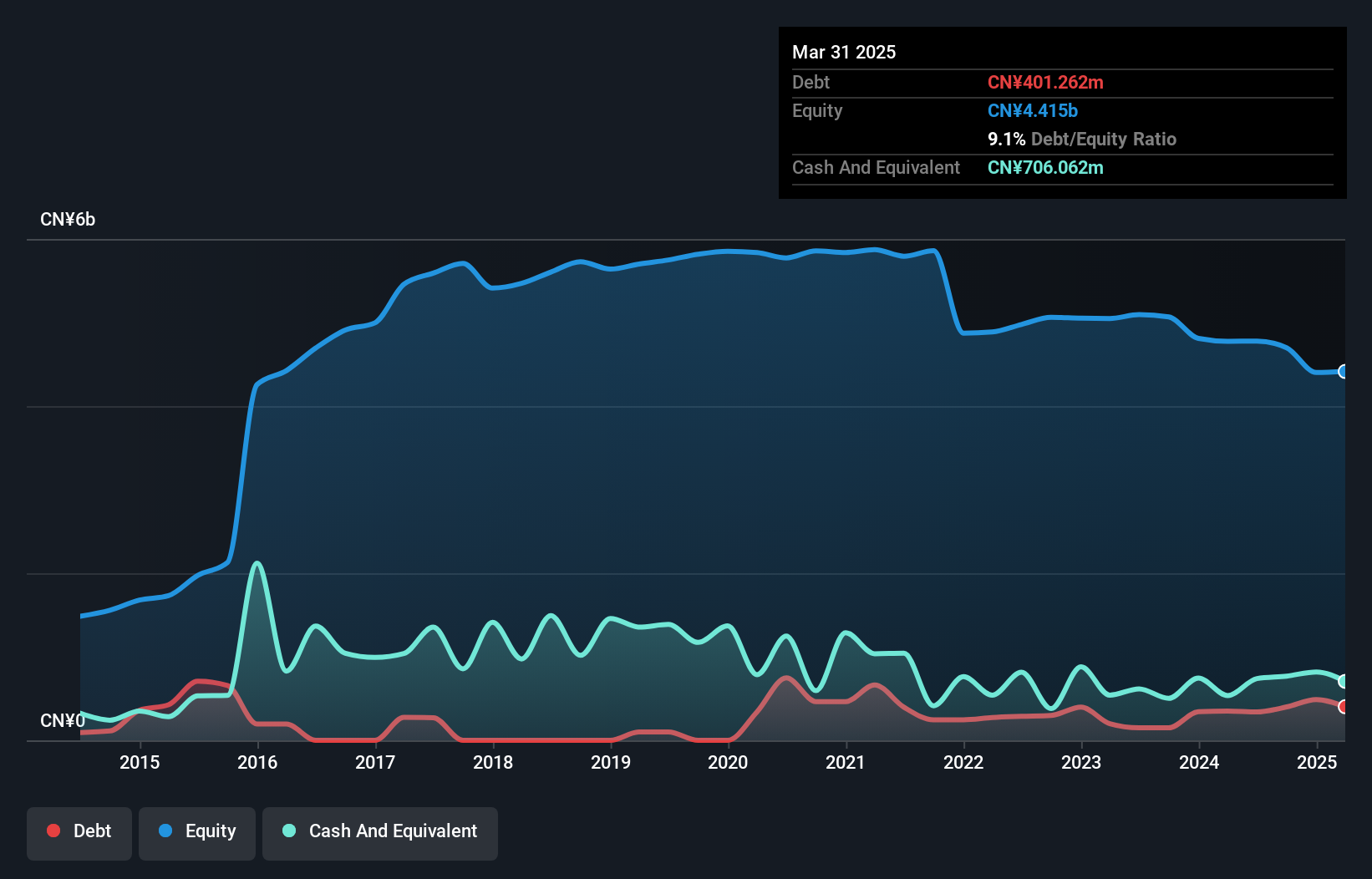

Guoquan Food (Shanghai) Co., Ltd. has shown robust earnings growth, with a 50.5% increase over the past year, surpassing the Consumer Retailing industry average. The company maintains a strong balance sheet, with short-term assets exceeding both short and long-term liabilities and more cash than total debt. However, its dividend yield of 4.48% is not well covered by earnings or free cash flows, raising sustainability concerns. Recent developments include a share repurchase program aimed at enhancing net asset value per share and inclusion in the S&P Global BMI Index, indicating positive market sentiment towards its stock performance.

- Click here to discover the nuances of Guoquan Food (Shanghai) with our detailed analytical financial health report.

- Gain insights into Guoquan Food (Shanghai)'s future direction by reviewing our growth report.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Overseas Grand Oceans Group Limited is an investment holding company that focuses on investing in, developing, and leasing real estate properties in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$8.61 billion.

Operations: The company generates revenue primarily from property development, which accounts for CN¥38.08 billion, and commercial property operations, contributing CN¥508.16 million.

Market Cap: HK$8.61B

China Overseas Grand Oceans Group Limited faces challenges with declining earnings, having reported a significant drop in net income to CN¥283.84 million for the first half of 2025 compared to the previous year. The company’s debt situation shows improvement as its debt-to-equity ratio has decreased over five years, yet operating cash flow covers only 17.6% of its debt, indicating potential liquidity concerns. Recent sales figures reveal a downward trend in contracted sales and gross floor area year-on-year. Despite these hurdles, short-term assets comfortably exceed both short and long-term liabilities, providing some financial stability amidst market volatility.

- Take a closer look at China Overseas Grand Oceans Group's potential here in our financial health report.

- Understand China Overseas Grand Oceans Group's earnings outlook by examining our growth report.

Hunan Er-Kang Pharmaceutical (SZSE:300267)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunan Er-Kang Pharmaceutical Co., Ltd operates in the pharmaceutical industry by manufacturing and selling APIs, finished drug products, and pharmaceutical excipients both in China and internationally, with a market cap of CN¥7.16 billion.

Operations: Hunan Er-Kang Pharmaceutical Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥7.16B

Hunan Er-Kang Pharmaceutical Co., Ltd has shown revenue growth, reporting CN¥681.88 million for the first half of 2025, up from CN¥621.35 million a year prior, with net income increasing to CN¥37.63 million from CN¥6.3 million. Despite this progress, the company remains unprofitable with a negative return on equity of -8.38%. Financially stable in some respects, Hunan Er-Kang's cash reserves exceed its total debt and short-term assets surpass both short and long-term liabilities significantly. The management team is experienced but challenges persist as earnings have declined by 22.8% annually over the past five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Hunan Er-Kang Pharmaceutical.

- Learn about Hunan Er-Kang Pharmaceutical's historical performance here.

Taking Advantage

- Jump into our full catalog of 952 Asian Penny Stocks here.

- Seeking Other Investments? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives