There's No Escaping Fuan Pharmaceutical (Group) Co., Ltd.'s (SZSE:300194) Muted Earnings

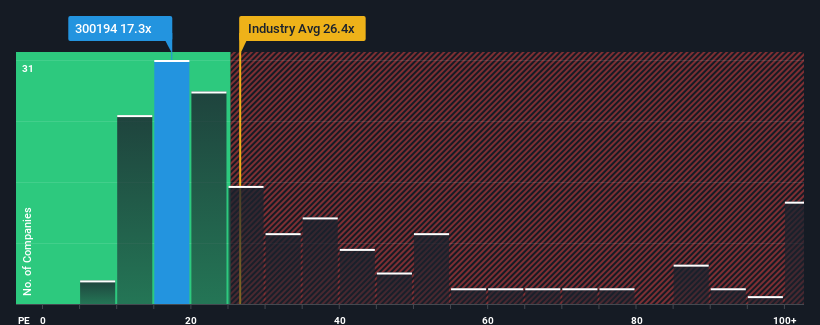

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 27x, you may consider Fuan Pharmaceutical (Group) Co., Ltd. (SZSE:300194) as an attractive investment with its 17.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Earnings have risen at a steady rate over the last year for Fuan Pharmaceutical (Group), which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

See our latest analysis for Fuan Pharmaceutical (Group)

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Fuan Pharmaceutical (Group)'s to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 4.3%. This was backed up an excellent period prior to see EPS up by 32% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Fuan Pharmaceutical (Group) is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Fuan Pharmaceutical (Group) maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Fuan Pharmaceutical (Group) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300194

Fuan Pharmaceutical (Group)

Research and develops, produces, and sells chemical drugs in the People's Republic of China.

Excellent balance sheet average dividend payer.