- China

- /

- Healthcare Services

- /

- SZSE:301015

Asian Stocks Estimated Below Intrinsic Value In December 2025

Reviewed by Simply Wall St

As global markets navigate the anticipation of interest rate decisions and economic indicators, Asia's stock markets are drawing attention for their unique dynamics. Amidst these developments, identifying stocks that are potentially undervalued can offer intriguing opportunities for investors looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.53 | CN¥302.13 | 49.2% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.58 | CN¥25.14 | 50% |

| Last One MileLtd (TSE:9252) | ¥3490.00 | ¥6861.35 | 49.1% |

| KIYO LearningLtd (TSE:7353) | ¥694.00 | ¥1385.64 | 49.9% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩28750.00 | ₩57013.96 | 49.6% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥10925.89 | 49.4% |

| IbidenLtd (TSE:4062) | ¥12610.00 | ¥24483.73 | 48.5% |

| H.U. Group Holdings (TSE:4544) | ¥3369.00 | ¥6592.59 | 48.9% |

| FIT Hon Teng (SEHK:6088) | HK$5.78 | HK$11.23 | 48.5% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.05 | CN¥55.78 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

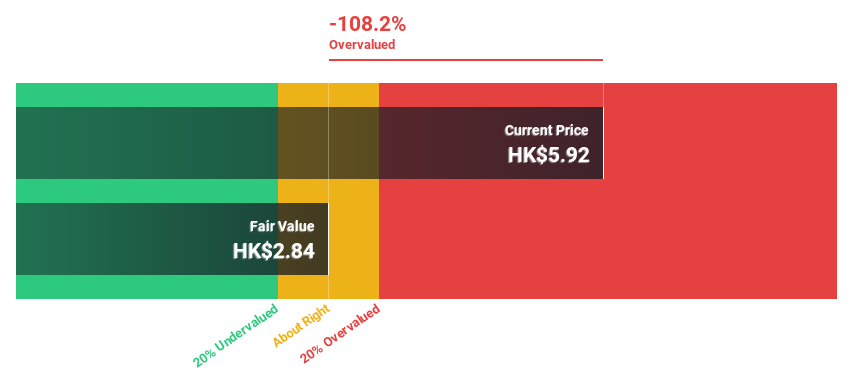

Morimatsu International Holdings (SEHK:2155)

Overview: Morimatsu International Holdings Company Limited specializes in designing, manufacturing, installing, operating, and maintaining core equipment and process systems for chemical reactions, biological reactions, and polymerization with a market cap of HK$10.60 billion.

Operations: The company's revenue primarily comes from the sale of comprehensive pressure equipment, amounting to CN¥6.16 billion.

Estimated Discount To Fair Value: 47.3%

Morimatsu International Holdings is trading at HK$8.51, significantly below its estimated fair value of HK$16.14, indicating it is highly undervalued based on cash flows. Despite insider selling in the past quarter, its earnings are projected to grow 23% annually over the next three years, outpacing both revenue growth and the Hong Kong market average. However, its return on equity remains modestly forecasted at 16.6% in three years.

- Our expertly prepared growth report on Morimatsu International Holdings implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Morimatsu International Holdings' balance sheet by reading our health report here.

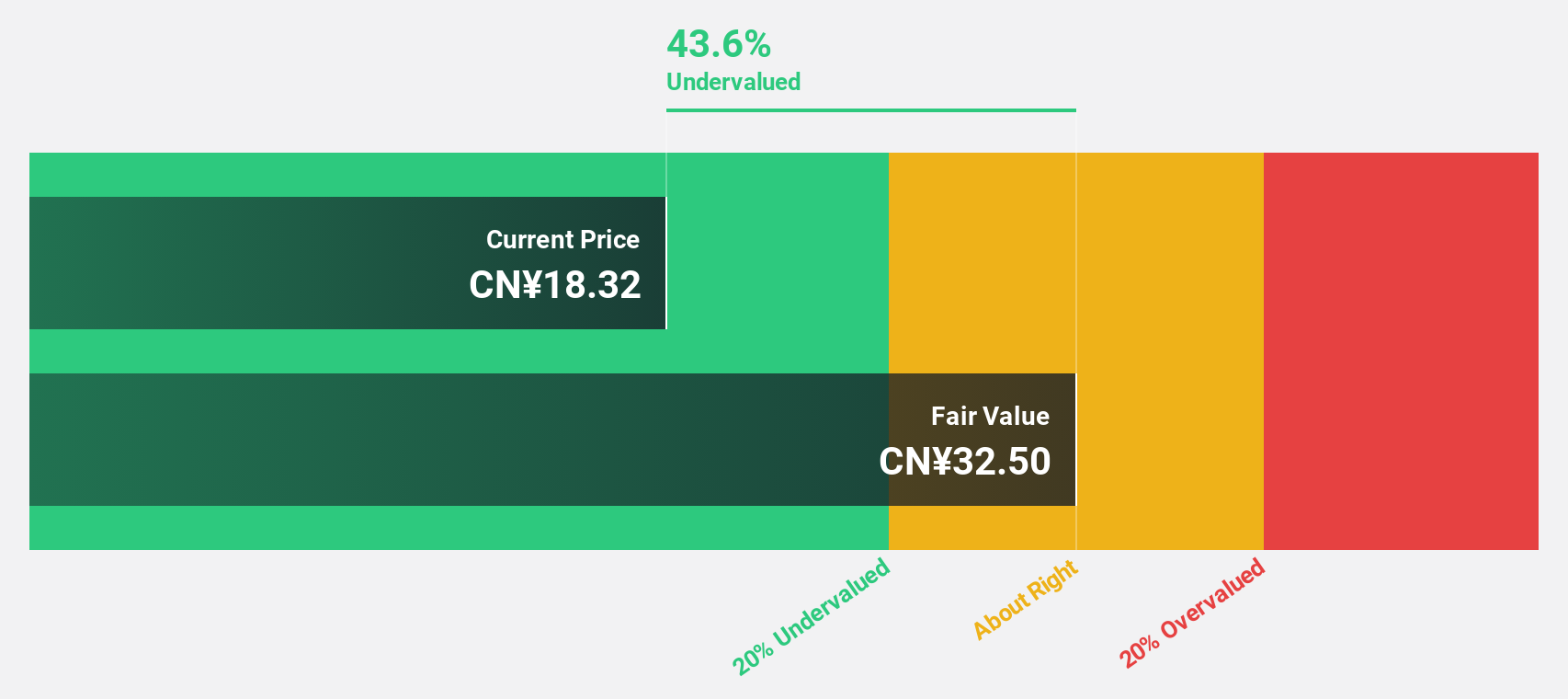

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Overview: Zhejiang Jolly Pharmaceutical Co., LTD focuses on the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥12.27 billion.

Operations: Zhejiang Jolly Pharmaceutical Co., LTD generates revenue through its research, production, and marketing of Chinese medicinal products in both domestic and international markets.

Estimated Discount To Fair Value: 45.5%

Zhejiang Jolly Pharmaceutical Co., LTD, trading at CN¥17.7, is significantly undervalued with an estimated fair value of CN¥32.5. Despite a dividend yield of 3.39% not well covered by free cash flows, the company shows robust revenue growth at 22.4% annually, outpacing the Chinese market's average growth rate. Recent financials reveal increased sales and net income for the first nine months of 2025, underscoring strong fundamentals despite high non-cash earnings levels.

- Our growth report here indicates Zhejiang Jolly PharmaceuticalLTD may be poised for an improving outlook.

- Navigate through the intricacies of Zhejiang Jolly PharmaceuticalLTD with our comprehensive financial health report here.

Qingdao Baheal Medical (SZSE:301015)

Overview: Qingdao Baheal Medical INC. is involved in the research, development, production, wholesale, and retail of pharmaceutical products across China, the United States, Hong Kong, and the United Kingdom with a market cap of CN¥12.32 billion.

Operations: The company's revenue is derived from its activities in research, development, production, wholesale, and retail of pharmaceutical products across multiple regions including China, the United States, Hong Kong, and the United Kingdom.

Estimated Discount To Fair Value: 14.0%

Qingdao Baheal Medical, trading at CN¥23.44, is undervalued compared to its fair value estimate of CN¥27.26. Despite a decline in sales and net income for the first nine months of 2025, the company's earnings are projected to grow significantly over the next three years, though slower than the market average. It offers good relative value within its industry and anticipates high future return on equity at 27.2%.

- The analysis detailed in our Qingdao Baheal Medical growth report hints at robust future financial performance.

- Take a closer look at Qingdao Baheal Medical's balance sheet health here in our report.

Taking Advantage

- Unlock our comprehensive list of 279 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qingdao Baheal Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301015

Qingdao Baheal Medical

Engages in the research and development, production, wholesale, and retail of pharmaceutical products in China, the United States, Hong Kong, and the United Kingdom.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion