Is Chongqing Zhifei Biological Products (SZSE:300122) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Chongqing Zhifei Biological Products Co., Ltd. (SZSE:300122) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Chongqing Zhifei Biological Products

What Is Chongqing Zhifei Biological Products's Debt?

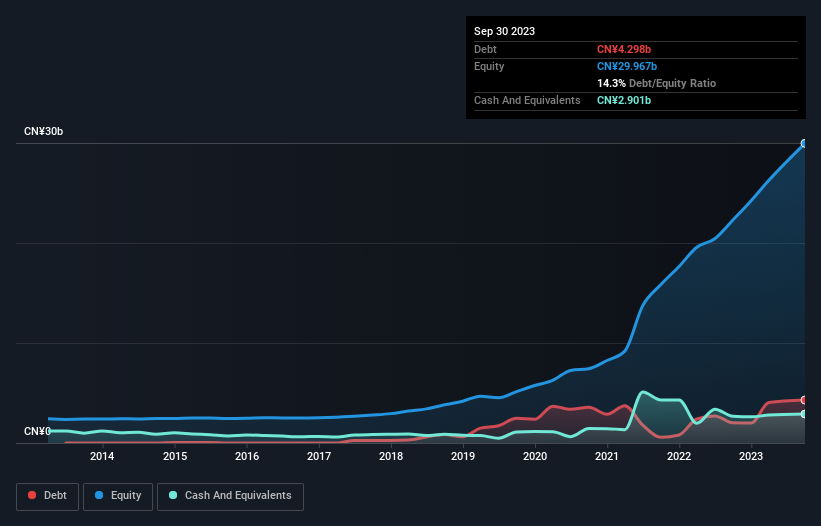

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Chongqing Zhifei Biological Products had CN¥4.30b of debt, an increase on CN¥2.02b, over one year. However, it also had CN¥2.90b in cash, and so its net debt is CN¥1.40b.

A Look At Chongqing Zhifei Biological Products' Liabilities

According to the last reported balance sheet, Chongqing Zhifei Biological Products had liabilities of CN¥18.6b due within 12 months, and liabilities of CN¥666.8m due beyond 12 months. Offsetting these obligations, it had cash of CN¥2.90b as well as receivables valued at CN¥28.6b due within 12 months. So it can boast CN¥12.2b more liquid assets than total liabilities.

This short term liquidity is a sign that Chongqing Zhifei Biological Products could probably pay off its debt with ease, as its balance sheet is far from stretched. Carrying virtually no net debt, Chongqing Zhifei Biological Products has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chongqing Zhifei Biological Products has a low net debt to EBITDA ratio of only 0.14. And its EBIT covers its interest expense a whopping 961 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also good is that Chongqing Zhifei Biological Products grew its EBIT at 15% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Chongqing Zhifei Biological Products's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Chongqing Zhifei Biological Products recorded free cash flow of 33% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Happily, Chongqing Zhifei Biological Products's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. Looking at the bigger picture, we think Chongqing Zhifei Biological Products's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Chongqing Zhifei Biological Products is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300122

Chongqing Zhifei Biological Products

Chongqing Zhifei Biological Products Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.