Suning UniversalLtd And 2 Other Promising Global Penny Stocks

Reviewed by Simply Wall St

As global markets navigate the complexities of renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are increasingly seeking opportunities that balance risk with potential for growth. Penny stocks, a term that may seem outdated but still holds relevance, often represent smaller or newer companies that could offer significant upside at lower price points. When backed by strong financial health and solid fundamentals, these stocks can present underappreciated growth opportunities without many of the common risks associated with this investment area.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.57 | HK$872.11M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.65 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.59 | MYR300M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.62 | HK$2.04B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.28 | SGD518.77M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.33 | MYR534.07M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.14 | SGD12.36B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.54 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.31M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,566 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Suning UniversalLtd (SZSE:000718)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suning Universal Co., Ltd is a real estate development company based in China with a market capitalization of CN¥7.92 billion.

Operations: The company's revenue is primarily derived from its Real Estate Business, contributing CN¥1.28 billion, followed by Medical Beauty and Biomedicine at CN¥182.42 million and Hotels generating CN¥102.89 million.

Market Cap: CN¥7.92B

Suning Universal Co., Ltd, a real estate company in China, faces challenges with declining earnings and profit margins. Recent half-year results show a drop in sales to CN¥890.09 million from CN¥1.25 billion the previous year, with net income falling to CN¥137.31 million from CN¥252.01 million. The company's interest coverage is low at 1.6x EBIT, and its return on equity is weak at 0.6%. Despite stable short-term asset coverage of liabilities and reduced debt levels over five years, Suning's high volatility and decreased dividend suggest caution for investors seeking stability in penny stocks.

- Click here to discover the nuances of Suning UniversalLtd with our detailed analytical financial health report.

- Learn about Suning UniversalLtd's historical performance here.

Chongqing Lummy Pharmaceutical (SZSE:300006)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chongqing Lummy Pharmaceutical Co., Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical products in China with a market cap of CN¥4.56 billion.

Operations: The company's revenue is primarily derived from its operations in China, amounting to CN¥791.04 million.

Market Cap: CN¥4.56B

Chongqing Lummy Pharmaceutical Co., Ltd. is navigating financial challenges, reporting a net loss of CN¥31.38 million for the first half of 2025 despite stable revenue compared to the previous year. The company remains unprofitable, but its cash position is robust, with short-term assets significantly exceeding liabilities and more cash than total debt, ensuring a cash runway exceeding three years even as free cash flow shrinks. Recent amendments to its articles of association indicate potential strategic shifts. While volatility has been stable and shareholder dilution minimal, the negative return on equity highlights ongoing profitability issues in this penny stock scenario.

- Click to explore a detailed breakdown of our findings in Chongqing Lummy Pharmaceutical's financial health report.

- Understand Chongqing Lummy Pharmaceutical's track record by examining our performance history report.

Tianjin Chase Sun PharmaceuticalLtd (SZSE:300026)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tianjin Chase Sun Pharmaceutical Co., Ltd is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market capitalization of CN¥11.15 billion.

Operations: No revenue segments are reported for Tianjin Chase Sun Pharmaceutical Co., Ltd.

Market Cap: CN¥11.15B

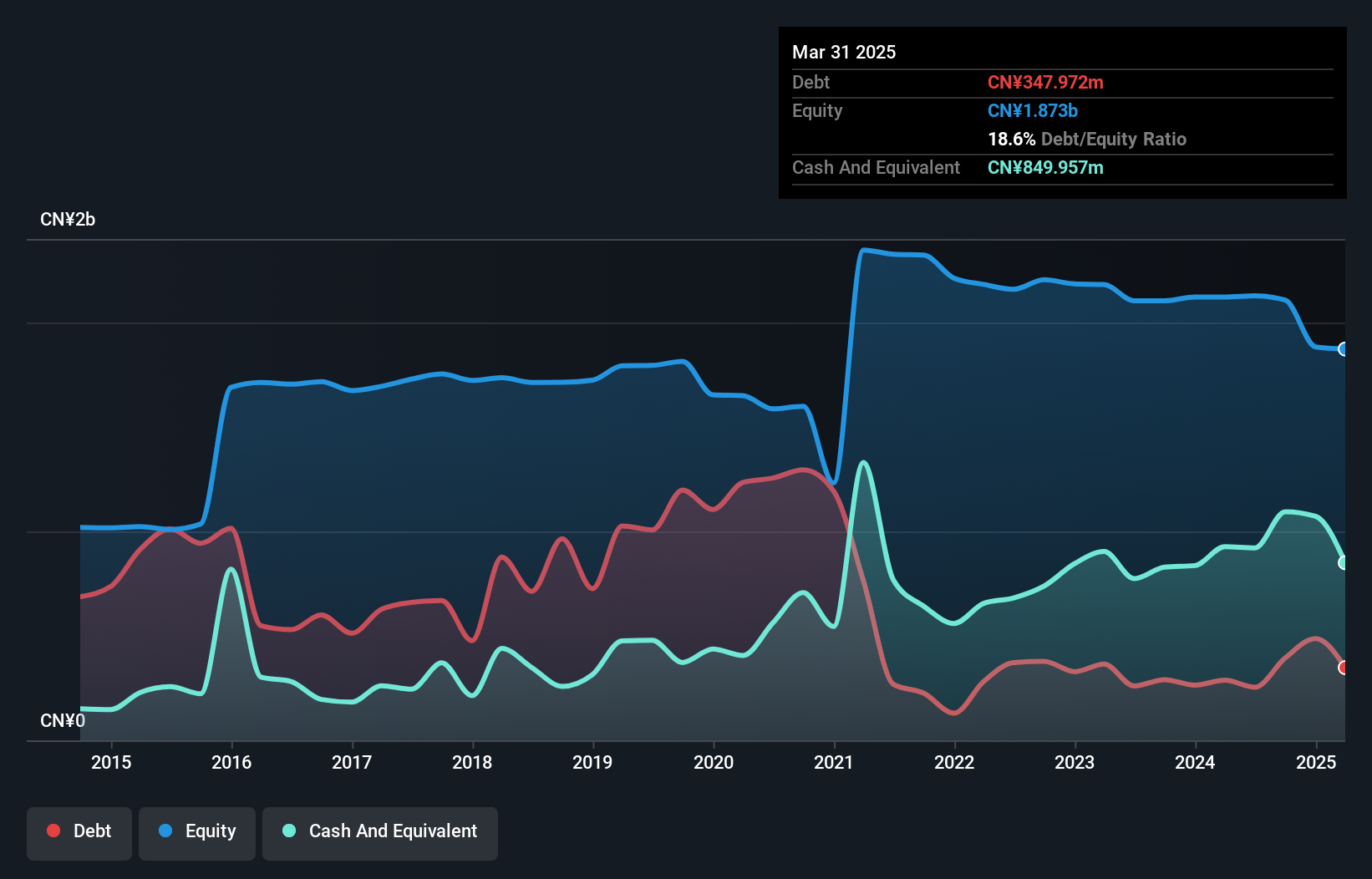

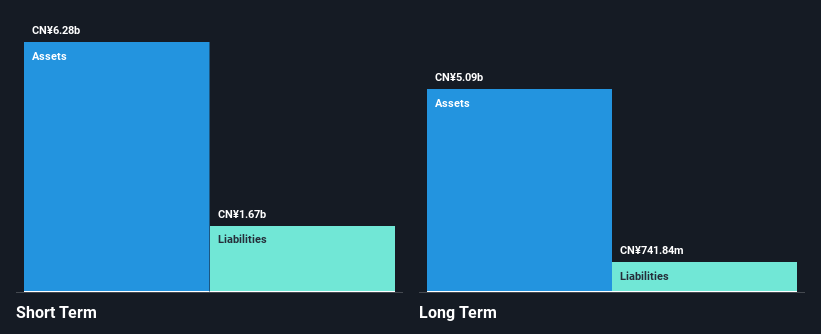

Tianjin Chase Sun Pharmaceutical Co., Ltd. is experiencing financial pressure, with recent earnings showing a decline in net income to CN¥78.63 million for the first half of 2025, compared to the previous year. Despite being unprofitable, the company's financial health is supported by short-term assets of CN¥6 billion exceeding both short and long-term liabilities significantly. The management team and board are experienced, with average tenures of 2.5 and 3.6 years respectively, which may aid in navigating current challenges. Although interest coverage is weak at 2.4 times EBIT, debt levels are well-managed with cash surpassing total debt and operating cash flow covering debt obligations effectively at over 165%.

- Click here and access our complete financial health analysis report to understand the dynamics of Tianjin Chase Sun PharmaceuticalLtd.

- Evaluate Tianjin Chase Sun PharmaceuticalLtd's prospects by accessing our earnings growth report.

Where To Now?

- Unlock more gems! Our Global Penny Stocks screener has unearthed 3,563 more companies for you to explore.Click here to unveil our expertly curated list of 3,566 Global Penny Stocks.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Chase Sun PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300026

Tianjin Chase Sun PharmaceuticalLtd

Engages in the research and development, production, and sale of various pharmaceutical products in China and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives