- China

- /

- Electrical

- /

- SZSE:300073

February 2025's Estimated Value Stocks For Savvy Investors

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, including tariff tensions and mixed employment data, investors are keenly observing the fluctuations in major indices like the S&P 500 and Nasdaq Composite. Amid these conditions, identifying stocks that may be undervalued can offer potential opportunities for those looking to navigate the current market landscape effectively. In this context, a good stock is often characterized by strong fundamentals and resilience against broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gilead Sciences (NasdaqGS:GILD) | US$96.14 | US$191.74 | 49.9% |

| National World (LSE:NWOR) | £0.227 | £0.45 | 49.5% |

| On the Beach Group (LSE:OTB) | £2.495 | £4.94 | 49.5% |

| TCI (TPEX:8436) | NT$119.00 | NT$237.00 | 49.8% |

| Hanjaya Mandala Sampoerna (IDX:HMSP) | IDR575.00 | IDR1141.10 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.455 | SGD0.91 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$53.64 | US$107.04 | 49.9% |

| Array Technologies (NasdaqGM:ARRY) | US$6.87 | US$13.66 | 49.7% |

| SK D&D (KOSE:A210980) | ₩7110.00 | ₩14097.07 | 49.6% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.27 | 49.5% |

Here's a peek at a few of the choices from the screener.

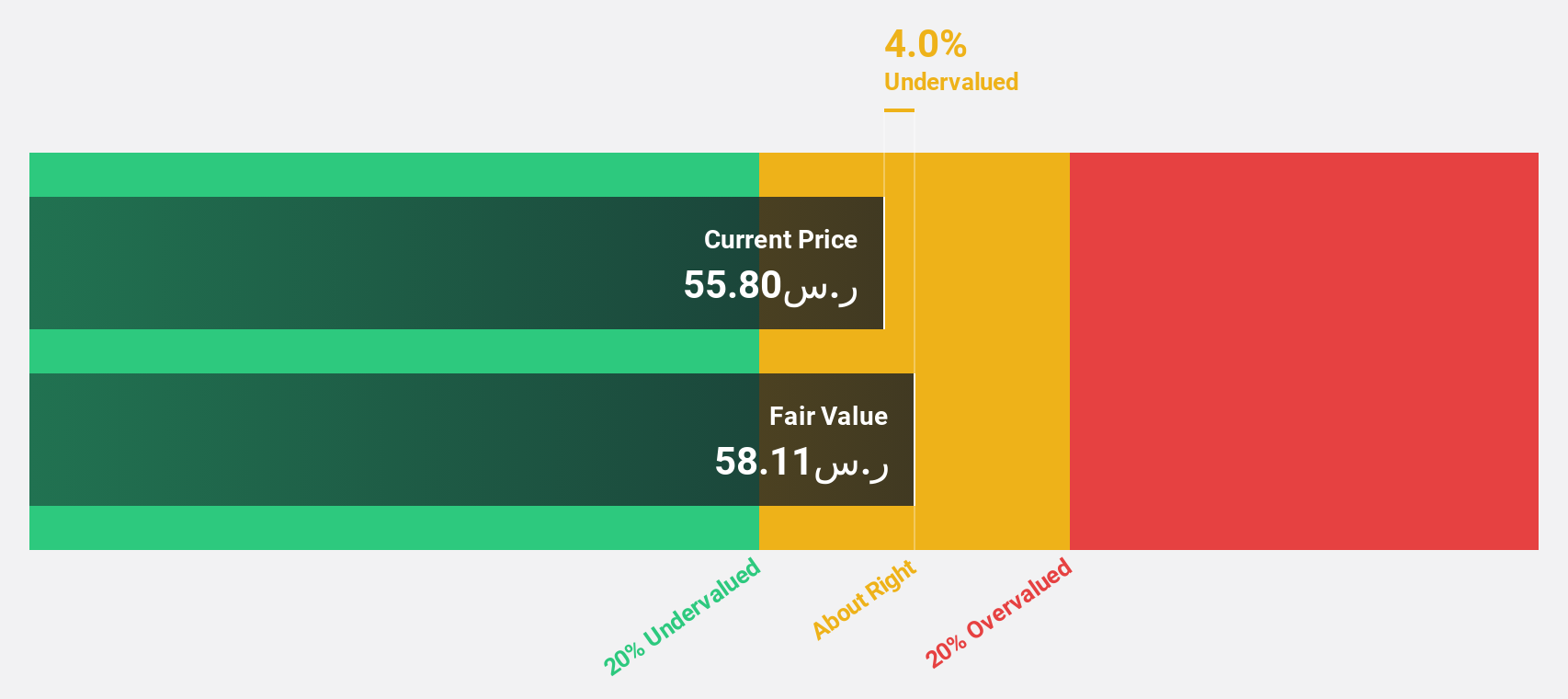

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation operates in the global manufacture, marketing, and distribution of chemicals, polymers, plastics, agri-nutrients, and metal products with a market cap of SAR203.40 billion.

Operations: The company's revenue is primarily derived from its Petrochemicals & Specialties segment, which generated SAR129.98 billion, and its Agri-Nutrients segment, contributing SAR10.34 billion.

Estimated Discount To Fair Value: 29.9%

Saudi Basic Industries is trading at SAR67.8, significantly below its estimated fair value of SAR96.76, indicating it may be undervalued based on cash flows. Despite a dividend yield of 5.01% not being well covered by earnings or free cash flows, the company's earnings are forecast to grow significantly over the next three years at 52% per year, outpacing the Saudi Arabian market's growth rate and suggesting strong future cash flow potential.

- According our earnings growth report, there's an indication that Saudi Basic Industries might be ready to expand.

- Get an in-depth perspective on Saudi Basic Industries' balance sheet by reading our health report here.

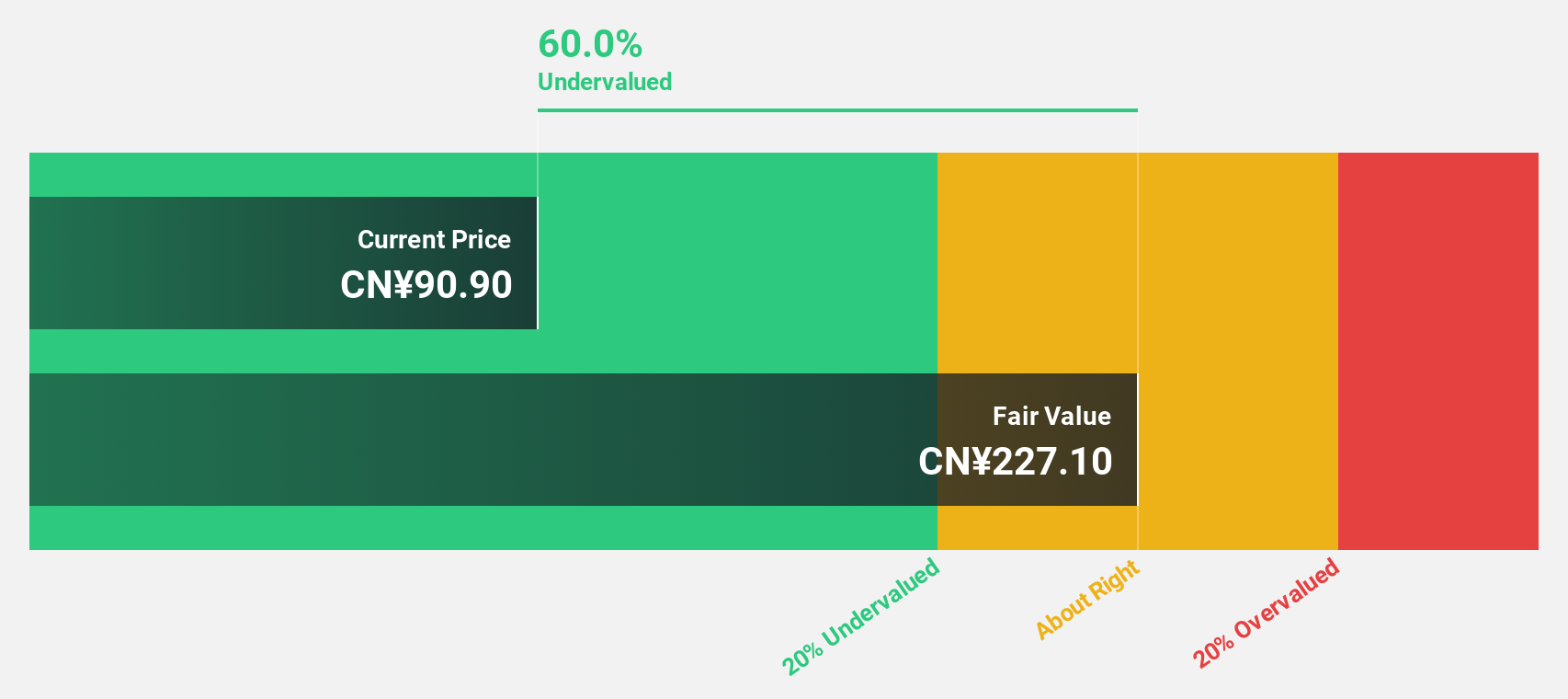

Asymchem Laboratories (Tianjin) (SZSE:002821)

Overview: Asymchem Laboratories (Tianjin) Co., Ltd. operates as a contract development and manufacturing organization (CDMO) providing services to the pharmaceutical industry, with a market cap of CN¥28.22 billion.

Operations: The company generates revenue of CN¥5.57 billion from its Pharmaceutical Technology segment.

Estimated Discount To Fair Value: 10.1%

Asymchem Laboratories (Tianjin), trading at CN¥81.9, is slightly undervalued against its fair value estimate of CN¥91.11. Despite a challenging year with net profit dropping significantly due to the absence of large orders and increased R&D expenses, earnings are expected to grow significantly over the next three years. The company has shown resilience with quarter-on-quarter revenue growth and strong order momentum from European and American markets, supporting future cash flow prospects.

- The analysis detailed in our Asymchem Laboratories (Tianjin) growth report hints at robust future financial performance.

- Dive into the specifics of Asymchem Laboratories (Tianjin) here with our thorough financial health report.

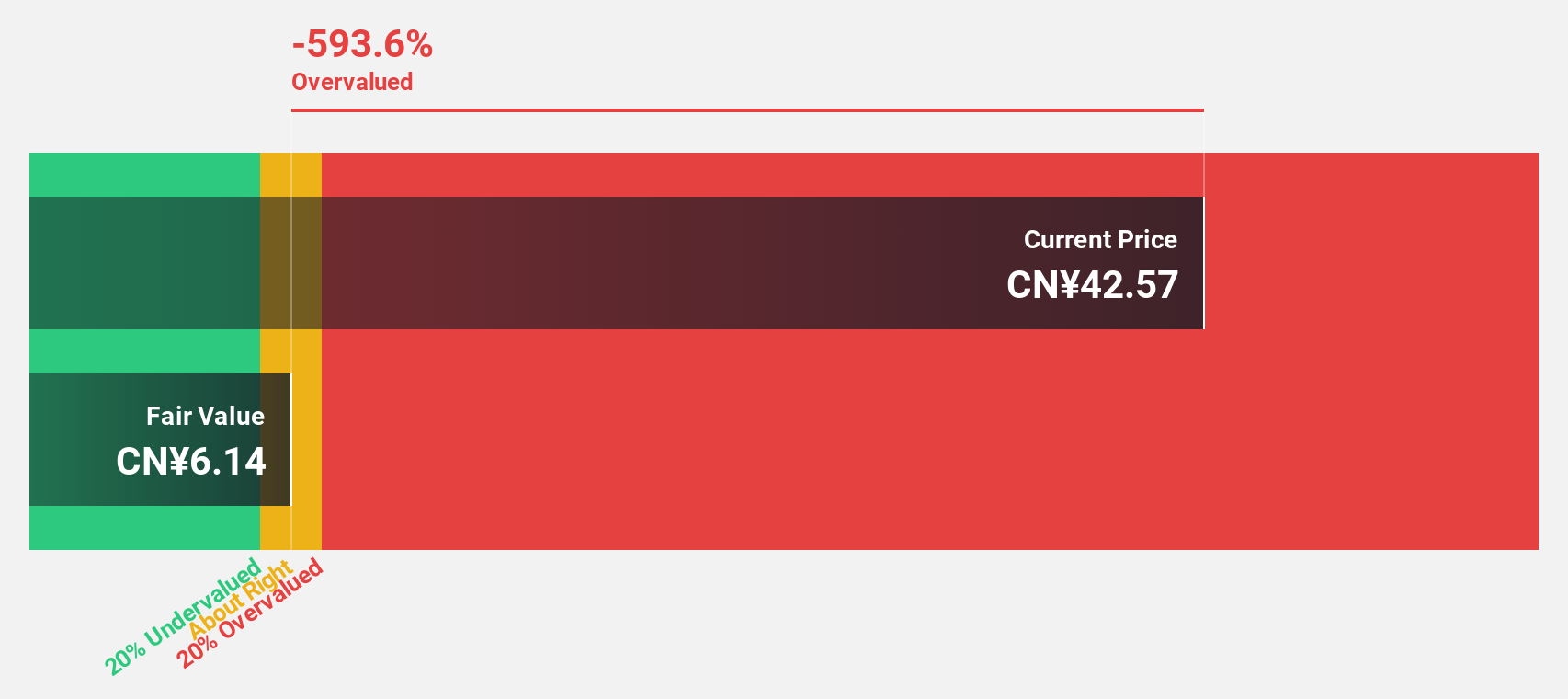

Beijing Easpring Material TechnologyLTD (SZSE:300073)

Overview: Beijing Easpring Material Technology Co., Ltd. develops, produces, and sells lithium battery materials both in China and internationally, with a market cap of CN¥20.29 billion.

Operations: The company generates revenue through its development, production, and sale of lithium battery materials across domestic and international markets.

Estimated Discount To Fair Value: 33.3%

Beijing Easpring Material Technology, trading at CN¥40.06, is significantly undervalued with a fair value estimate of CN¥60.02, offering potential for cash flow-driven investment returns. Despite a low forecasted return on equity and unsustainable dividend coverage by free cash flows, the company anticipates robust revenue growth of 28.6% annually, outpacing the Chinese market average. Recent shareholder meetings focus on optimizing fund allocation from previous share offerings to enhance project investments.

- Upon reviewing our latest growth report, Beijing Easpring Material TechnologyLTD's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Beijing Easpring Material TechnologyLTD with our comprehensive financial health report here.

Next Steps

- Discover the full array of 899 Undervalued Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Easpring Material TechnologyLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300073

Beijing Easpring Material TechnologyLTD

Develops, produces, and sells lithium battery positive electrode materials and smart device products in China, South Korea, Japan, Europe, the United States, Southeast Asia, South Asia, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives