3 Global Stocks Estimated To Be Up To 48.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with ongoing trade tensions and recession fears, investors are closely monitoring economic indicators for signs of stability. Amidst this uncertainty, the search for undervalued stocks becomes increasingly pertinent, as these investments may offer potential opportunities when market conditions improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €32.15 | €64.13 | 49.9% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.30 | CN¥30.32 | 49.5% |

| Net Insight (OM:NETI B) | SEK4.83 | SEK9.58 | 49.6% |

| S Foods (TSE:2292) | ¥2546.00 | ¥5084.09 | 49.9% |

| JSHLtd (TSE:150A) | ¥557.00 | ¥1104.15 | 49.6% |

| Star7 (BIT:STAR7) | €6.20 | €12.36 | 49.8% |

| dormakaba Holding (SWX:DOKA) | CHF686.00 | CHF1359.67 | 49.5% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.67 | SGD1.33 | 49.6% |

| Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €1.13 | €2.25 | 49.8% |

| Ryman Healthcare (NZSE:RYM) | NZ$2.80 | NZ$5.59 | 49.9% |

Let's explore several standout options from the results in the screener.

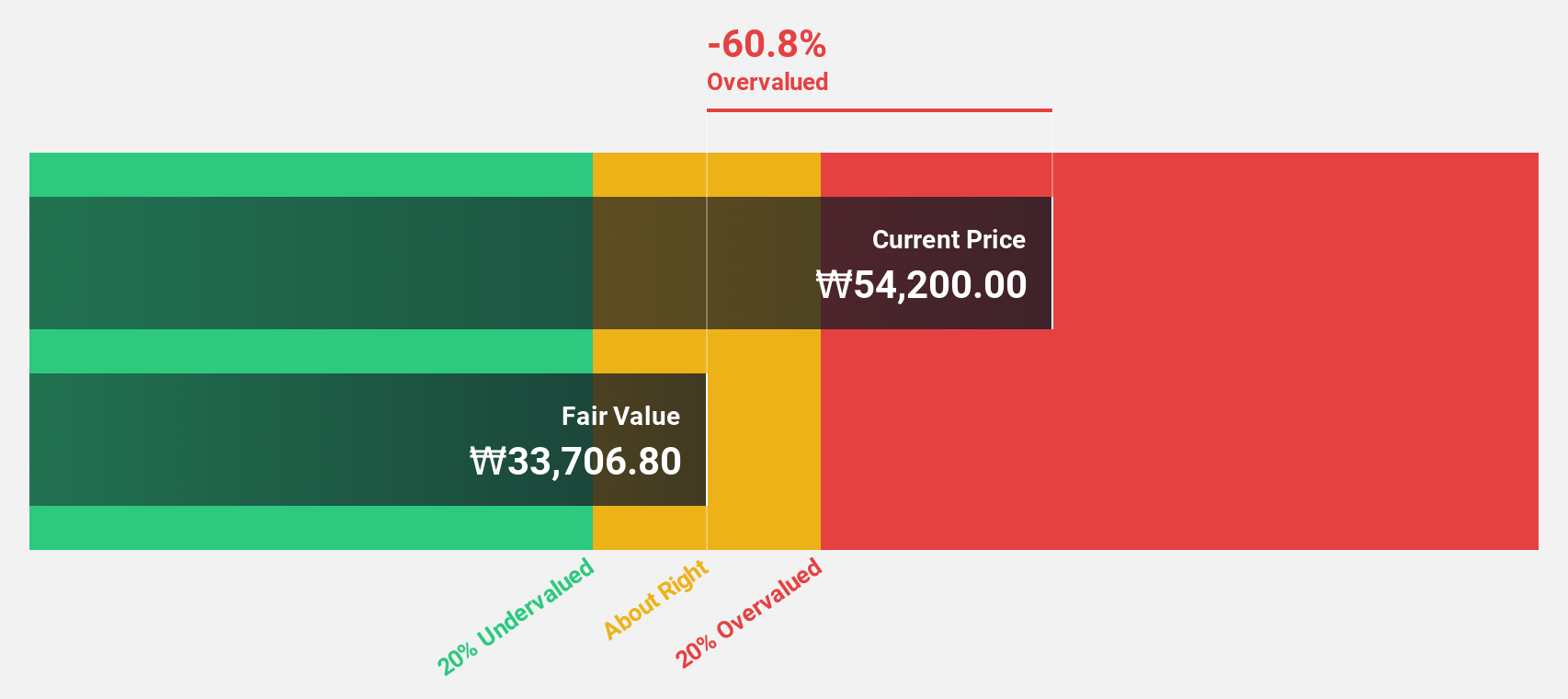

Hanwha Systems (KOSE:A272210)

Overview: Hanwha Systems Co., Ltd. manufactures and sells various military equipment in South Korea and internationally, with a market cap of ₩7.26 billion.

Operations: The company's revenue segments include the Defense Sector at ₩1.96 billion and the ICT Division at ₩685.09 million, along with contributions from New Business amounting to ₩11.53 million.

Estimated Discount To Fair Value: 48.5%

Hanwha Systems is trading at ₩41,150, significantly undervalued compared to its estimated fair value of ₩79,884.3. Despite a volatile share price recently and profit margins dropping from 11.6% to 5.2%, the company's earnings are expected to grow significantly at 27.1% per year over the next three years, outpacing the Korean market's growth rate of 25.1%. Investors should note potential impacts from large one-off items in financial results and upcoming board decisions on self-dealing transactions and business transfers with affiliates.

- In light of our recent growth report, it seems possible that Hanwha Systems' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Hanwha Systems.

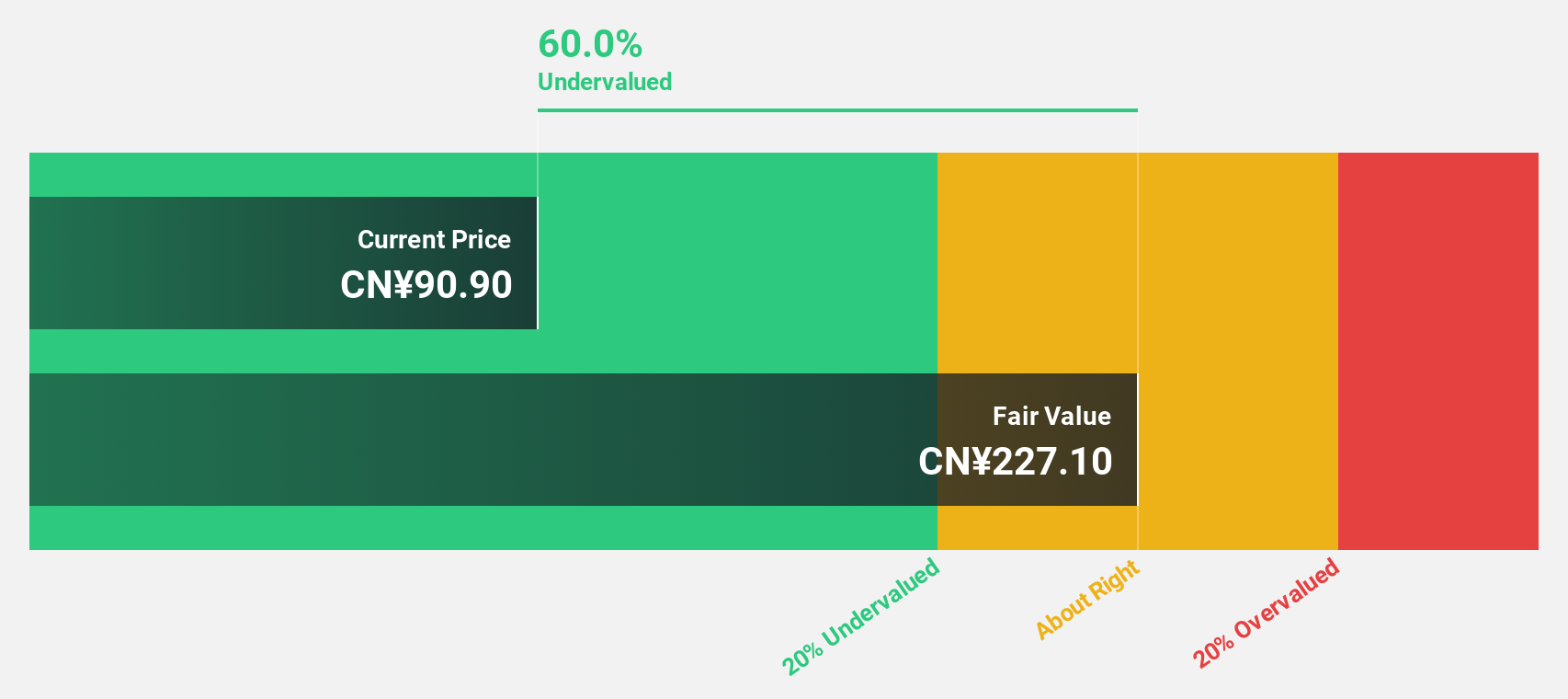

Asymchem Laboratories (Tianjin) (SZSE:002821)

Overview: Asymchem Laboratories (Tianjin) Co., Ltd. operates as a contract development and manufacturing organization (CDMO) providing services to the pharmaceutical industry, with a market cap of approximately CN¥27.33 billion.

Operations: The company's revenue primarily comes from its Pharmaceutical Technology segment, which generated CN¥5.57 billion.

Estimated Discount To Fair Value: 12.8%

Asymchem Laboratories (Tianjin) is trading at CN¥81.91, slightly below its estimated fair value of CN¥93.9, indicating some undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 27.4% annually, surpassing the Chinese market's average growth rate of 25.1%. Despite a recent decline in profit margins from 31.7% to 13.8%, new commercial agreements and robust order growth in European and American markets bolster its financial outlook amidst competitive pressures and operational ramp-ups.

- Our comprehensive growth report raises the possibility that Asymchem Laboratories (Tianjin) is poised for substantial financial growth.

- Get an in-depth perspective on Asymchem Laboratories (Tianjin)'s balance sheet by reading our health report here.

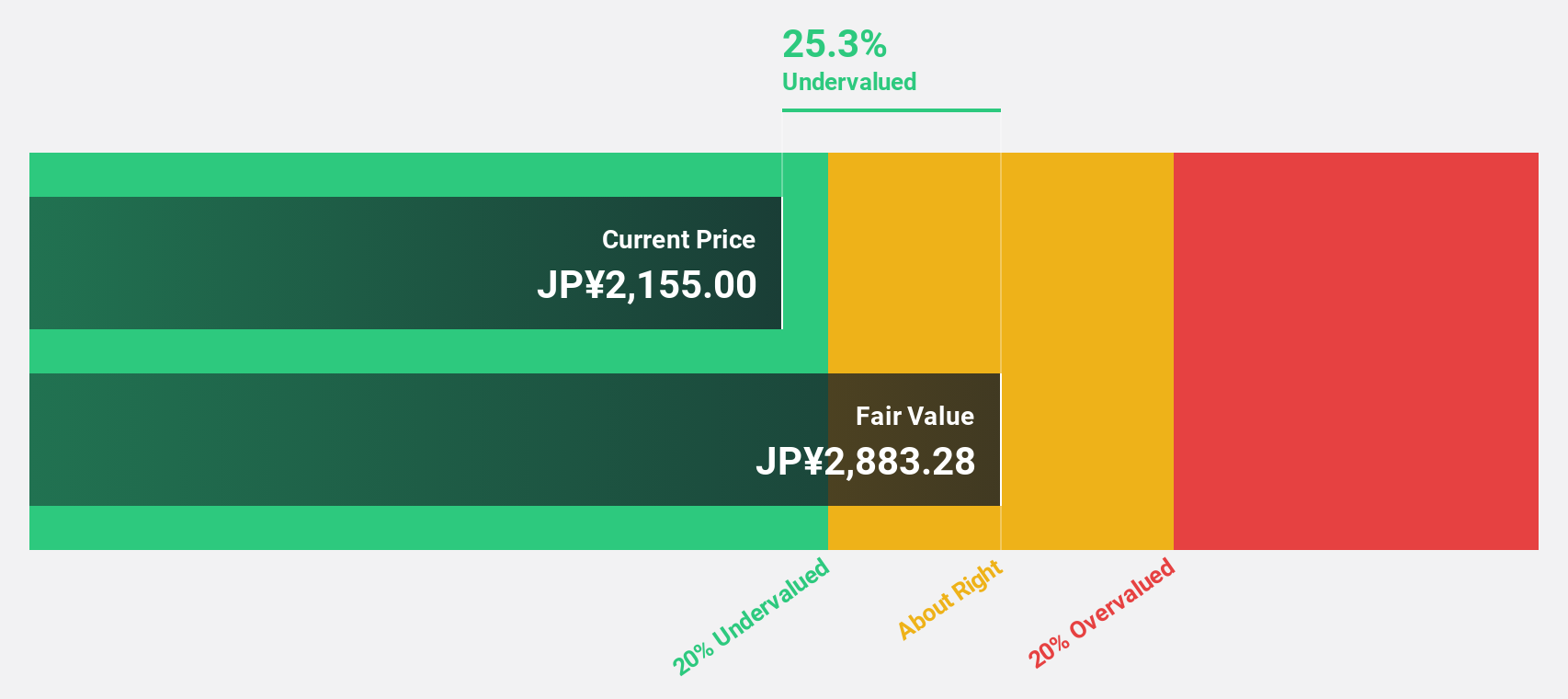

Nishi-Nippon Financial Holdings (TSE:7189)

Overview: Nishi-Nippon Financial Holdings, Inc. manages and operates banks and companies offering financial and non-financial solutions in Japan, Hong Kong, China, and Singapore, with a market cap of ¥2.87 billion.

Operations: The company generates revenue through its subsidiaries that provide a range of financial and non-financial services across Japan, Hong Kong, China, and Singapore.

Estimated Discount To Fair Value: 37.4%

Nishi-Nippon Financial Holdings is trading at ¥2,115, significantly below its estimated fair value of ¥3,381.3. The company's earnings are expected to grow substantially at 23% annually over the next three years, outpacing the Japanese market's average growth rate of 8.1%. Despite a low return on equity forecasted at 6.8%, recent dividend increases and share buybacks reflect strong cash flow management and potential undervaluation based on discounted cash flows.

- The growth report we've compiled suggests that Nishi-Nippon Financial Holdings' future prospects could be on the up.

- Click here to discover the nuances of Nishi-Nippon Financial Holdings with our detailed financial health report.

Make It Happen

- Click through to start exploring the rest of the 492 Undervalued Global Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002821

Asymchem Laboratories (Tianjin)

Asymchem Laboratories (Tianjin) Co., Ltd.

Flawless balance sheet with reasonable growth potential.