3 Asian Stocks Estimated To Be Trading Below Their Fair Value

Reviewed by Simply Wall St

As global markets face various challenges, including tariff concerns and inflationary pressures, Asian stocks have not been immune to these economic headwinds. Despite these uncertainties, opportunities may exist for investors seeking undervalued stocks in Asia that could potentially offer growth prospects when trading below their fair value. Identifying such stocks often involves assessing factors like strong fundamentals and resilience amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Chifeng Jilong Gold MiningLtd (SHSE:600988) | CN¥18.22 | CN¥35.98 | 49.4% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩432500.00 | ₩861631.53 | 49.8% |

| Sichuan Injet Electric (SZSE:300820) | CN¥48.12 | CN¥94.65 | 49.2% |

| Hibino (TSE:2469) | ¥2843.00 | ¥5584.46 | 49.1% |

| Power Wind Health Industry (TWSE:8462) | NT$112.00 | NT$223.37 | 49.9% |

| BalnibarbiLtd (TSE:3418) | ¥1059.00 | ¥2076.26 | 49% |

| Food & Life Companies (TSE:3563) | ¥4100.00 | ¥8097.79 | 49.4% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.675 | SGD1.32 | 48.9% |

| Medy-Tox (KOSDAQ:A086900) | ₩126200.00 | ₩246809.47 | 48.9% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16540.00 | ₩32393.46 | 48.9% |

Here's a peek at a few of the choices from the screener.

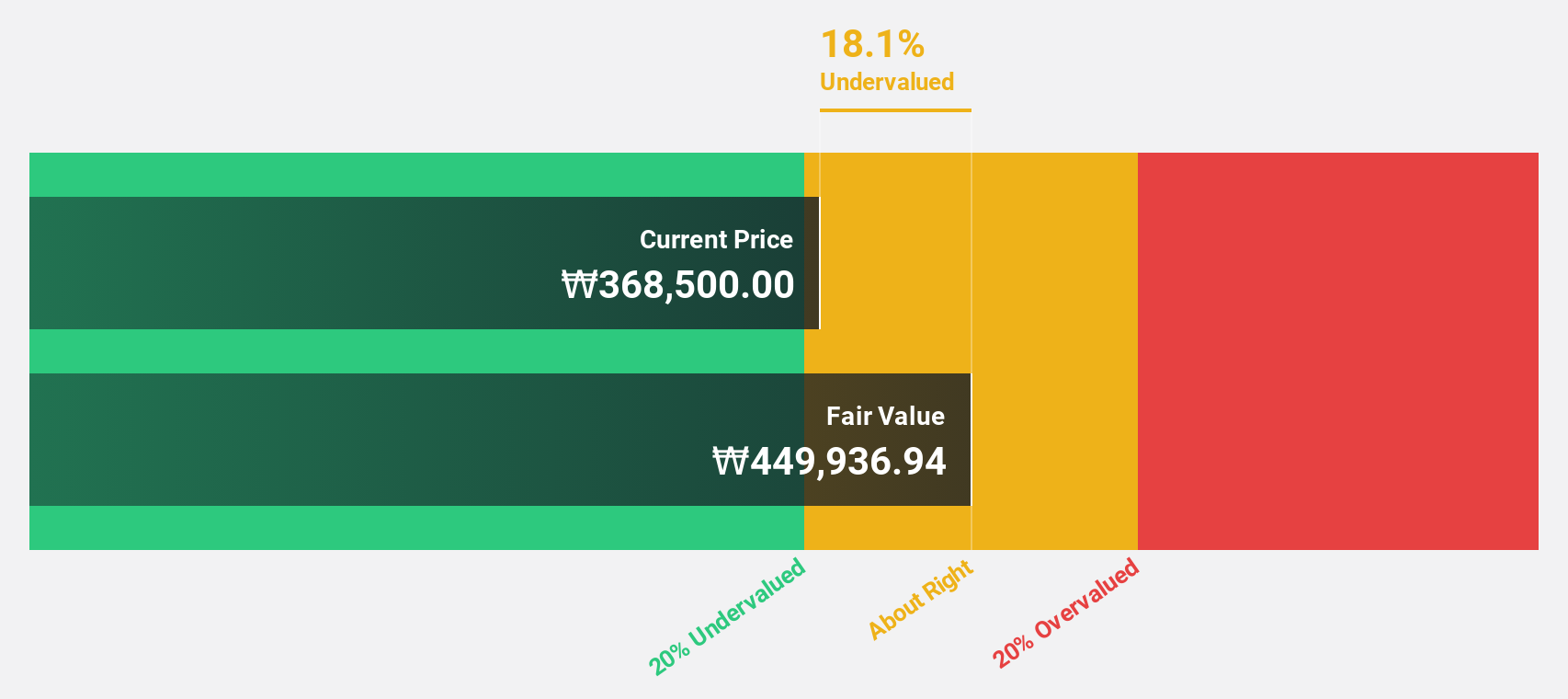

Hugel (KOSDAQ:A145020)

Overview: Hugel, Inc. is a biopharmaceutical company that develops and manufactures products in South Korea and internationally, with a market cap of approximately ₩3.49 trillion.

Operations: The company's revenue segment includes Pharmaceuticals, generating approximately ₩363.79 billion.

Estimated Discount To Fair Value: 43.8%

Hugel is trading at ₩317,000, significantly below its estimated fair value of ₩564,504.71, suggesting it may be undervalued based on cash flows. Despite a slower revenue growth forecast of 17.8% annually compared to earnings growth of 25.66%, the company has initiated a KRW 70 billion share buyback program to enhance shareholder value and stabilize stock price. Earnings are projected to grow faster than the Korean market average over the next three years.

- Insights from our recent growth report point to a promising forecast for Hugel's business outlook.

- Dive into the specifics of Hugel here with our thorough financial health report.

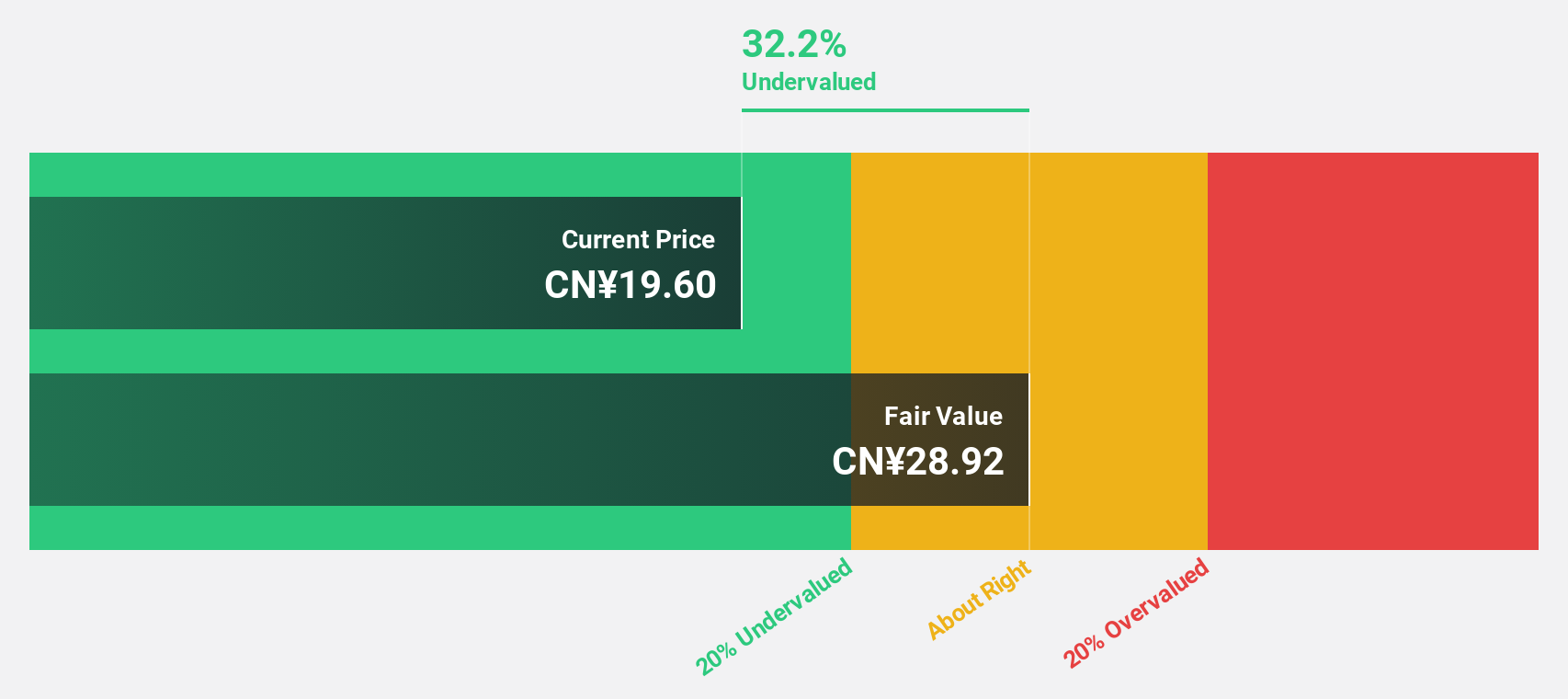

Tongqinglou Catering (SHSE:605108)

Overview: Tongqinglou Catering Co., Ltd. operates in China offering catering services and has a market cap of CN¥5.58 billion.

Operations: The company generates revenue from its catering services in China.

Estimated Discount To Fair Value: 45.4%

Tongqinglou Catering is trading at CN¥21.55, well below its estimated fair value of CN¥39.45, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 44.9% annually, outpacing the Chinese market average of 25.3%. However, its dividend yield of 1.9% is not well covered by free cash flows and it carries a high level of debt, which could impact financial flexibility despite expected revenue growth surpassing the market rate.

- Our expertly prepared growth report on Tongqinglou Catering implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Tongqinglou Catering's balance sheet by reading our health report here.

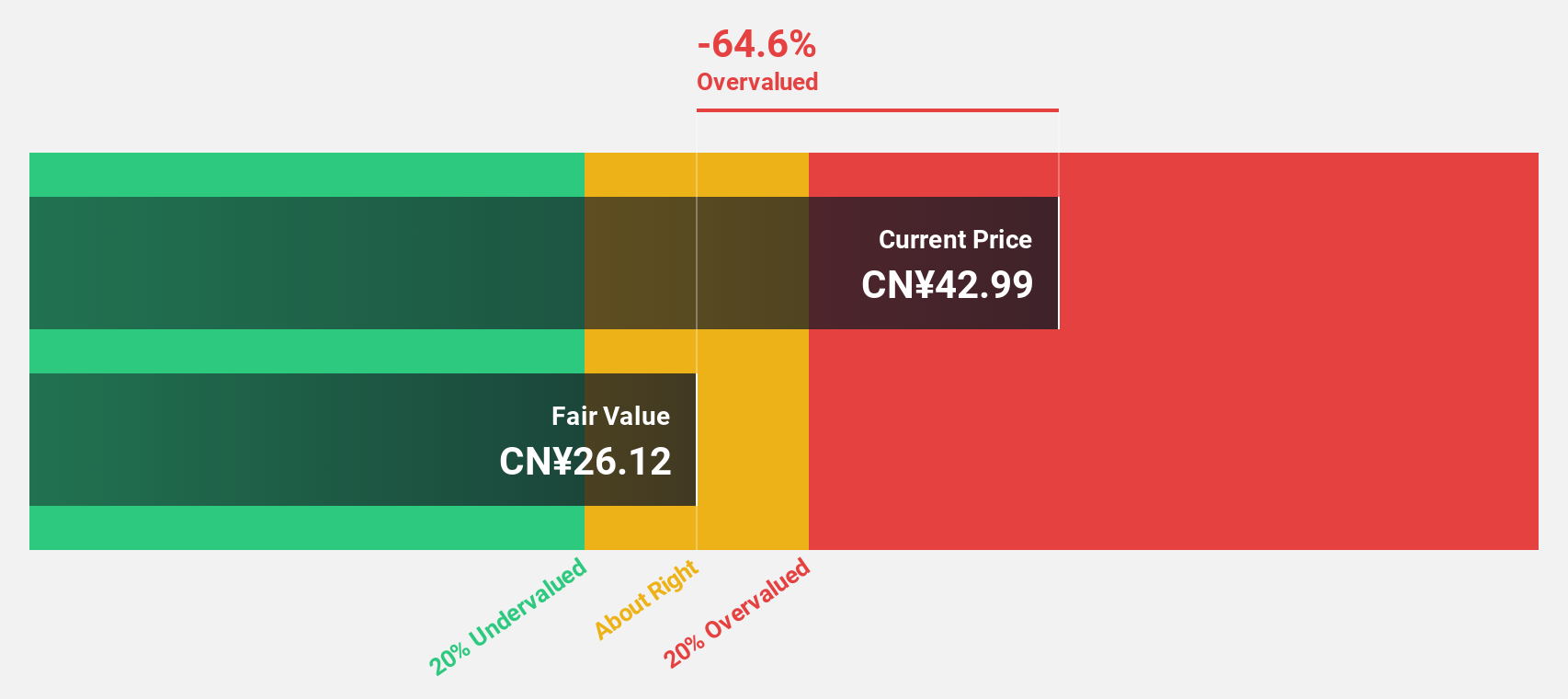

Haisco Pharmaceutical Group (SZSE:002653)

Overview: Haisco Pharmaceutical Group Co., Ltd. researches, develops, manufactures, and sells pharmaceuticals in China with a market cap of CN¥36.95 billion.

Operations: Haisco Pharmaceutical Group's revenue is primarily derived from its research, development, manufacturing, and sales of pharmaceuticals within China.

Estimated Discount To Fair Value: 36.4%

Haisco Pharmaceutical Group is trading at CN¥33.31, significantly below its estimated fair value of CN¥52.36, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow by 35.67% annually, surpassing the Chinese market's average growth rate of 25.3%. Despite this promising growth outlook, its dividend yield of 0.81% is not well-supported by earnings or free cash flows, and return on equity is forecasted to remain modest at 16.1%.

- Our comprehensive growth report raises the possibility that Haisco Pharmaceutical Group is poised for substantial financial growth.

- Take a closer look at Haisco Pharmaceutical Group's balance sheet health here in our report.

Taking Advantage

- Discover the full array of 284 Undervalued Asian Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haisco Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002653

Haisco Pharmaceutical Group

Research, develops, manufactures, and sells pharmaceuticals in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives