Investor Optimism Abounds Guangdong Zhongsheng Pharmaceutical Co., Ltd. (SZSE:002317) But Growth Is Lacking

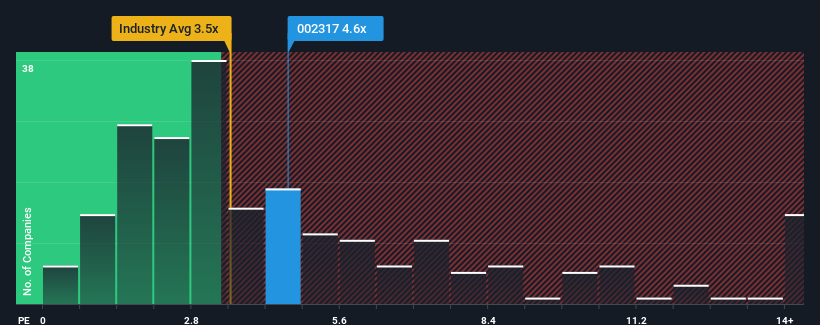

Guangdong Zhongsheng Pharmaceutical Co., Ltd.'s (SZSE:002317) price-to-sales (or "P/S") ratio of 4.6x may not look like an appealing investment opportunity when you consider close to half the companies in the Pharmaceuticals industry in China have P/S ratios below 3.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Guangdong Zhongsheng Pharmaceutical

How Guangdong Zhongsheng Pharmaceutical Has Been Performing

Guangdong Zhongsheng Pharmaceutical hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Zhongsheng Pharmaceutical.What Are Revenue Growth Metrics Telling Us About The High P/S?

Guangdong Zhongsheng Pharmaceutical's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. Regardless, revenue has managed to lift by a handy 7.4% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 25% during the coming year according to the two analysts following the company. With the industry predicted to deliver 141% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Guangdong Zhongsheng Pharmaceutical's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Guangdong Zhongsheng Pharmaceutical's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Guangdong Zhongsheng Pharmaceutical, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Guangdong Zhongsheng Pharmaceutical is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002317

Guangdong Zhongsheng Pharmaceutical

Guangdong Zhongsheng Pharmaceutical Co., Ltd.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives