Guangdong Zhongsheng Pharmaceutical Co., Ltd.'s (SZSE:002317) P/E Is On The Mark

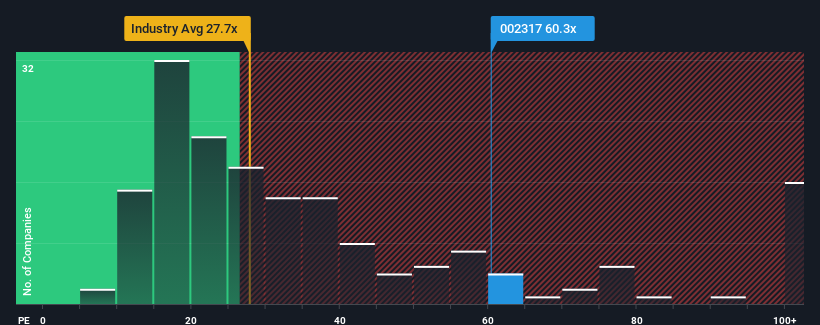

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Guangdong Zhongsheng Pharmaceutical Co., Ltd. (SZSE:002317) as a stock to avoid entirely with its 60.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Guangdong Zhongsheng Pharmaceutical's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Guangdong Zhongsheng Pharmaceutical

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Guangdong Zhongsheng Pharmaceutical's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 56%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 129% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 37% growth forecast for the broader market.

With this information, we can see why Guangdong Zhongsheng Pharmaceutical is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Guangdong Zhongsheng Pharmaceutical's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Guangdong Zhongsheng Pharmaceutical's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Guangdong Zhongsheng Pharmaceutical has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Guangdong Zhongsheng Pharmaceutical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002317

Guangdong Zhongsheng Pharmaceutical

Guangdong Zhongsheng Pharmaceutical Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives