Undiscovered Gems Three Top Small Cap Stocks with Strong Potential

Reviewed by Simply Wall St

In the current market landscape, major U.S. stock indexes have shown mixed performances with large-cap indices reaching record highs while small-cap stocks, as represented by the Russell 2000 Index, have recently experienced a decline. Amidst these fluctuations and economic reports indicating a rebound in job growth, investors are increasingly looking towards small-cap stocks that possess strong fundamentals and growth potential as attractive opportunities. Identifying such undiscovered gems involves assessing factors like financial health, market position, and industry trends that can thrive even when broader market conditions are uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 37.70% | 48.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

LiJiang YuLong Tourism (SZSE:002033)

Simply Wall St Value Rating: ★★★★★★

Overview: LiJiang YuLong Tourism Co., LTD. focuses on the development and operation of tourism businesses in China with a market cap of CN¥5.08 billion.

Operations: LiJiang YuLong Tourism derives its revenue primarily from its tourism operations in China. It has a market cap of CN¥5.08 billion.

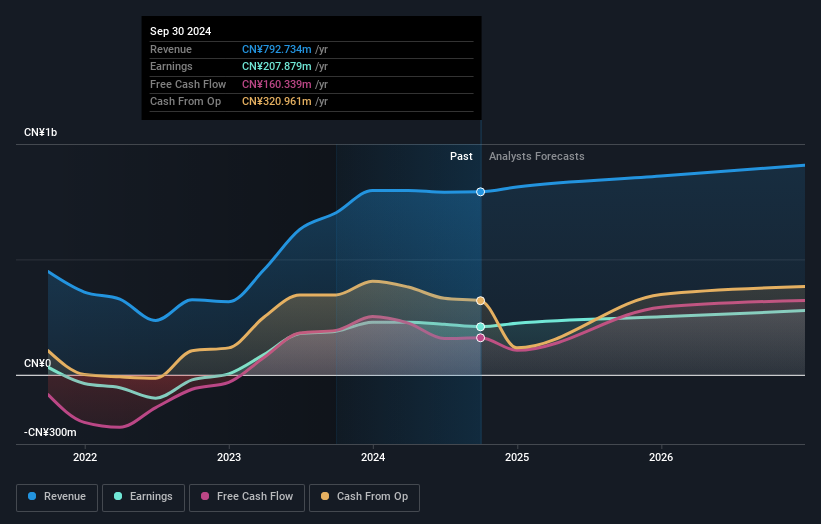

LiJiang YuLong Tourism, a smaller player in the tourism sector, is navigating its financial landscape with some challenges. Recent figures show sales at CNY 635.65 million for the first nine months of 2024, slightly down from CNY 641.82 million the previous year. Net income also saw a dip to CNY 192.28 million from CNY 211.81 million last year, reflecting tighter margins with basic earnings per share dropping to CNY 0.35 from CNY 0.39 previously. Positively, it trades at about 14% below estimated fair value and remains debt-free, suggesting potential resilience and room for growth in earnings forecasted at an annual rate of approximately 12%.

- Click here to discover the nuances of LiJiang YuLong Tourism with our detailed analytical health report.

Explore historical data to track LiJiang YuLong Tourism's performance over time in our Past section.

Guilin Sanjin Pharmaceutical (SZSE:002275)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guilin Sanjin Pharmaceutical Co., Ltd. is involved in the research, production, and sale of traditional Chinese and natural medicines in China with a market cap of CN¥8.77 billion.

Operations: Guilin Sanjin generates revenue primarily from the sale of traditional Chinese and natural medicines. The company's net profit margin is 15%, reflecting its efficiency in converting sales into actual profit.

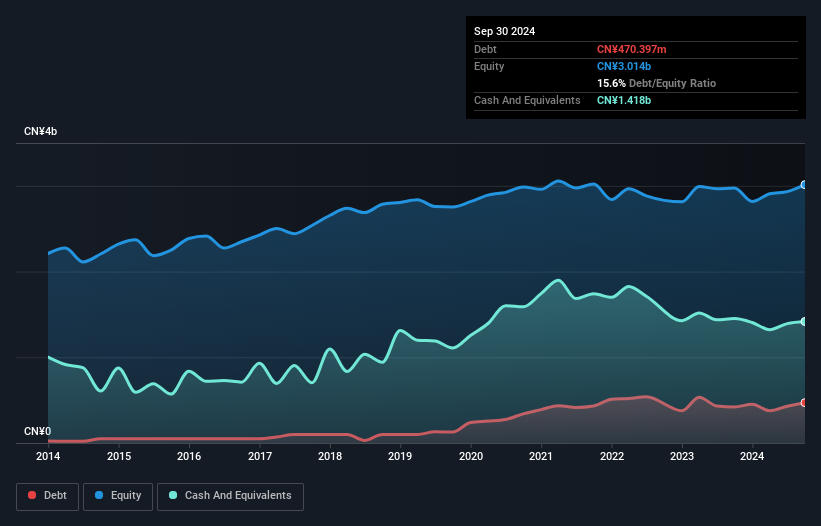

Guilin Sanjin Pharmaceutical, a nimble player in the pharmaceuticals sector, has shown resilience with earnings growth of 1.6% over the past year, outpacing the industry's -2.5%. Despite a dip in sales to CN¥1.57 billion from CN¥1.63 billion last year, it remains profitable with free cash flow positive and more cash than total debt—a solid financial footing. The company trades at 37.6% below its estimated fair value and recently announced a dividend of CNY 2.50 per ten shares for Q3 2024, reflecting confidence in its financial health despite some impact from one-off gains of CN¥84 million this year.

- Get an in-depth perspective on Guilin Sanjin Pharmaceutical's performance by reading our health report here.

Understand Guilin Sanjin Pharmaceutical's track record by examining our Past report.

Shanghai Kaibao PharmaceuticalLtd (SZSE:300039)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Kaibao Pharmaceutical Co., Ltd focuses on the research, development, production, and sale of modern Chinese medicines primarily in China with a market capitalization of CN¥7.19 billion.

Operations: Shanghai Kaibao Pharmaceutical generates revenue primarily from its industry segment, totaling CN¥1.56 billion. The company's financials reflect a gross profit margin trend that may be of interest to potential investors seeking insights into its profitability dynamics.

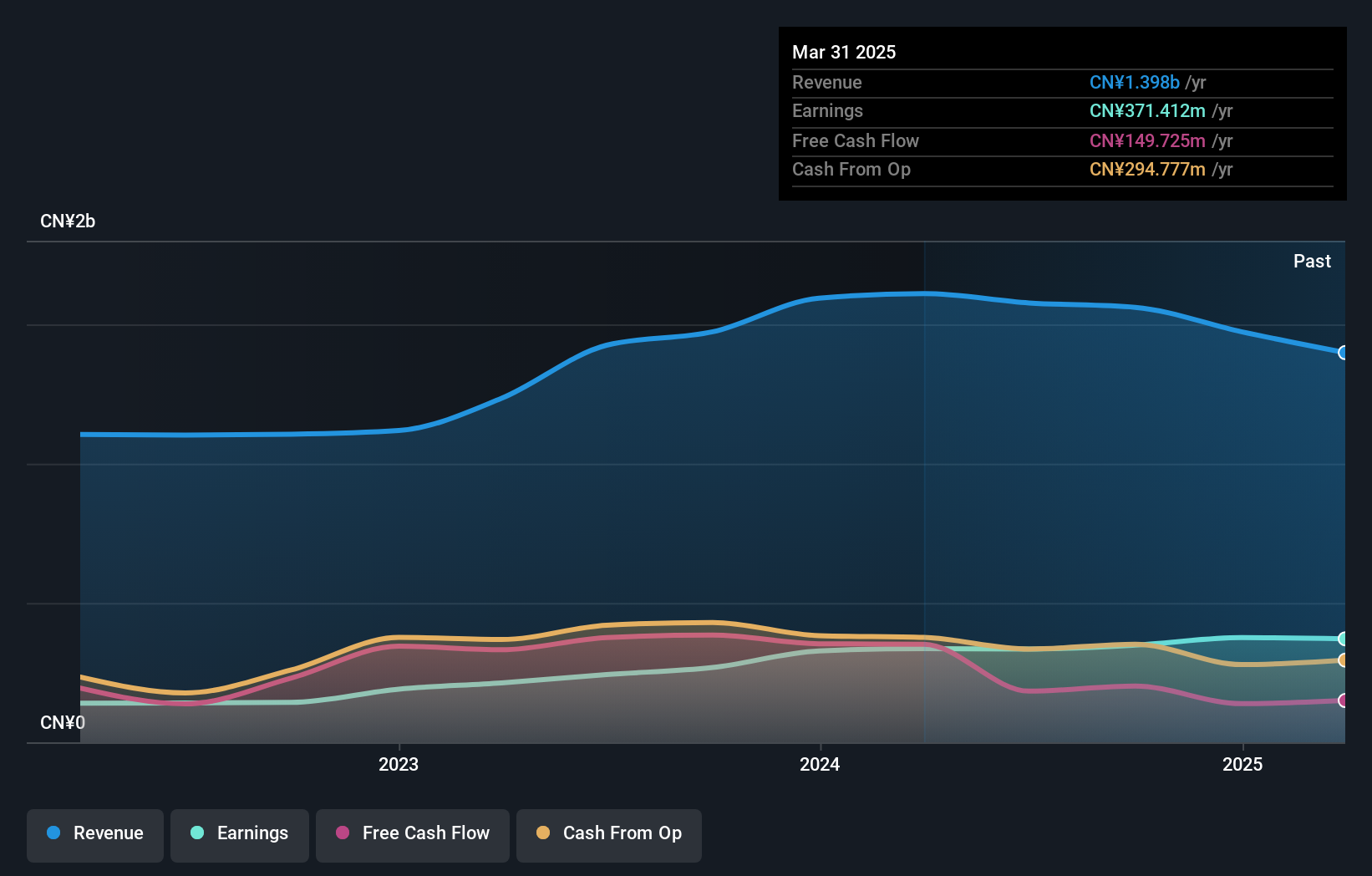

Shanghai Kaibao Pharmaceutical, a dynamic player in the pharmaceutical industry, has seen its earnings grow by 30% over the past year, outpacing the industry average of -2.5%. The company boasts high-quality earnings and maintains a price-to-earnings ratio of 21.1x, which is competitive compared to the CN market's 37.6x. Despite a slight dip in sales from CNY 1,154 million to CNY 1,121 million for the nine months ending September 2024, net income rose to CNY 217 million from CNY 196 million last year. With free cash flow remaining positive and debt levels manageable at a ratio of just 0.08%, Shanghai Kaibao appears well-positioned within its sector.

Make It Happen

- Get an in-depth perspective on all 4629 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300039

Shanghai Kaibao PharmaceuticalLtd

Engages in the research, development, production, and sale of modern Chinese medicines primarily in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives