- China

- /

- Renewable Energy

- /

- SZSE:000690

Discovering Undiscovered Gems with Strong Fundamentals December 2024

Reviewed by Simply Wall St

As global markets experience a divergence in major indexes, with growth stocks continuing to rally while small-cap indices like the Russell 2000 face declines, investors are keenly observing economic indicators such as labor market data and potential interest rate cuts by the Federal Reserve. In this environment of mixed signals and sector disparities, identifying stocks with strong fundamentals becomes crucial for navigating the complexities of today's market. A good stock often demonstrates robust financial health, consistent earnings growth, and resilience amidst broader market fluctuations—traits that can help it stand out as an undiscovered gem in a volatile landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 37.70% | 48.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanghai Rongtai Health Technology (SHSE:603579)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Rongtai Health Technology Corporation Limited focuses on the R&D, design, production, and sales of massage appliances both in China and internationally, with a market cap of CN¥2.89 billion.

Operations: Rongtai Health generates revenue primarily through the sale of massage appliances. The company's financial performance is reflected in its gross profit margin, which shows a notable trend over recent periods.

Shanghai Rongtai Health Technology, a small player in the industry, showcases a mixed financial landscape. While earnings grew by 1.7% over the past year, outperforming the leisure sector's -0.7%, recent figures reveal some challenges with net income at CNY 142 million for nine months ending September 2024 compared to CNY 152 million last year. The company's debt-to-equity ratio has climbed significantly from 1.9% to 51.8% over five years, indicating increased leverage but they have more cash than total debt which is reassuring for stability. Despite these hurdles, its Price-To-Earnings ratio of 15x suggests it remains undervalued against the broader CN market at 37x.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the energy sector and has a market capitalization of approximately CN¥10.34 billion.

Operations: The company generates revenue primarily from its energy sector operations. It has a market capitalization of approximately CN¥10.34 billion, reflecting its position in the industry.

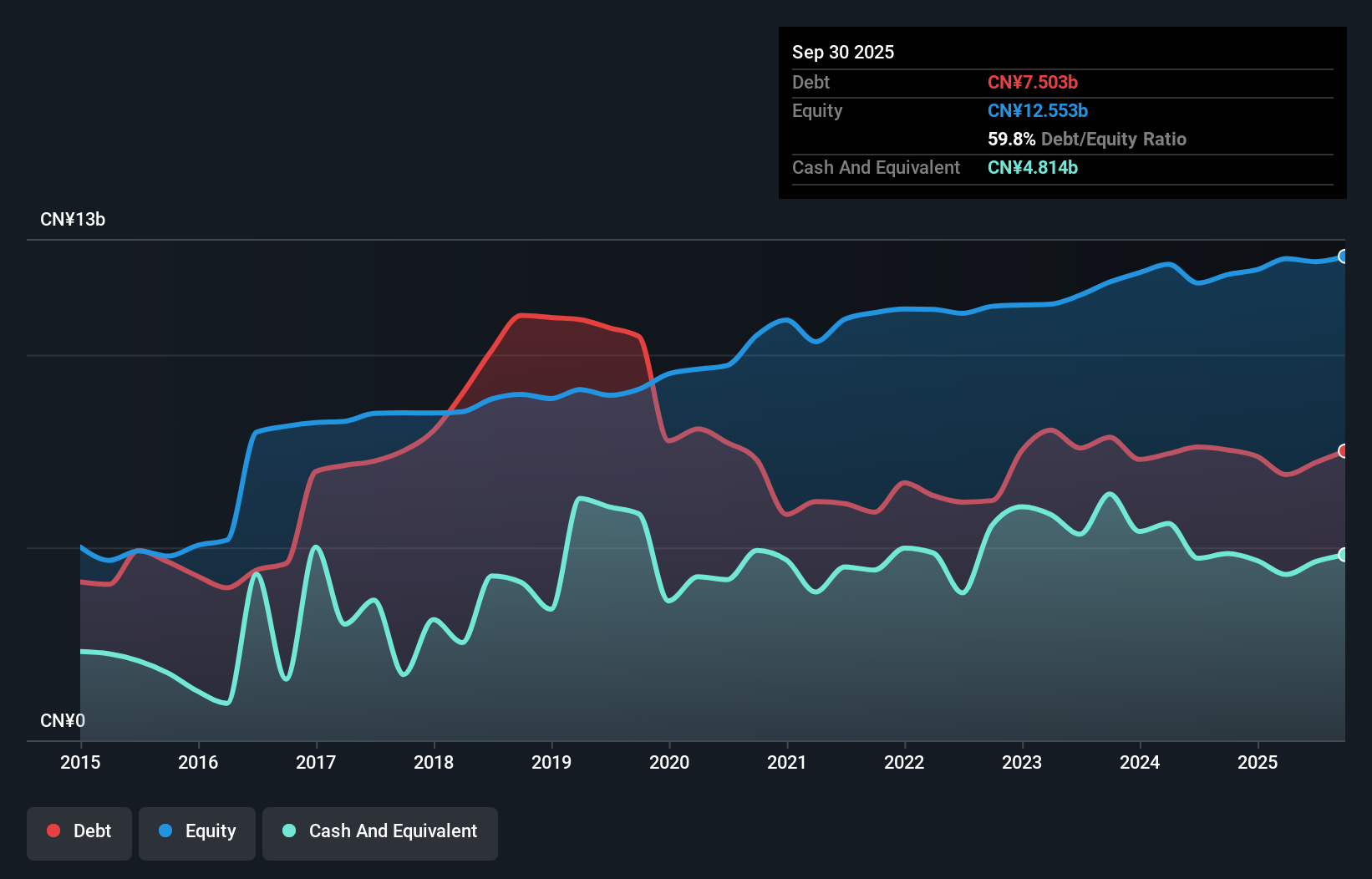

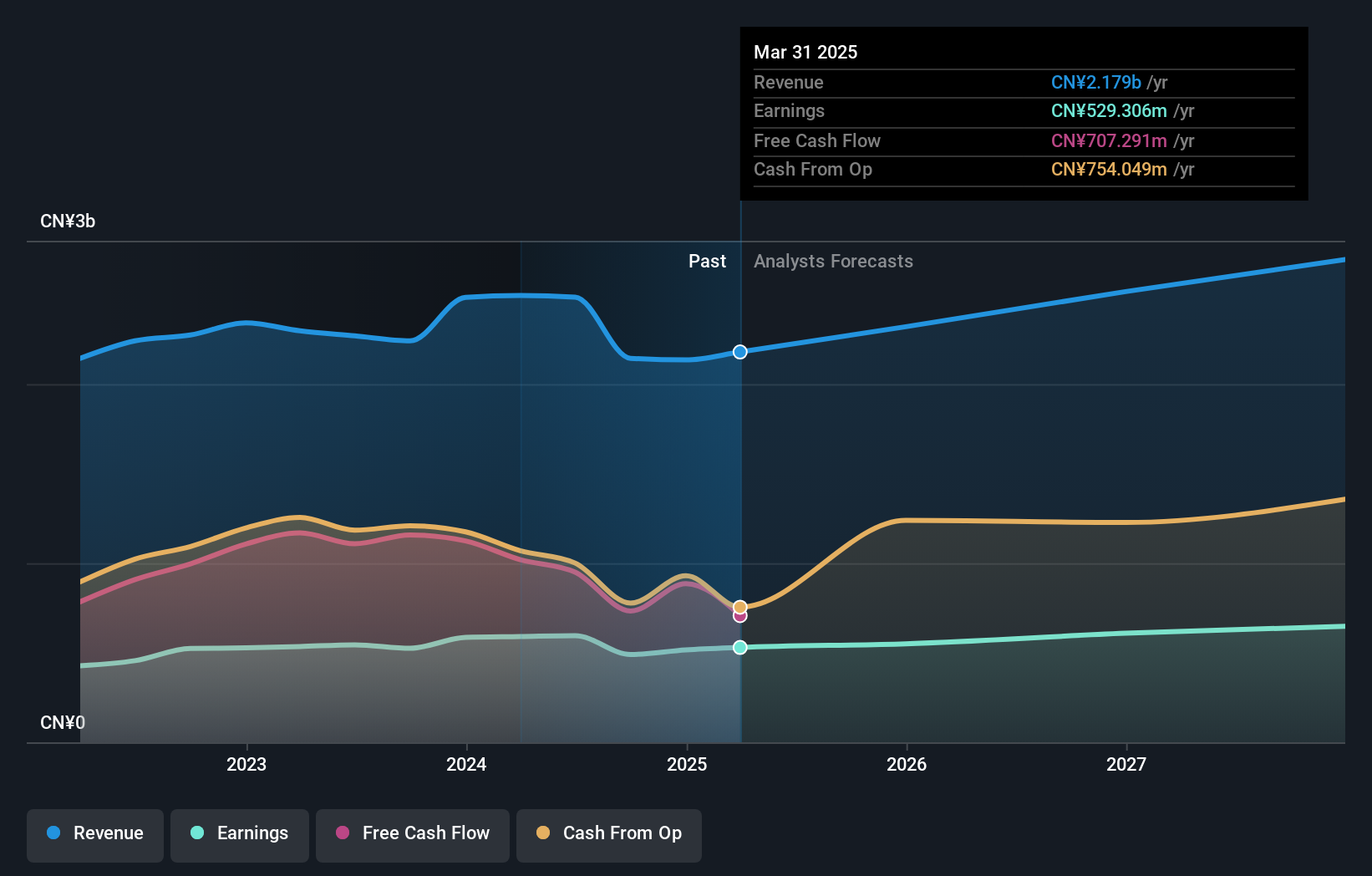

Guangdong Baolihua New Energy Stock, a player in the renewable energy sector, showcases intriguing financial dynamics. Over the past year, earnings surged by 31%, significantly outpacing the industry average of 6.8%. Despite a drop in revenue to CNY 6.11 billion from CNY 7.70 billion last year, net income remained robust at CNY 592 million compared to CNY 645 million previously. The company's debt management has improved notably with its debt-to-equity ratio decreasing from 115% to a satisfactory level of 22.3% over five years, suggesting prudent financial handling and potential for future growth within its market niche.

Shandong Wit Dyne HealthLtd (SZSE:000915)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Wit Dyne Health Co., Ltd. operates in the pharmaceutical industry in China with a market capitalization of CN¥6.36 billion.

Operations: Shandong Wit Dyne Health Co., Ltd. generates revenue primarily from its pharmaceutical operations in China, contributing significantly to its financial performance. The company's cost structure includes expenses related to production and distribution, impacting its overall profitability. Notably, the net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

Shandong Wit Dyne Health, a small cap player in the pharmaceutical sector, recently reported sales of CNY 1.38 billion for the first nine months of 2024, down from CNY 1.72 billion last year. Net income also dipped to CNY 365.42 million from CNY 460.79 million previously, with earnings per share sliding to CNY 1.56 from CNY 1.97. Despite these challenges, it's trading at an attractive valuation—48% below its estimated fair value—and remains debt-free with high-quality past earnings and positive free cash flow, suggesting a solid foundation for potential recovery and growth in profitability over time.

Taking Advantage

- Unlock our comprehensive list of 4629 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000690

Guangdong Baolihua New Energy Stock

Guangdong Baolihua New Energy Stock Co., Ltd.

Flawless balance sheet and undervalued.