In a week marked by record highs in major stock indexes such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, the Russell 2000 Index experienced a decline after previously outperforming its larger-cap counterparts. This divergence highlights the complex landscape for small-cap stocks amid mixed economic signals like rebounding job growth and potential interest rate cuts. In this environment, identifying promising stocks involves looking beyond market trends to find companies with strong fundamentals and unique growth opportunities that may not yet be recognized by mainstream investors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 37.70% | 48.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shanghai Kaichuang Marine International (SHSE:600097)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Kaichuang Marine International Co., Ltd. operates in deep-sea fishing, aquatic product processing, and related trading businesses both in China and internationally, with a market capitalization of CN¥2.60 billion.

Operations: The company generates revenue primarily from deep-sea fishing, aquatic product processing, and related trading activities. It has a market capitalization of CN¥2.60 billion.

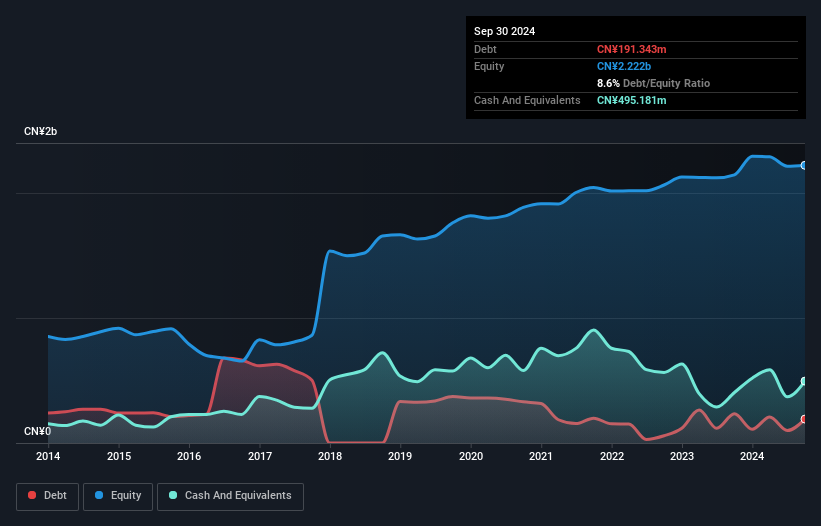

Shanghai Kaichuang Marine International, a smaller player in the market, has shown significant earnings growth of 89.3% over the past year, outpacing the broader Food industry. Despite this impressive rise, its net income for the first nine months of 2024 was CN¥16.38 million, nearly unchanged from CN¥16.4 million in 2023. The company appears undervalued by trading at 93.1% below estimated fair value and benefits from a reduced debt-to-equity ratio now at 8.6%, down from 21.1% five years ago. Recent meetings suggest active shareholder engagement as they navigate these financial dynamics and aim for future stability and growth.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. engages in the research, development, production, and sale of rice wine both domestically and internationally, with a market capitalization of CN¥5.73 billion.

Operations: Kuaijishan generates revenue primarily through the sale of rice wine in domestic and international markets. The company has a market capitalization of CN¥5.73 billion.

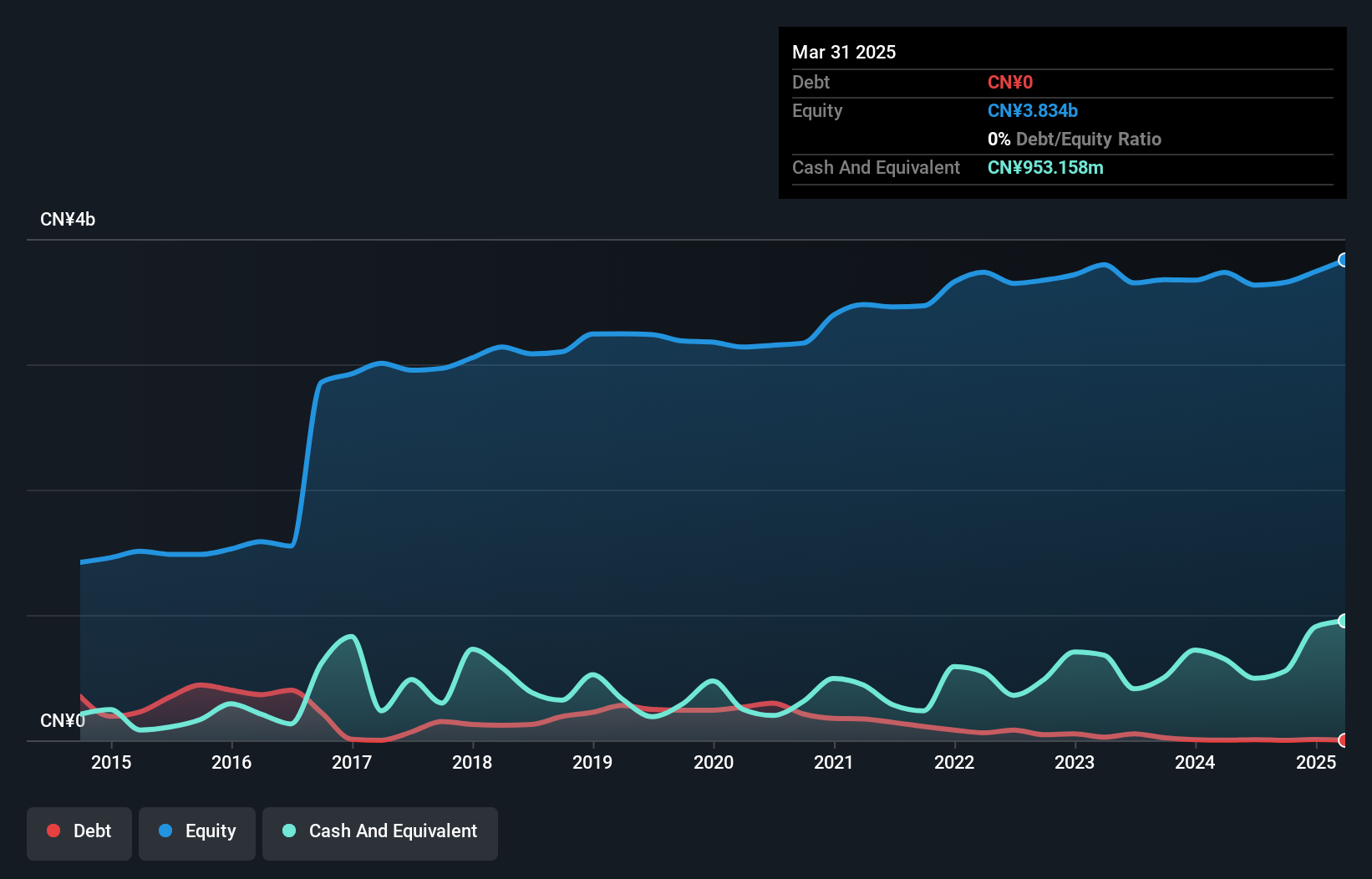

Kuaijishan Shaoxing Rice Wine, a smaller player in the beverage sector, showcases a promising trajectory with its debt-free status and high-quality earnings. The company reported CNY 1.06 billion in sales for the first nine months of 2024, up from CNY 935.19 million last year, while net income reached CNY 112.63 million compared to CNY 103.39 million previously. With an earnings growth of 18% over the past year surpassing industry averages and a price-to-earnings ratio of 33x below the market benchmark, Kuaijishan appears well-positioned for continued expansion within its niche market segment.

Elegant Home-Tech (SHSE:603221)

Simply Wall St Value Rating: ★★★★★☆

Overview: Elegant Home-Tech Co., Ltd. specializes in the research, development, production, and sales of polyvinyl chloride (PVC) elastic floorings both in China and internationally, with a market cap of CN¥2.53 billion.

Operations: Elegant Home-Tech generates revenue primarily through the sale of polyvinyl chloride (PVC) elastic floorings, focusing on both domestic and international markets. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency in the competitive flooring industry.

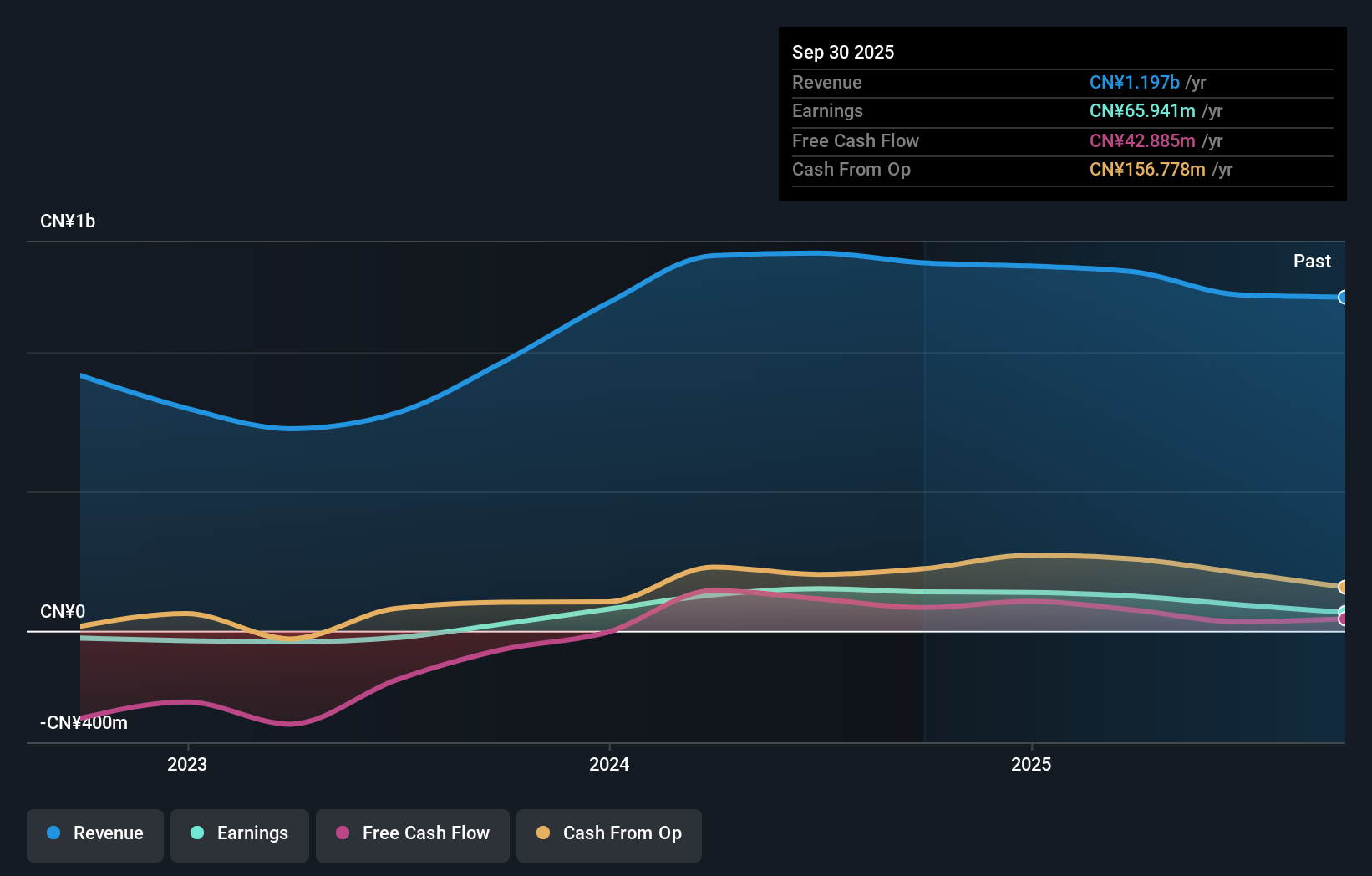

Elegant Home-Tech, a promising player in the market, has demonstrated impressive growth with earnings surging by 481% over the past year, outpacing its industry. The company reported CNY 933.25 million in sales for the first nine months of 2024, compared to CNY 789 million last year. Net income also rose significantly to CNY 93.56 million from CNY 31.52 million previously. With a price-to-earnings ratio of 19.9x below the CN market average and more cash than total debt, it seems well-positioned financially despite an increased debt-to-equity ratio from 11.6% to 16.5%.

- Navigate through the intricacies of Elegant Home-Tech with our comprehensive health report here.

Understand Elegant Home-Tech's track record by examining our Past report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4626 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elegant Home-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603221

Elegant Home-Tech

Engages in the research and development, production, and sales of polyvinyl chloride (PVC) elastic floorings in China and internationally.

Excellent balance sheet with proven track record.