- China

- /

- Metals and Mining

- /

- SHSE:600459

Revealing Three Top Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices, the Russell 2000 Index, which tracks small-cap stocks, saw a decline after previously outperforming its larger-cap counterparts. This shift in market dynamics underscores the importance of identifying stocks with strong fundamentals and growth potential that may not yet be on investors' radars. In this context, undiscovered gems can offer unique opportunities for those willing to explore beyond the usual market leaders.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 37.70% | 48.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shiyue Daotian Group (SEHK:9676)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shiyue Daotian Group Co., Ltd. operates in the People's Republic of China, focusing on the manufacturing and sale of pantry staple foods, with a market capitalization of HK$7.84 billion.

Operations: The company generates revenue primarily from rice products (CN¥3.80 billion), followed by whole grain, bean, and other products (CN¥1.04 billion), and dried food and other products (CN¥422.83 million).

Shiyue Daotian Group, a relatively small player in its sector, has recently turned profitable, which makes its performance stand out against the broader food industry's recent -2.9% trend. The company's interest payments are well-covered by EBIT at 16.3 times, indicating solid financial health in this regard. Despite having more cash than total debt, Shiyue Daotian's free cash flow is negative at US$12.72 million as of June 2024, suggesting potential liquidity challenges ahead. However, high-quality earnings and profitability offer a promising outlook for future stability and growth amidst recent share price volatility and insider selling activity.

- Unlock comprehensive insights into our analysis of Shiyue Daotian Group stock in this health report.

Understand Shiyue Daotian Group's track record by examining our Past report.

Sino-Platinum MetalsLtd (SHSE:600459)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sino-Platinum Metals Co., Ltd. is involved in the research, development, production, sales, and technical services of metal and non-metal materials in China with a market capitalization of approximately CN¥11.01 billion.

Operations: Sino-Platinum Metals generates revenue primarily from its Metal Processors and Fabrication segment, amounting to CN¥46.97 billion.

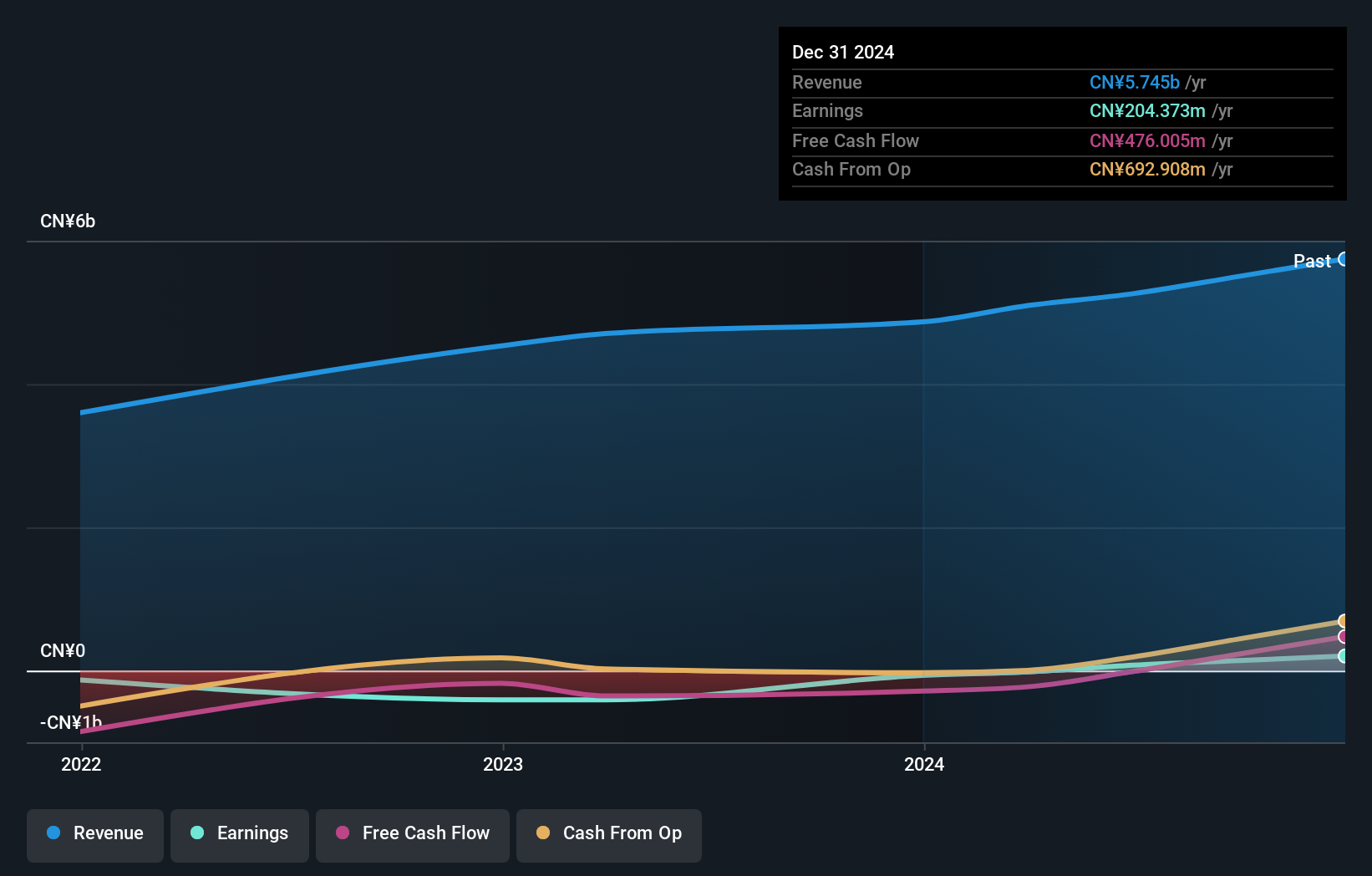

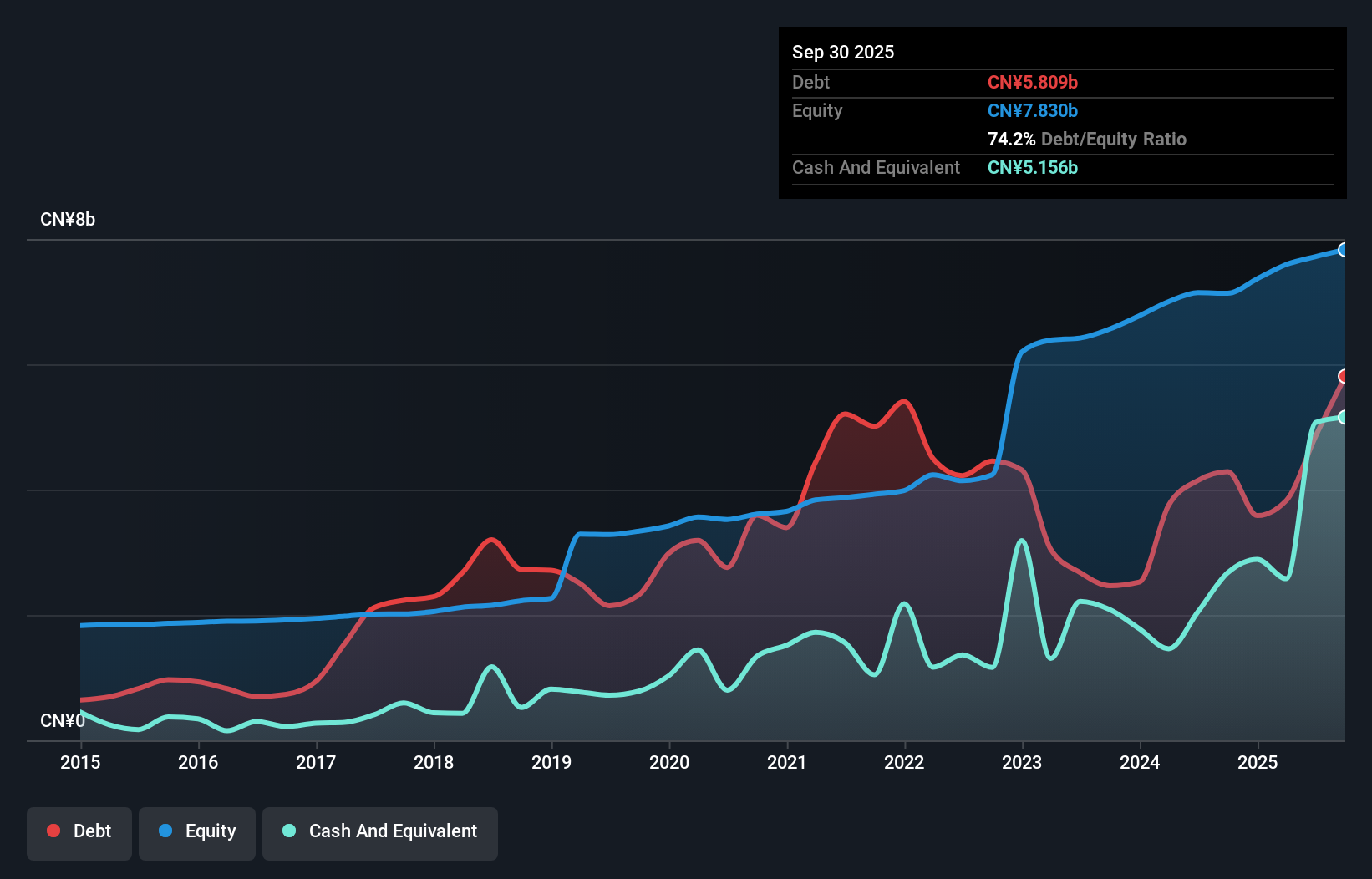

Sino-Platinum Metals, a smaller player in the metals and mining sector, has shown resilience with earnings growth of 6% over the past year, outpacing an industry that saw a 2.3% decline. The company's net debt to equity ratio stands at a satisfactory 22.6%, reflecting sound financial management. Additionally, interest payments are comfortably covered by EBIT at 14.6 times coverage, underscoring strong operational performance. Despite facing large one-off gains of CN¥212 million impacting recent results, it trades at a favorable price-to-earnings ratio of 21.5x compared to the broader CN market's 37.6x, suggesting potential value for investors seeking opportunities in this niche market segment.

- Get an in-depth perspective on Sino-Platinum MetalsLtd's performance by reading our health report here.

Assess Sino-Platinum MetalsLtd's past performance with our detailed historical performance reports.

Wuhan Sante Cableway Group (SZSE:002159)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuhan Sante Cableway Group Co., Ltd. operates in the tourism industry in China with a market capitalization of CN¥3.18 billion.

Operations: Wuhan Sante Cableway Group generates revenue primarily from its tourism-related operations in China. The company's financial performance highlights a net profit margin trend, reflecting its ability to manage costs relative to income.

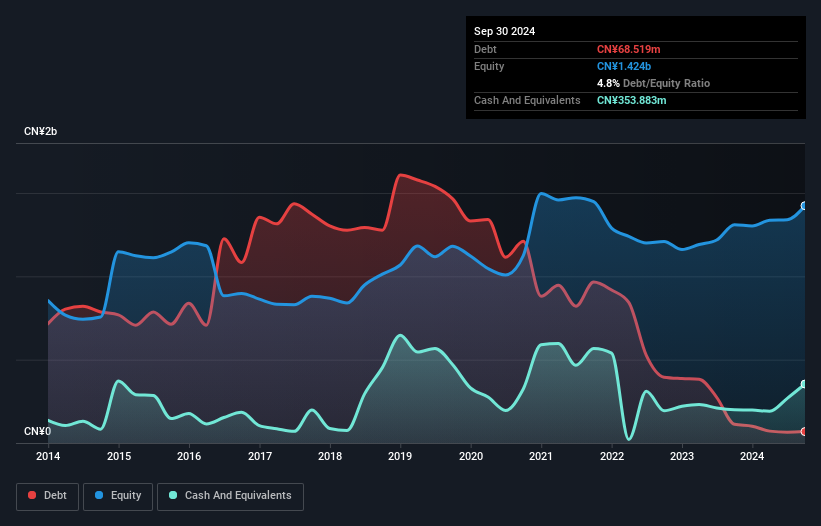

Wuhan Sante Cableway Group, a relatively small player in its field, has shown impressive earnings growth of 49.7% over the past year, outpacing the broader hospitality industry. The company boasts a favorable price-to-earnings ratio of 21.3x compared to the CN market average of 37.6x, indicating good value relative to peers. Its debt management is noteworthy with a reduction in debt-to-equity from 124% to just 4.8% over five years, and it holds more cash than total debt—an encouraging sign for potential investors looking at financial stability and future growth prospects.

- Click here to discover the nuances of Wuhan Sante Cableway Group with our detailed analytical health report.

Gain insights into Wuhan Sante Cableway Group's past trends and performance with our Past report.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4629 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600459

Sino-Platinum MetalsLtd

Engages in the research, development, production, sales, and technical services of metal and non-metal materials in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives