Shareholders in Changchun High-Tech Industry (Group) (SZSE:000661) are in the red if they invested three years ago

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Changchun High-Tech Industry (Group) Co., Ltd. (SZSE:000661) shareholders. Sadly for them, the share price is down 63% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 32% lower in that time.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for Changchun High-Tech Industry (Group)

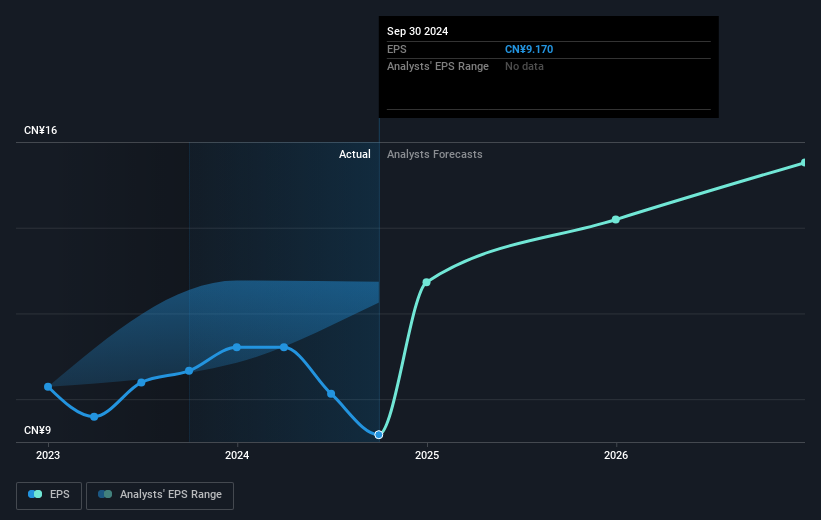

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Changchun High-Tech Industry (Group) saw its EPS decline at a compound rate of 1.8% per year, over the last three years. This reduction in EPS is slower than the 28% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 10.78.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Changchun High-Tech Industry (Group)'s earnings, revenue and cash flow.

A Different Perspective

Investors in Changchun High-Tech Industry (Group) had a tough year, with a total loss of 29% (including dividends), against a market gain of about 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Importantly, we haven't analysed Changchun High-Tech Industry (Group)'s dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course Changchun High-Tech Industry (Group) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000661

Changchun High-Tech Industry (Group)

Researches, develops, manufactures, and sells biopharmaceuticals and traditional Chinese medicines products in China.

6 star dividend payer with excellent balance sheet.