- China

- /

- Electrical

- /

- SHSE:603119

Bangkok Life Assurance Leads These 3 Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, small-cap stocks have shown resilience with indices like the Russell 2000 posting modest gains. In this environment, identifying stocks with strong fundamentals becomes crucial, as they can offer stability and potential growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dr. Miele Cosmed Group | 21.75% | 8.35% | 15.31% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bangkok Life Assurance (SET:BLA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bangkok Life Assurance Public Company Limited, with a market cap of THB36.03 billion, offers life insurance services to both individuals and corporates in Thailand through its subsidiaries.

Operations: Bangkok Life Assurance generates revenue primarily from its life insurance business, amounting to THB45.65 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

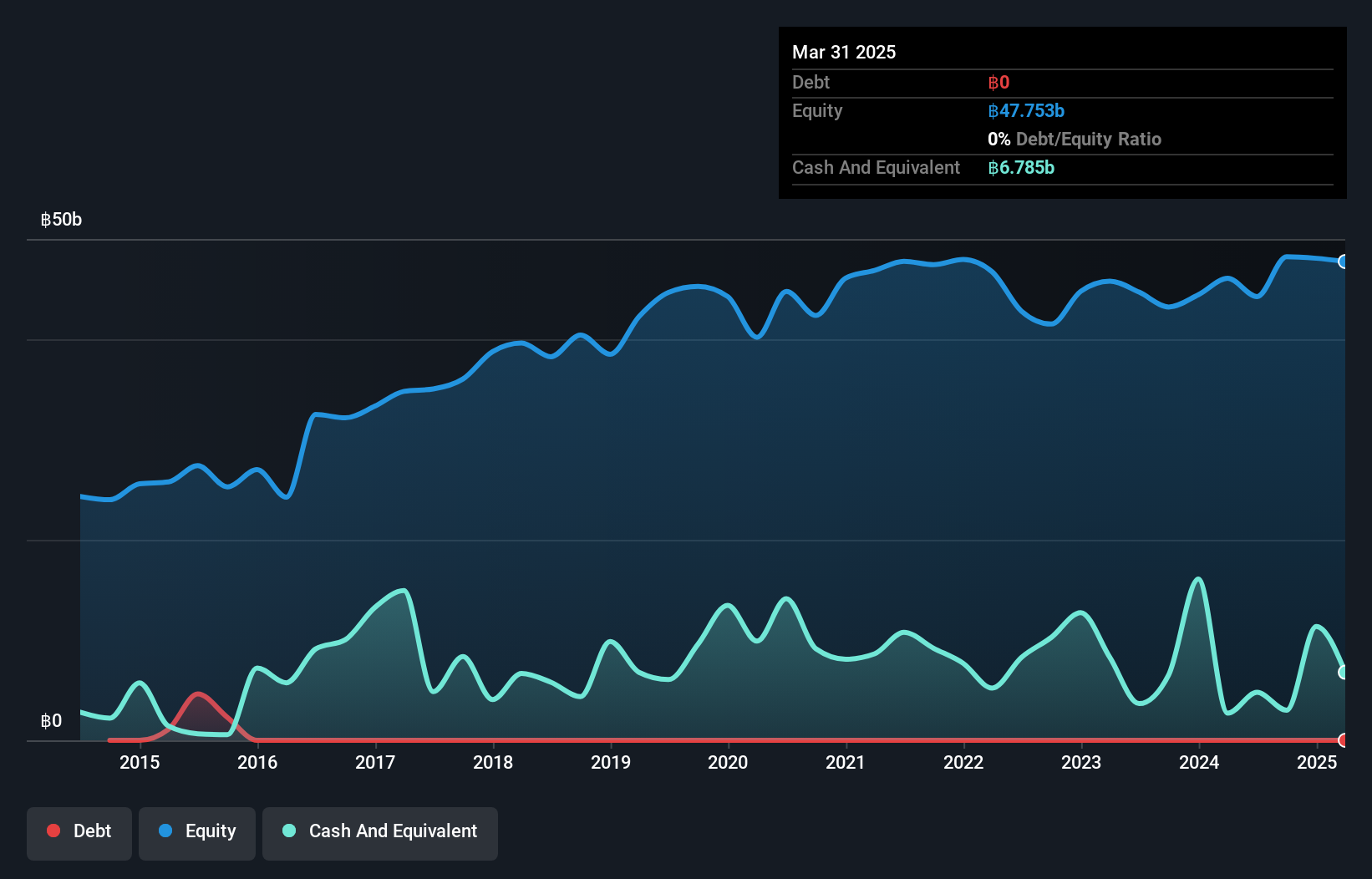

Bangkok Life Assurance, a relatively small player in the insurance sector, showcases a compelling growth narrative. With earnings growing by 22.6% over the past year and forecasted to rise 20.48% annually, it outpaces the industry average of 10.9%. The company is debt-free, highlighting its robust financial health and eliminating concerns over interest payments. Despite reporting third-quarter revenue of THB 12,774 million (down from THB 13,211 million last year), net income for nine months increased to THB 2,669 million from THB 2,190 million previously. Trading at a discount of 16.5% below estimated fair value suggests potential upside for investors seeking undervalued opportunities.

- Take a closer look at Bangkok Life Assurance's potential here in our health report.

Learn about Bangkok Life Assurance's historical performance.

Zhejiang Rongtai Electric MaterialLtd (SHSE:603119)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Rongtai Electric Material Co., Ltd. operates in the electric materials industry and has a market cap of CN¥8.12 billion.

Operations: Rongtai Electric Material generates revenue primarily from its electric materials segment. The company has a market cap of CN¥8.12 billion, reflecting its presence in the industry.

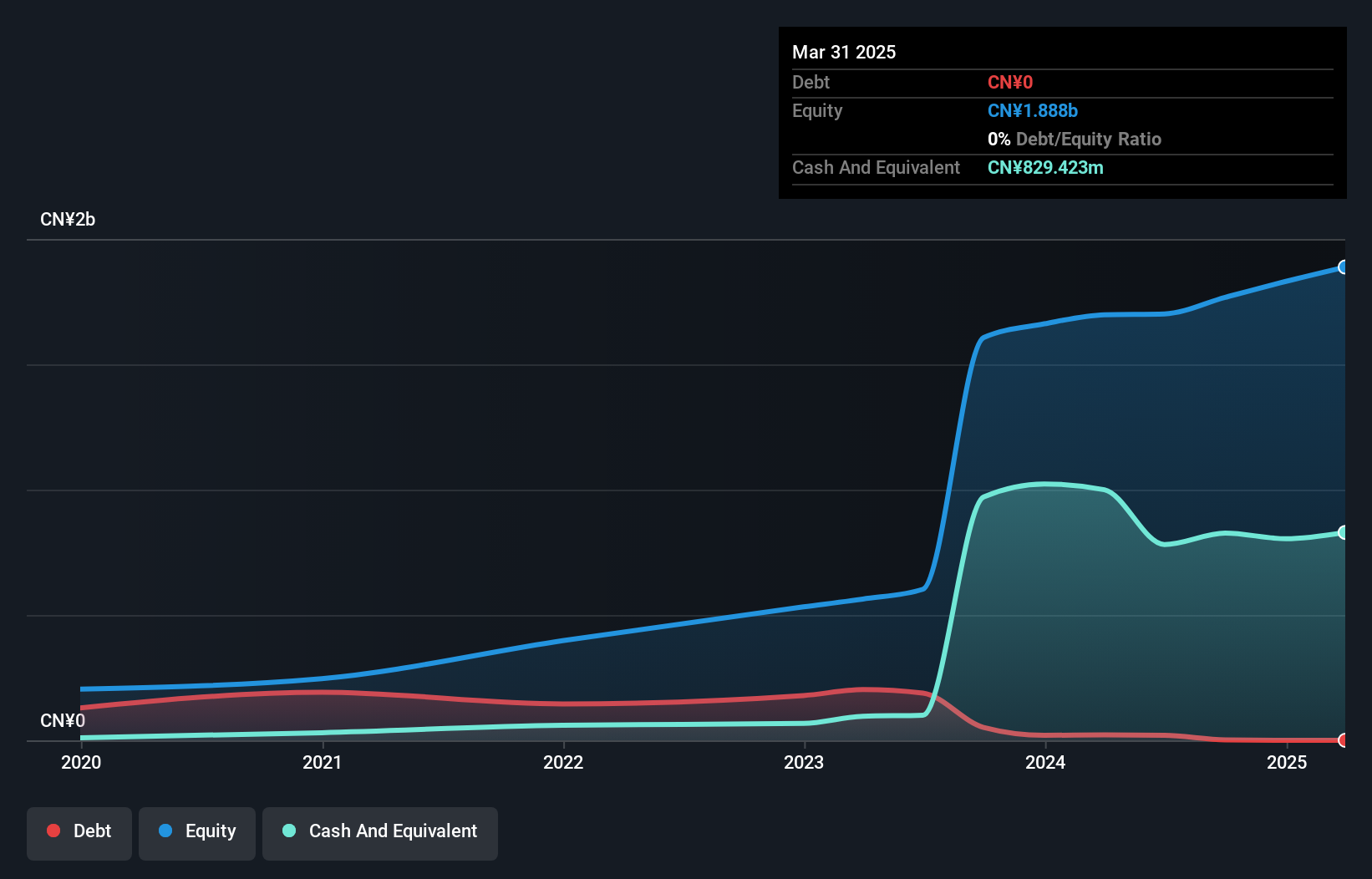

Zhejiang Rongtai Electric Material, a small player in its sector, recently showcased robust performance with earnings growing 40.8% over the past year, outpacing the Electrical industry’s 1.1%. The company reported sales of CNY 808.96 million for nine months ending September 2024, up from CNY 582.62 million the previous year, with net income reaching CNY 166.55 million compared to CNY 117.68 million earlier. Trading at a slight discount of 3.3% below estimated fair value and having more cash than debt suggests financial stability and potential for future growth amidst ongoing industry challenges.

Zhejiang Mustang BatteryLtd (SHSE:605378)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Mustang Battery Co., Ltd specializes in the research, development, production, and sale of dry batteries in China with a market capitalization of CN¥3.85 billion.

Operations: Zhejiang Mustang Battery Co., Ltd generates revenue primarily through the sale of dry batteries. The company's cost structure includes expenses related to research, development, and production. It has a market capitalization of CN¥3.85 billion, reflecting its position in the industry.

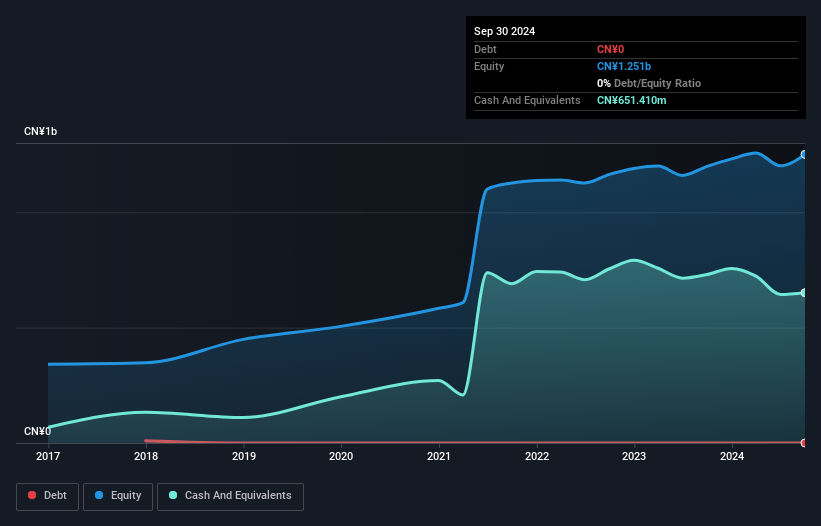

Zhejiang Mustang Battery, a nimble player in its sector, has shown impressive earnings growth of 43.5% over the past year, outpacing the Household Products industry which saw a 6.7% decline. The company is debt-free and boasts high-quality non-cash earnings, indicating robust financial health. Recent reports highlight significant revenue gains to CNY 950 million from CNY 765 million last year, with net income climbing to CNY 117 million from CNY 77 million. Its price-to-earnings ratio stands at an attractive 26.4x compared to the broader CN market's average of 35.9x, suggesting potential value for investors seeking growth opportunities in this space.

Where To Now?

- Discover the full array of 4636 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Rongtai Electric MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603119

Zhejiang Rongtai Electric MaterialLtd

Zhejiang Rongtai Electric Material Co.,Ltd.

High growth potential with solid track record.