Jiangsu Jibeier Pharmaceutical Co., Ltd.'s (SHSE:688566) Shares Lagging The Market But So Is The Business

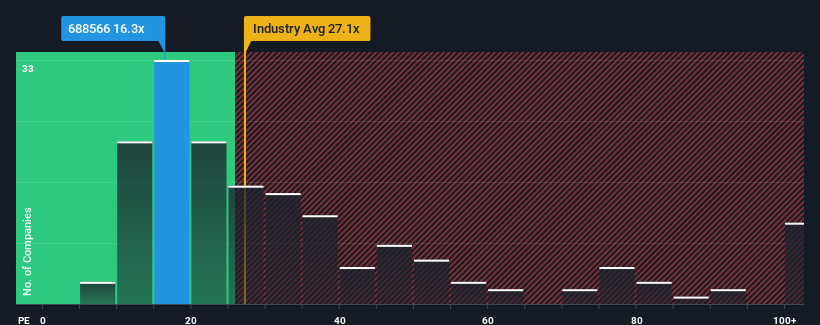

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 28x, you may consider Jiangsu Jibeier Pharmaceutical Co., Ltd. (SHSE:688566) as an attractive investment with its 16.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Jiangsu Jibeier Pharmaceutical as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Jiangsu Jibeier Pharmaceutical

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jiangsu Jibeier Pharmaceutical's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 42%. The strong recent performance means it was also able to grow EPS by 71% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 20% per year during the coming three years according to the two analysts following the company. That's shaping up to be materially lower than the 24% per year growth forecast for the broader market.

With this information, we can see why Jiangsu Jibeier Pharmaceutical is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jiangsu Jibeier Pharmaceutical maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Jiangsu Jibeier Pharmaceutical (1 makes us a bit uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Jiangsu Jibeier Pharmaceutical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688566

Jiangsu Jibeier Pharmaceutical

A pharmaceutical company, engages in the research, development, production, and sale of chemical pharmaceutical preparations, Chinese medicine, and drugs.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives