Amidst renewed U.S.-China trade tensions and mixed performances across global markets, the Asian tech sector continues to capture investor interest due to its potential for high growth. In this dynamic environment, identifying promising tech stocks involves assessing factors such as innovative capabilities, market adaptability, and resilience to geopolitical shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 23.97% | 28.52% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai OPM Biosciences Co., Ltd. is a company that offers cell culture media and CDMO services both in China and internationally, with a market capitalization of CN¥6.37 billion.

Operations: Shanghai OPM Biosciences generates revenue primarily through its cell culture media and CDMO services. The company's operations span both domestic and international markets.

Shanghai OPM Biosciences, a key player in the biotech sector in Asia, has demonstrated robust financial performance with a notable 23% annual revenue growth and an impressive 48% forecasted annual earnings growth. Recent financial disclosures reveal half-year sales rising from CNY 143.38 million to CNY 177.52 million, alongside net income surging from CNY 24.14 million to CNY 37.55 million, reflecting strong operational execution and market demand. Despite challenges like a highly volatile share price and lower profit margins year-over-year—from 15.2% down to 10.4%—the company's significant R&D investments underscore its commitment to innovation and future competitiveness in the high-growth biotech landscape of Asia.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. focuses on the R&D, production, and sales of optical modules both in China and globally, with a market cap of CN¥314.59 billion.

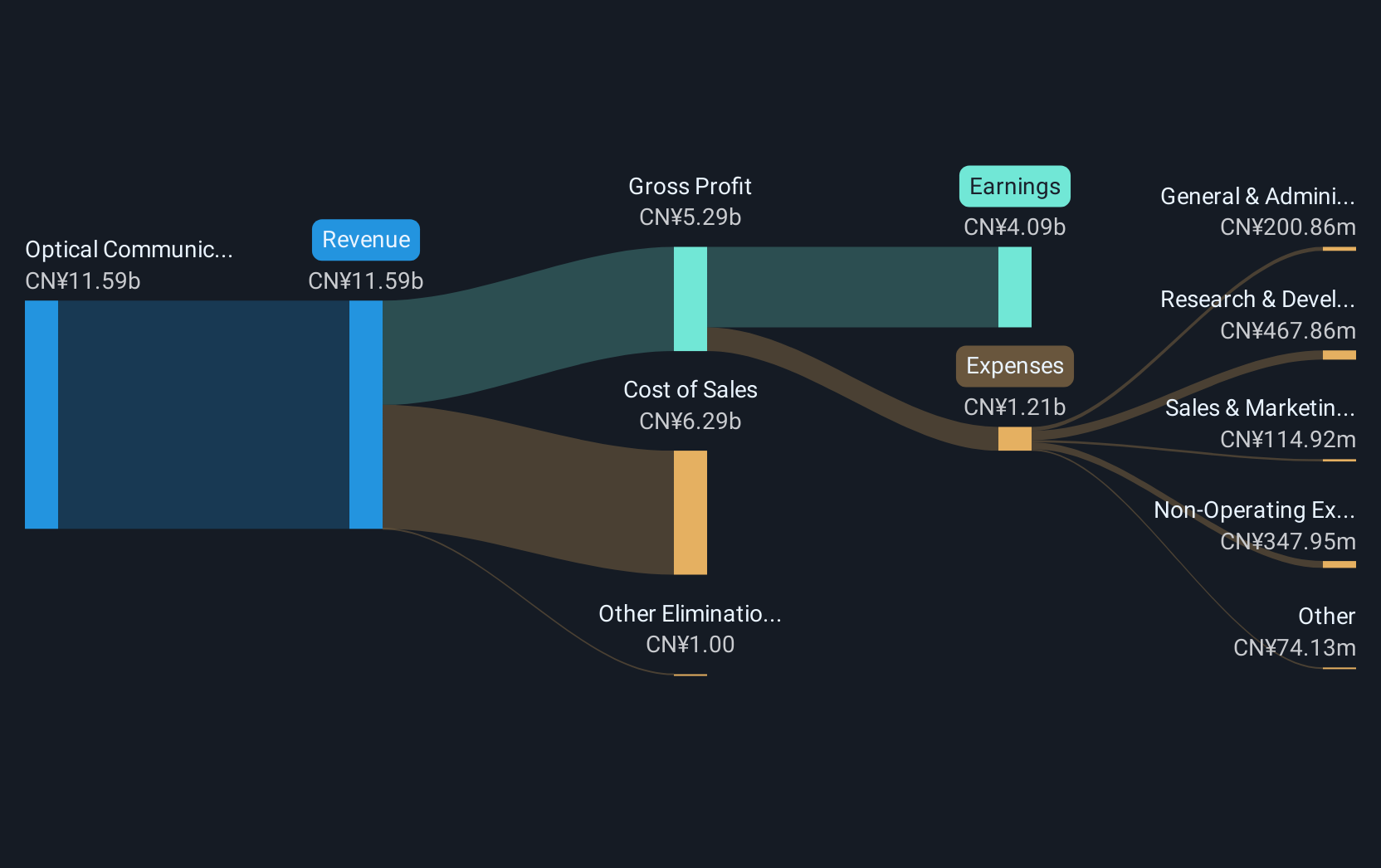

Operations: Eoptolink Technology Inc., Ltd. specializes in optical communication equipment, generating revenue of CN¥16.36 billion from this segment.

Eoptolink Technology, amidst a dynamic tech landscape in Asia, has showcased remarkable financial growth with revenue soaring to CNY 10.44 billion, a significant leap from CNY 2.73 billion the previous year. This surge is mirrored in its net income which escalated to CNY 3.94 billion from CNY 865 million, underpinned by an annualized earnings growth of 35.4%. Contributing to this robust performance is the company's aggressive R&D strategy, investing heavily to fuel innovations that keep them at the forefront of technological advancements. With recent amendments in corporate governance and participation in global tech summits like OCP Global Summit 2025, Eoptolink is not only expanding its market influence but also reinforcing its operational foundations for sustained growth.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China with a market capitalization of CN¥8.73 billion.

Operations: Tongxingbao focuses on providing smart transportation platform solutions, with its primary revenue stream coming from Software and Information Technology, generating CN¥956.61 million.

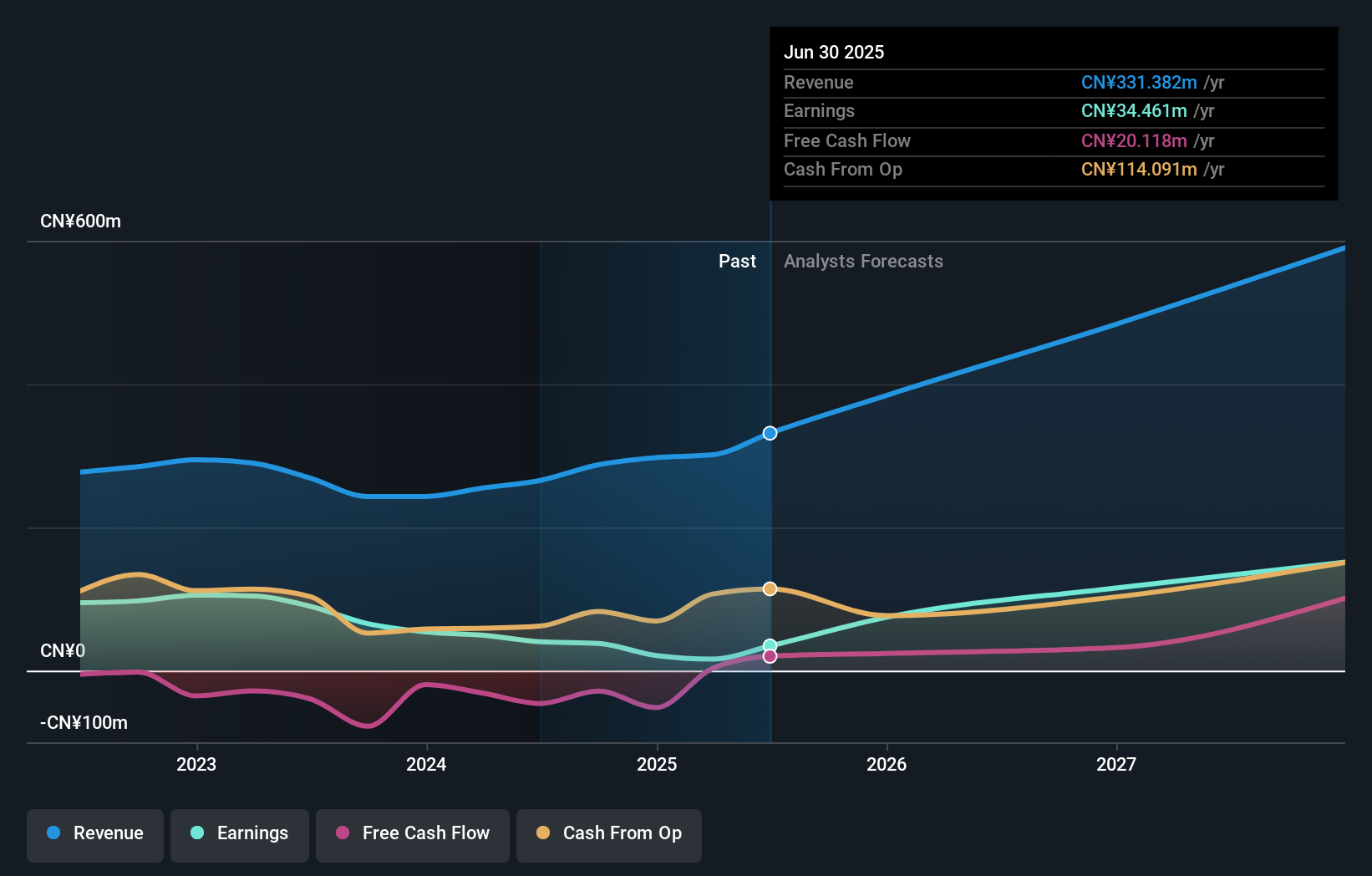

Jiangsu Tongxingbao Intelligent Transportation Technology, amid a robust tech sector in Asia, has demonstrated impressive growth with revenue and earnings climbing by 45% and 37.1% annually. The company's commitment to innovation is evident from its R&D spending, which significantly bolsters its competitive edge in intelligent transport solutions. Recent corporate activities include a shareholders meeting focused on strategic financial allocations and leadership adjustments to sustain expansion. These moves are pivotal as they navigate the fast-evolving demands of Asia’s transportation tech landscape, positioning them well for future technological advancements and market expansion.

Summing It All Up

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 184 more companies for you to explore.Click here to unveil our expertly curated list of 187 Asian High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688293

Shanghai OPM Biosciences

Provides cell culture media and CDMO services in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives