Amidst easing U.S. inflation and ongoing trade policy uncertainties, global markets have experienced a challenging period, with key indices like the S&P 500 and Nasdaq Composite posting consecutive weeks of losses. In this climate of heightened volatility and recession concerns, identifying high growth tech stocks requires a focus on companies with robust innovation capabilities and resilience to economic fluctuations.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| CD Projekt | 30.55% | 39.06% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Xiamen Amoytop Biotech (SHSE:688278)

Simply Wall St Growth Rating: ★★★★★★

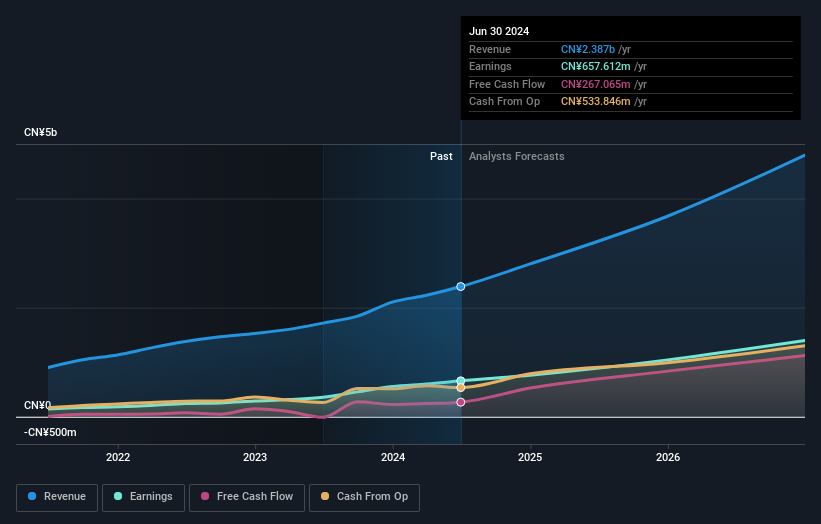

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥32.87 billion.

Operations: The company generates revenue primarily through its biologics segment, which contributed CN¥2.82 billion.

Xiamen Amoytop Biotech has demonstrated robust growth with a 49% increase in earnings over the past year, surpassing the biotech industry's average of 7.4%. This performance is underpinned by significant R&D investments, which are crucial for sustaining innovation and competitiveness in biotechnology. With earnings expected to grow by 29% annually and revenue forecasts at an impressive 27% per year, the company's strategic focus on developing advanced biotechnologies appears to be paying off. Recent financials reveal a jump in annual sales to CNY 2.82 billion from CNY 2.1 billion, alongside a surge in net income from CNY 555.45 million to CNY 827.6 million, reflecting strong operational execution and market demand for its offerings.

Anker Innovations (SZSE:300866)

Simply Wall St Growth Rating: ★★★★☆☆

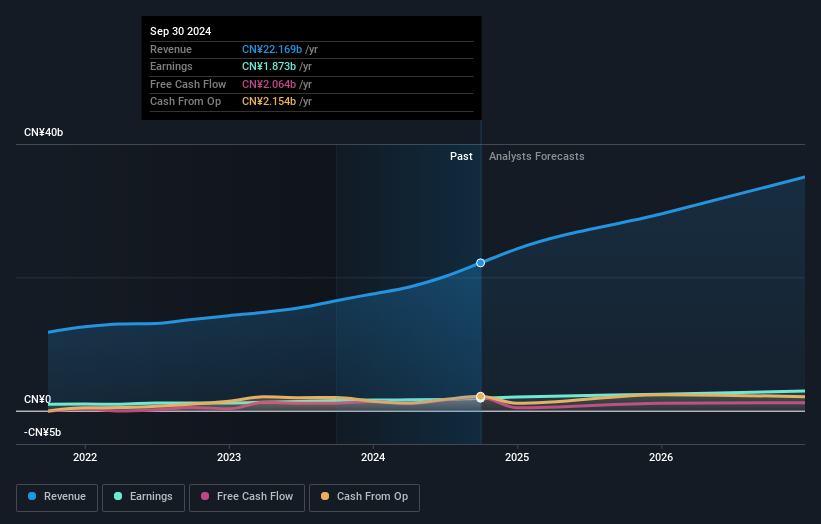

Overview: Anker Innovations Limited focuses on the development and sale of mobile charging products, with a market cap of CN¥54.10 billion.

Operations: The company generates revenue primarily through the development and sale of mobile charging products. With a market cap of CN¥54.10 billion, its business model is centered around leveraging technological innovation to capture market share in the consumer electronics sector.

Anker Innovations, amid a dynamic tech landscape, is making significant strides in the high-growth tech sector with an impressive annual revenue growth of 20.2% and earnings growth of 19.9%. The company's commitment to innovation is evident from its R&D spending trends, which show a consistent increase to strategically bolster its competitive edge in portable power solutions and charging technologies. Recently, Anker has been spotlighted for powering major events like the Electrify Expo with its SOLIX series, showcasing not only the practicality but also the sustainability of its energy solutions. This approach not only enhances brand visibility but also aligns with global shifts towards renewable energy sources, positioning Anker favorably within both consumer and industrial markets.

- Dive into the specifics of Anker Innovations here with our thorough health report.

Understand Anker Innovations' track record by examining our Past report.

Oracle Corporation Japan (TSE:4716)

Simply Wall St Growth Rating: ★★★★☆☆

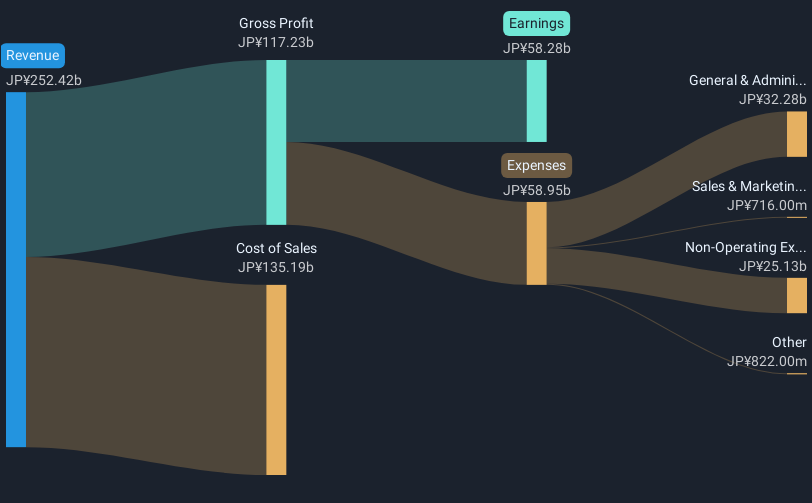

Overview: Oracle Corporation Japan focuses on developing and selling software and hardware products and solutions within Japan, with a market capitalization of ¥1.81 trillion.

Operations: The company generates revenue through the sale of software and hardware products, as well as related solutions. Its operations are concentrated in Japan, leveraging its expertise in technology to cater to local market demands.

Oracle Corporation Japan, amidst a competitive software industry, is demonstrating resilience with its revenue growing at 7.4% annually, outpacing the Japanese market's average of 4.2%. This growth is supported by an 8.6% expected annual increase in earnings, reflecting efficient operational management and robust market positioning. The company also shows a strong commitment to innovation with significant R&D investments aimed at enhancing product offerings and maintaining technological leadership. With a high Return on Equity forecasted at 29.9%, Oracle Japan is strategically positioned to leverage industry trends and customer needs effectively, ensuring sustained growth in the evolving tech landscape.

Seize The Opportunity

- Unlock our comprehensive list of 786 Global High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in research, development, production, and sale of recombinant protein drugs in China.

Exceptional growth potential with outstanding track record.