- Taiwan

- /

- Tech Hardware

- /

- TWSE:3515

Exploring High Growth Tech Stocks In The Global Market

Reviewed by Simply Wall St

In recent weeks, the global markets have experienced a mix of modest gains and losses, with small-cap stocks in the U.S. showing resilience as evidenced by the Russell 2000 Index outperforming larger indices like the S&P 500. Against this backdrop, high-growth tech stocks continue to capture investor interest due to their potential for innovation and expansion, making them attractive candidates for those looking to navigate current market conditions effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 27.20% | 39.47% | ★★★★★★ |

| Fositek | 33.77% | 43.92% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Bonesupport Holding | 25.30% | 59.70% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| CD Projekt | 34.94% | 42.68% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Xiamen Amoytop Biotech (SHSE:688278)

Simply Wall St Growth Rating: ★★★★★★

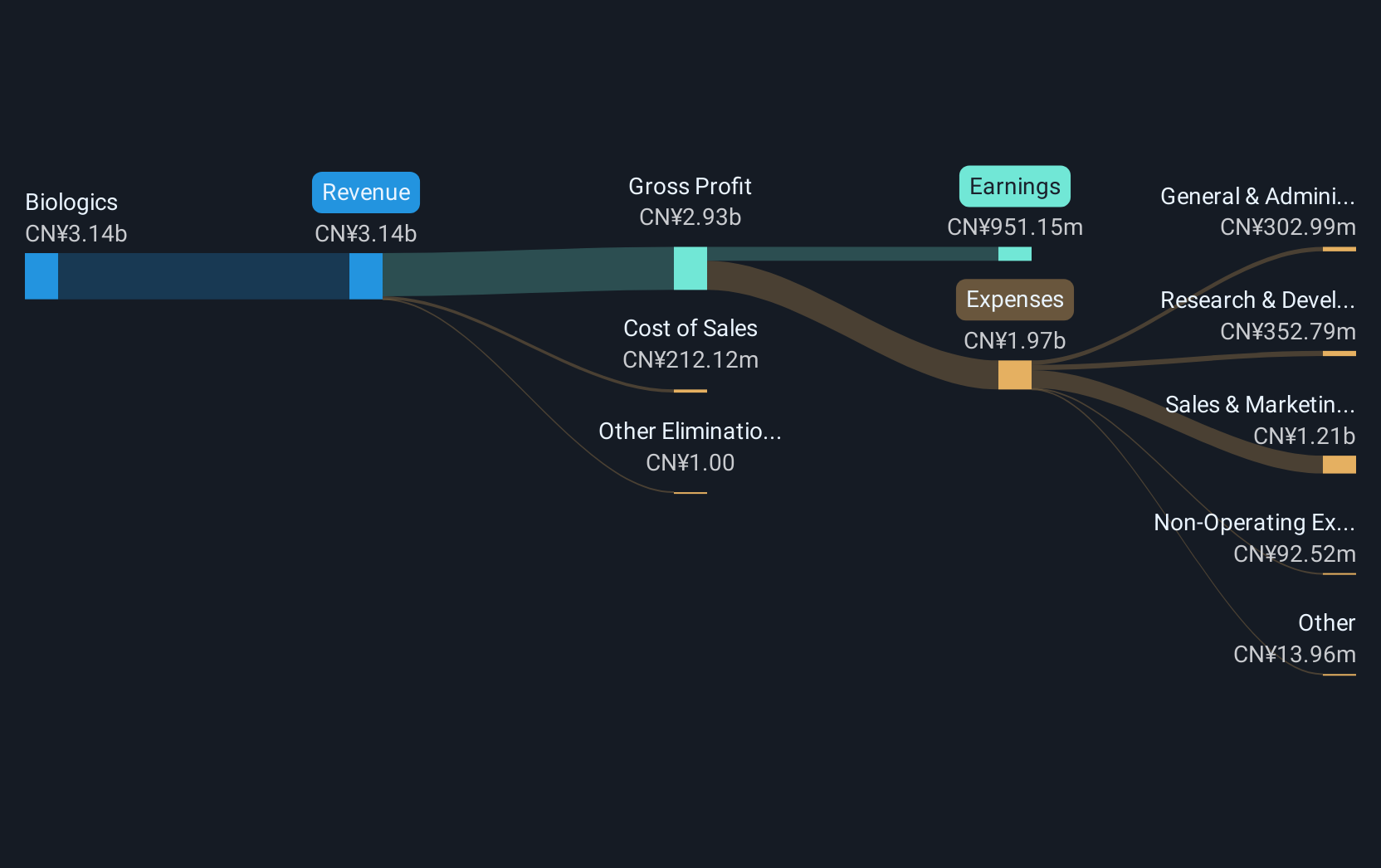

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market capitalization of CN¥33.80 billion.

Operations: Amoytop Biotech primarily generates revenue from its biologics segment, totaling CN¥3.14 billion. The company is involved in the research, development, production, and sale of recombinant protein drugs within China.

Xiamen Amoytop Biotech has demonstrated robust growth, with a notable 44.6% increase in earnings over the past year, outpacing the biotech industry's decline of 17.3%. This performance is underpinned by a significant R&D commitment, evidenced by recent expenditures that align closely with its revenue surge to CNY 1.51 billion—a growth rate of 25.4% annually. The company's strategic maneuvers, including a recent acquisition increasing stakeholder value and diversifying its portfolio, underscore its proactive approach in a competitive sector. With earnings projected to grow at an annual rate of 30%, Xiamen Amoytop is not just keeping pace but setting benchmarks in biotechnology innovation and market expansion.

- Click here and access our complete health analysis report to understand the dynamics of Xiamen Amoytop Biotech.

Learn about Xiamen Amoytop Biotech's historical performance.

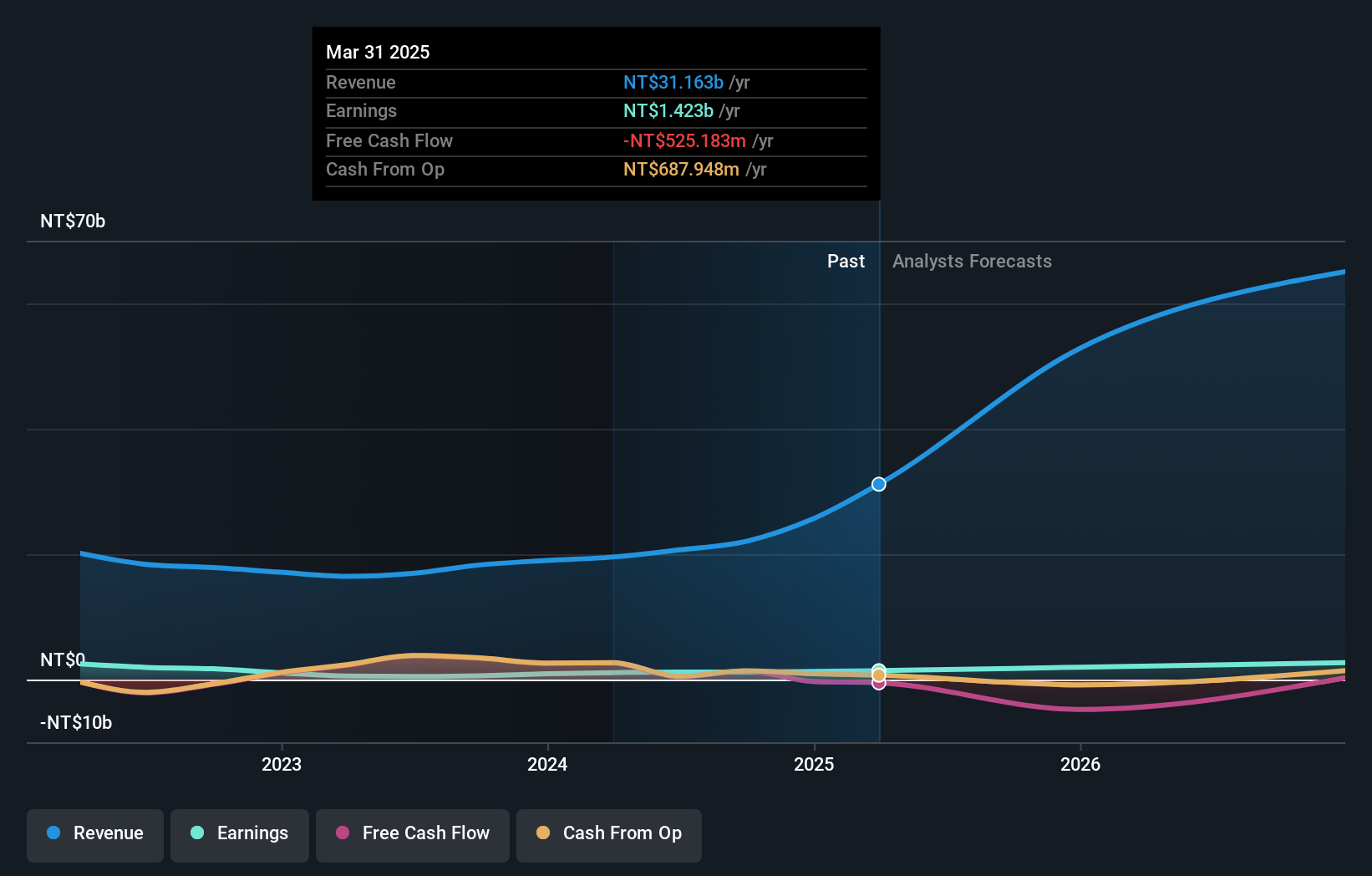

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ASROCK Incorporation is a company based in Taiwan that focuses on designing, developing, and selling motherboards, with a market capitalization of NT$34.41 billion.

Operations: The company generates revenue primarily from motherboards and related products, totaling NT$37.96 billion.

ASROCK Incorporation has recently demonstrated a compelling growth trajectory, with its second-quarter sales doubling to TWD 12.02 billion from TWD 5.22 billion in the previous year. This surge is mirrored in net income, which rose to TWD 409.72 million, up from TWD 264.17 million, reflecting a robust earnings growth of approximately 55%. These figures are indicative of ASROCK's increasing market presence and operational efficiency, particularly noteworthy in a competitive tech landscape where innovation drives success. The company's commitment to research and development is evident from its latest financials, positioning it well for sustained future growth amidst evolving technological demands.

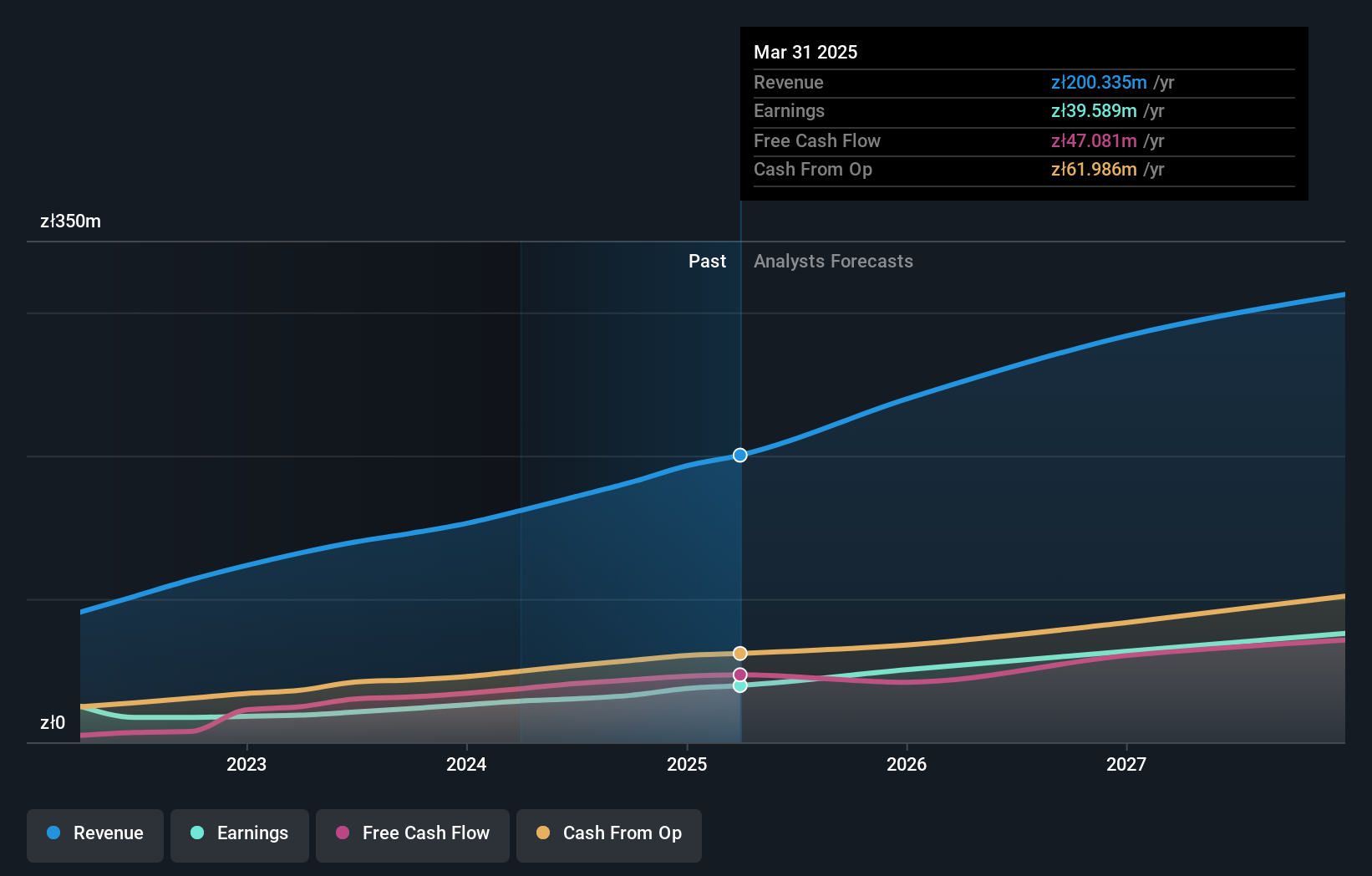

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shoper S.A. is a Polish company that offers Software as a Service solutions for e-commerce, with a market capitalization of PLN1.38 billion.

Operations: Shoper S.A. focuses on providing e-commerce SaaS solutions in Poland, generating revenue primarily from Solutions (PLN157.26 million) and Subscriptions (PLN43.08 million).

Shoper is distinguishing itself in the tech sector with a robust earnings growth forecast of 20% per year, outpacing the Polish market's average of 13.9%. This performance is underscored by a significant past year earnings increase of 37.8%, which also surpasses the software industry's growth rate of 28.7%. With annual revenue expected to grow at 14.3%, faster than the market's 4.6%, Shoper demonstrates strong market adaptability and potential for sustained expansion. The company’s strategic focus on R&D, evidenced by its commitment to reinvesting in innovation, positions it well to leverage emerging technological trends, ensuring its competitiveness and future growth prospects in an evolving industry landscape.

- Navigate through the intricacies of Shoper with our comprehensive health report here.

Evaluate Shoper's historical performance by accessing our past performance report.

Seize The Opportunity

- Explore the 238 names from our Global High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3515

ASROCK Incorporation

Designs, develops, and sells motherboards in Taiwan.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives