- South Korea

- /

- Semiconductors

- /

- KOSE:A195870

3 Asian Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious central bank policies and inflationary pressures, investors are increasingly looking towards Asia for potential opportunities. In this environment, identifying stocks that may be trading below their estimated value can be particularly compelling, as these investments could offer upside potential amid the broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.05 | CN¥165.09 | 49.1% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.88 | 49.8% |

| Takara Bio (TSE:4974) | ¥932.00 | ¥1829.46 | 49.1% |

| Taiwan Union Technology (TPEX:6274) | NT$316.50 | NT$621.45 | 49.1% |

| Meitu (SEHK:1357) | HK$9.27 | HK$18.06 | 48.7% |

| Malee Group (SET:MALEE) | THB5.60 | THB11.01 | 49.1% |

| Devsisters (KOSDAQ:A194480) | ₩48700.00 | ₩95419.63 | 49% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.21 | CN¥93.18 | 49.3% |

| Cosmax (KOSE:A192820) | ₩209000.00 | ₩412986.93 | 49.4% |

| Chanjet Information Technology (SEHK:1588) | HK$10.87 | HK$21.51 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

HAESUNG DS (KOSE:A195870)

Overview: HAESUNG DS Co., Ltd. manufactures and sells semiconductor components both in South Korea and internationally, with a market cap of ₩605.20 billion.

Operations: The company's revenue is primarily derived from its semiconductor segment, which generated ₩589.48 billion.

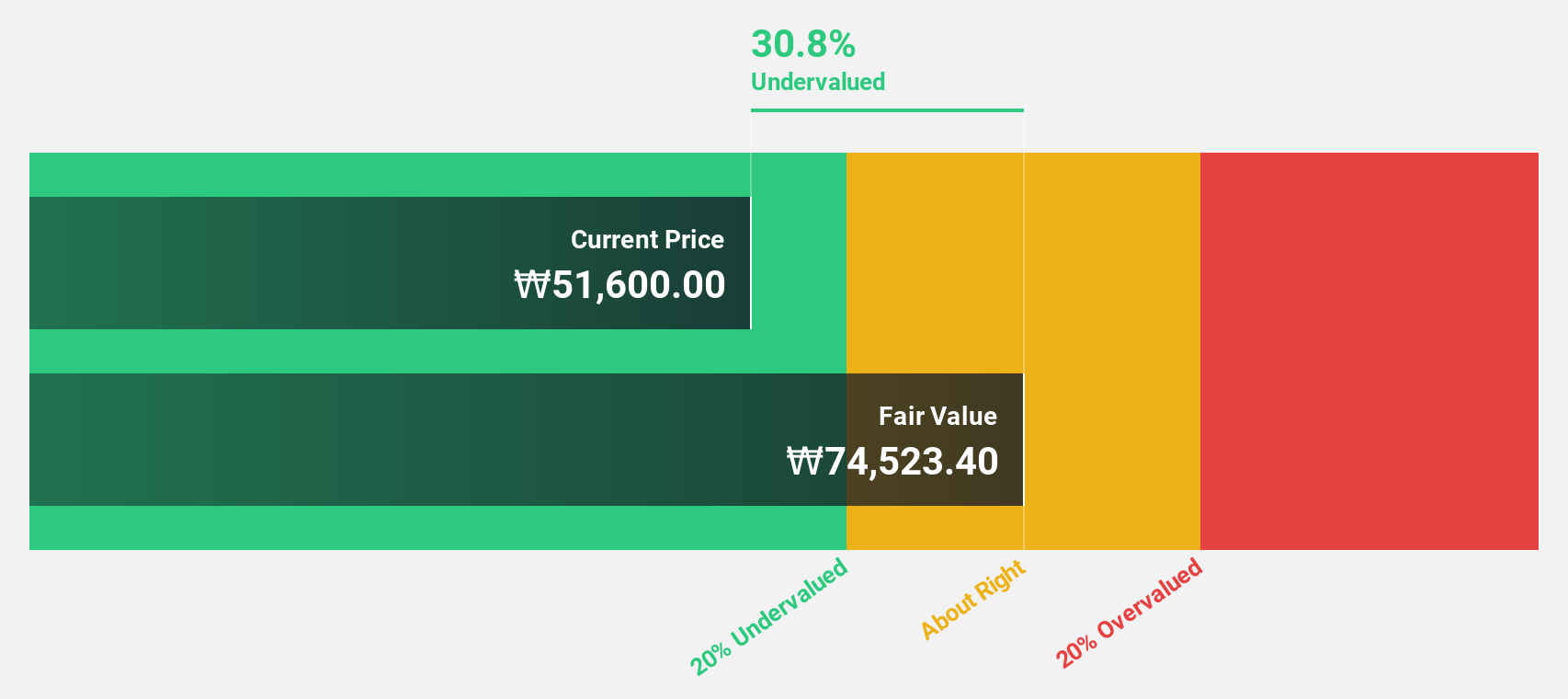

Estimated Discount To Fair Value: 42.9%

HAESUNG DS is trading at ₩35,600, significantly below its estimated fair value of ₩62,397.06. Despite a volatile share price recently and profit margins dropping to 3.1% from 11.2% last year, the company is expected to see substantial earnings growth of over 51% per year, outpacing the Korean market's average growth rate. However, its dividend yield of 2.25% isn't well supported by free cash flows and return on equity remains low at an anticipated 10%.

- Our expertly prepared growth report on HAESUNG DS implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of HAESUNG DS.

Everest Medicines (SEHK:1952)

Overview: Everest Medicines Limited is a biopharmaceutical company focused on discovering, licensing, developing, and commercializing therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets, with a market cap of HK$19.89 billion.

Operations: The company generates its revenue primarily from pharmaceutical products, amounting to CN¥851.28 million.

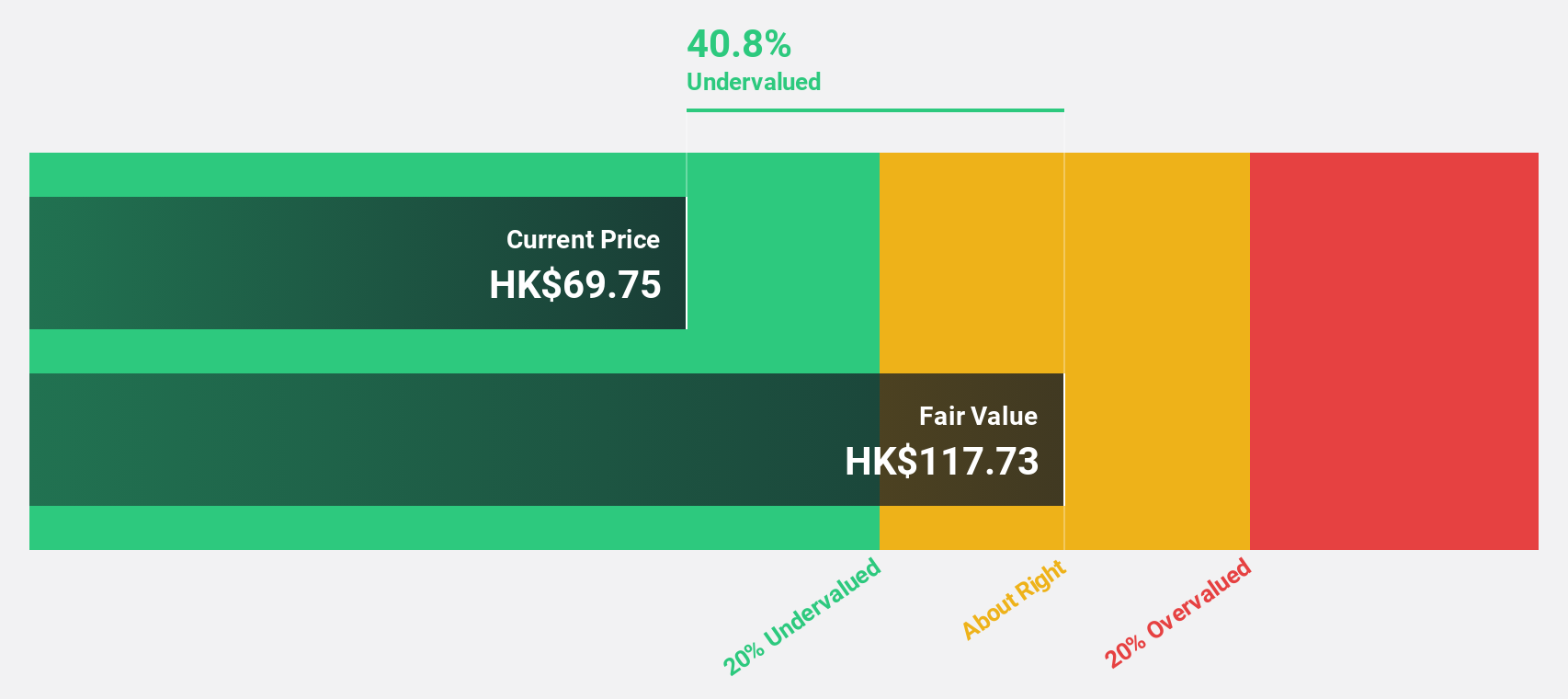

Estimated Discount To Fair Value: 47.6%

Everest Medicines is trading at HK$56.3, significantly below its estimated fair value of HK$107.34, suggesting it may be undervalued based on discounted cash flow analysis. Despite reporting a net loss of CNY 249.79 million for H1 2025, the company's earnings are forecast to grow substantially by 118.47% annually and become profitable within three years. Revenue is expected to rise faster than the Hong Kong market average, driven by strong NEFECON sales projections between RMB 1.2 billion and RMB 1.4 billion for the year.

- Our comprehensive growth report raises the possibility that Everest Medicines is poised for substantial financial growth.

- Dive into the specifics of Everest Medicines here with our thorough financial health report.

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥34.19 billion.

Operations: The company generates revenue from its biologics segment, amounting to CN¥3.14 billion.

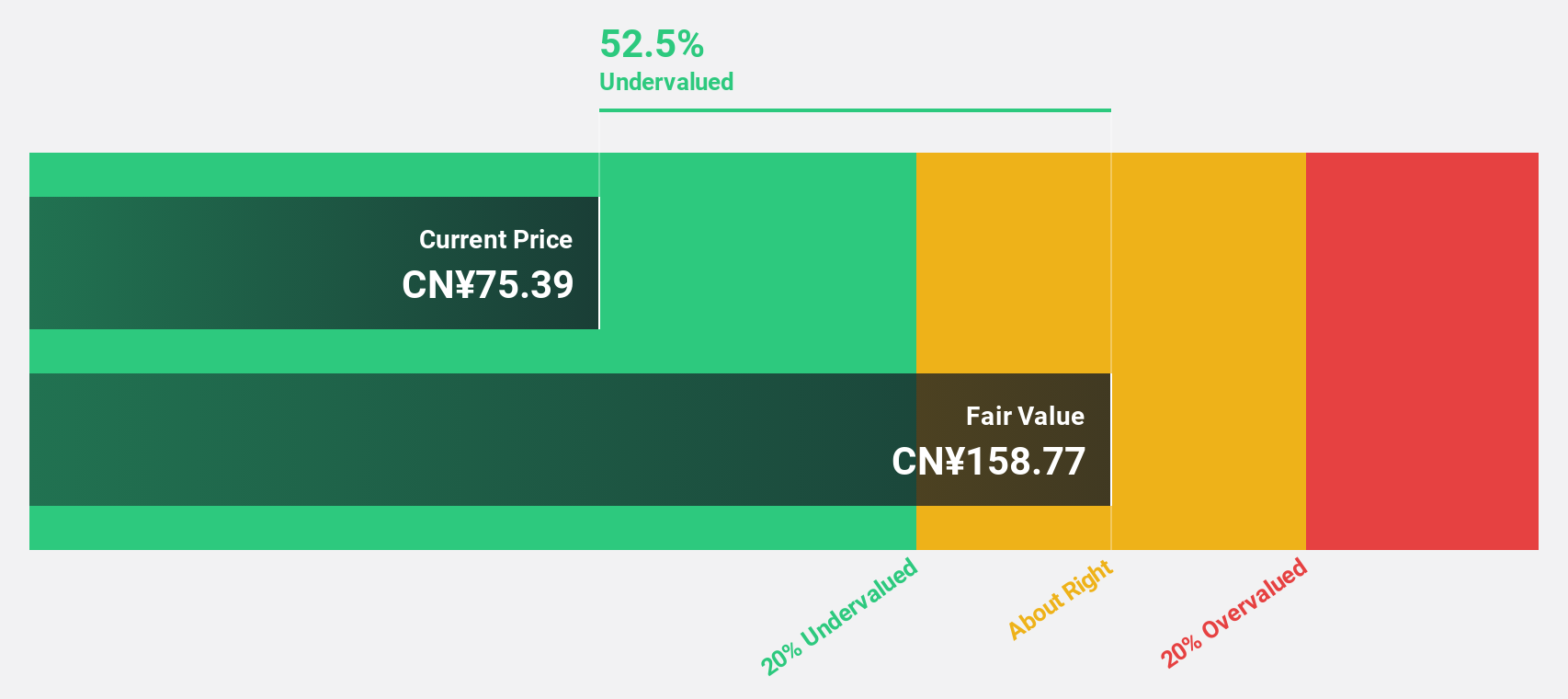

Estimated Discount To Fair Value: 49.1%

Xiamen Amoytop Biotech, with a current trading price of CN¥84.05, is significantly undervalued compared to its estimated fair value of CN¥165.09 based on discounted cash flow analysis. The company reported strong H1 2025 results with sales reaching CNY 1.51 billion and net income at CNY 427.89 million, marking substantial growth from the previous year. Earnings are projected to grow significantly at nearly 30% annually, outpacing both market revenue and profit benchmarks in China.

- The growth report we've compiled suggests that Xiamen Amoytop Biotech's future prospects could be on the up.

- Navigate through the intricacies of Xiamen Amoytop Biotech with our comprehensive financial health report here.

Next Steps

- Click this link to deep-dive into the 294 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HAESUNG DS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A195870

HAESUNG DS

Manufactures and sells semiconductor components in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives