Market Might Still Lack Some Conviction On Changchun BCHT Biotechnology Co. (SHSE:688276) Even After 36% Share Price Boost

Changchun BCHT Biotechnology Co. (SHSE:688276) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. But the last month did very little to improve the 53% share price decline over the last year.

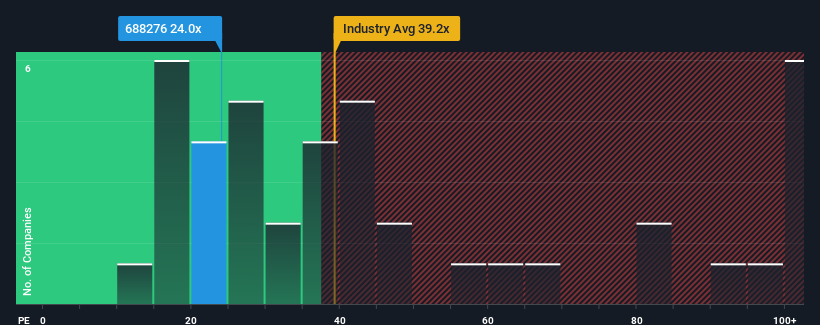

In spite of the firm bounce in price, Changchun BCHT Biotechnology's price-to-earnings (or "P/E") ratio of 24x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Changchun BCHT Biotechnology as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Changchun BCHT Biotechnology

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Changchun BCHT Biotechnology's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 139% gain to the company's bottom line. EPS has also lifted 27% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 27% each year during the coming three years according to the nine analysts following the company. With the market only predicted to deliver 19% per annum, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Changchun BCHT Biotechnology's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Changchun BCHT Biotechnology's P/E?

Despite Changchun BCHT Biotechnology's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Changchun BCHT Biotechnology currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You need to take note of risks, for example - Changchun BCHT Biotechnology has 2 warning signs (and 1 which is concerning) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688276

Changchun BCHT Biotechnology

Changchun BCHT Biotechnology Co. Ltd., a biopharmaceutical company, engages in the research and development, production, and sale of human vaccines in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives