Suzhou Zelgen Biopharmaceuticals Co.,Ltd. (SHSE:688266) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Suzhou Zelgen Biopharmaceuticals Co.,Ltd. (SHSE:688266) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 79% in the last year.

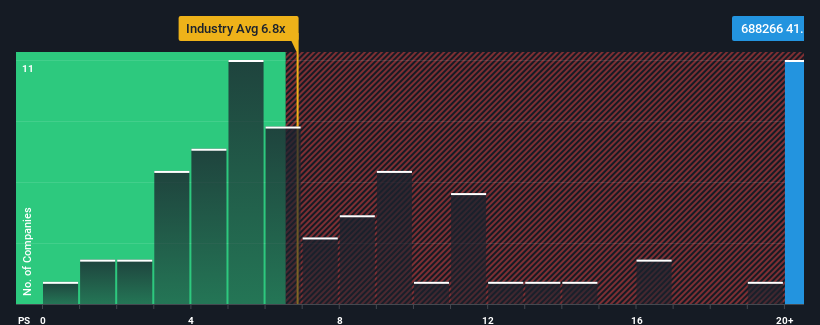

Since its price has surged higher, when almost half of the companies in China's Biotechs industry have price-to-sales ratios (or "P/S") below 6.8x, you may consider Suzhou Zelgen BiopharmaceuticalsLtd as a stock not worth researching with its 41.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Suzhou Zelgen BiopharmaceuticalsLtd

What Does Suzhou Zelgen BiopharmaceuticalsLtd's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Suzhou Zelgen BiopharmaceuticalsLtd has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Suzhou Zelgen BiopharmaceuticalsLtd.How Is Suzhou Zelgen BiopharmaceuticalsLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Suzhou Zelgen BiopharmaceuticalsLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. The strong recent performance means it was also able to grow revenue by 180% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 129% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 45% growth forecast for the broader industry.

In light of this, it's understandable that Suzhou Zelgen BiopharmaceuticalsLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The strong share price surge has lead to Suzhou Zelgen BiopharmaceuticalsLtd's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Suzhou Zelgen BiopharmaceuticalsLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Suzhou Zelgen BiopharmaceuticalsLtd with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688266

Suzhou Zelgen BiopharmaceuticalsLtd

Suzhou Zelgen Biopharmaceuticals Co.,Ltd.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives