As global markets show signs of optimism with easing trade tensions and U.S. equities advancing, the tech sector continues to capture attention, particularly in the realm of high growth opportunities. In this dynamic environment, identifying promising tech stocks involves assessing their potential for innovation and market disruption, especially as small- and mid-cap equities gain momentum amidst constructive economic indicators.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Elm (SASE:7203)

Simply Wall St Growth Rating: ★★★★☆☆

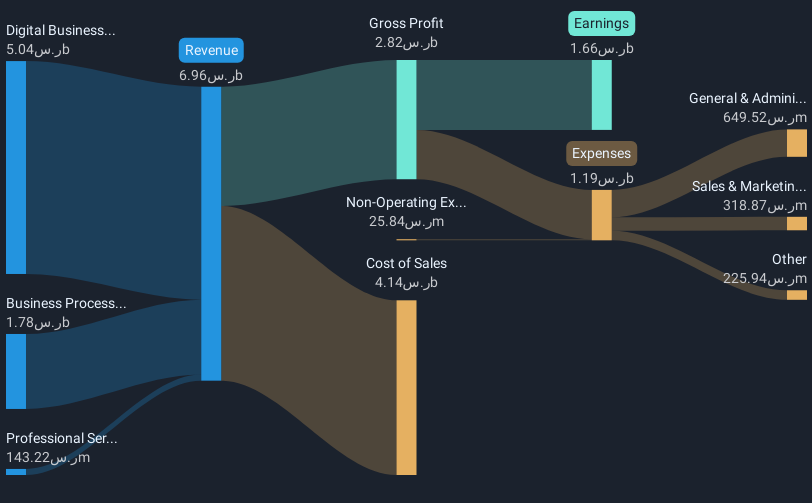

Overview: Elm Company, along with its subsidiaries, offers information security services to government entities, individuals, and private sector companies in Saudi Arabia and has a market cap of SAR80.41 billion.

Operations: Elm generates revenue primarily from its Digital Business segment, which accounts for SAR5.47 billion, complemented by Business Process Outsourcing at SAR1.78 billion and Professional Services at SAR152.57 million. The company's focus on diverse service offerings supports its role in the information security sector within Saudi Arabia.

Elm's recent performance underscores its robust position in the tech sector, with a notable 25.7% earnings growth surpassing the IT industry average. This growth trajectory is supported by a significant investment in R&D, aligning with an annual revenue increase of 14.4%, which outpaces the broader Saudi market's 2.5% expansion rate. At a recent GITEX conference, Elm highlighted innovations likely to drive future growth, further evidenced by their substantial net income rise to SAR 1.83 billion from SAR 1.36 billion year-over-year and an EPS increase from SAR 17.46 to SAR 23.51 in FY2024 alone. The company's strategic focus on high-quality earnings—marked by a high level of non-cash earnings—and positive free cash flow positions it well for sustained advancement within its sector. Moreover, Elm’s forward-looking ROE is projected at an impressive 37%, signaling strong profitability potential ahead amidst competitive pressures and evolving market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Elm.

Gain insights into Elm's historical performance by reviewing our past performance report.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

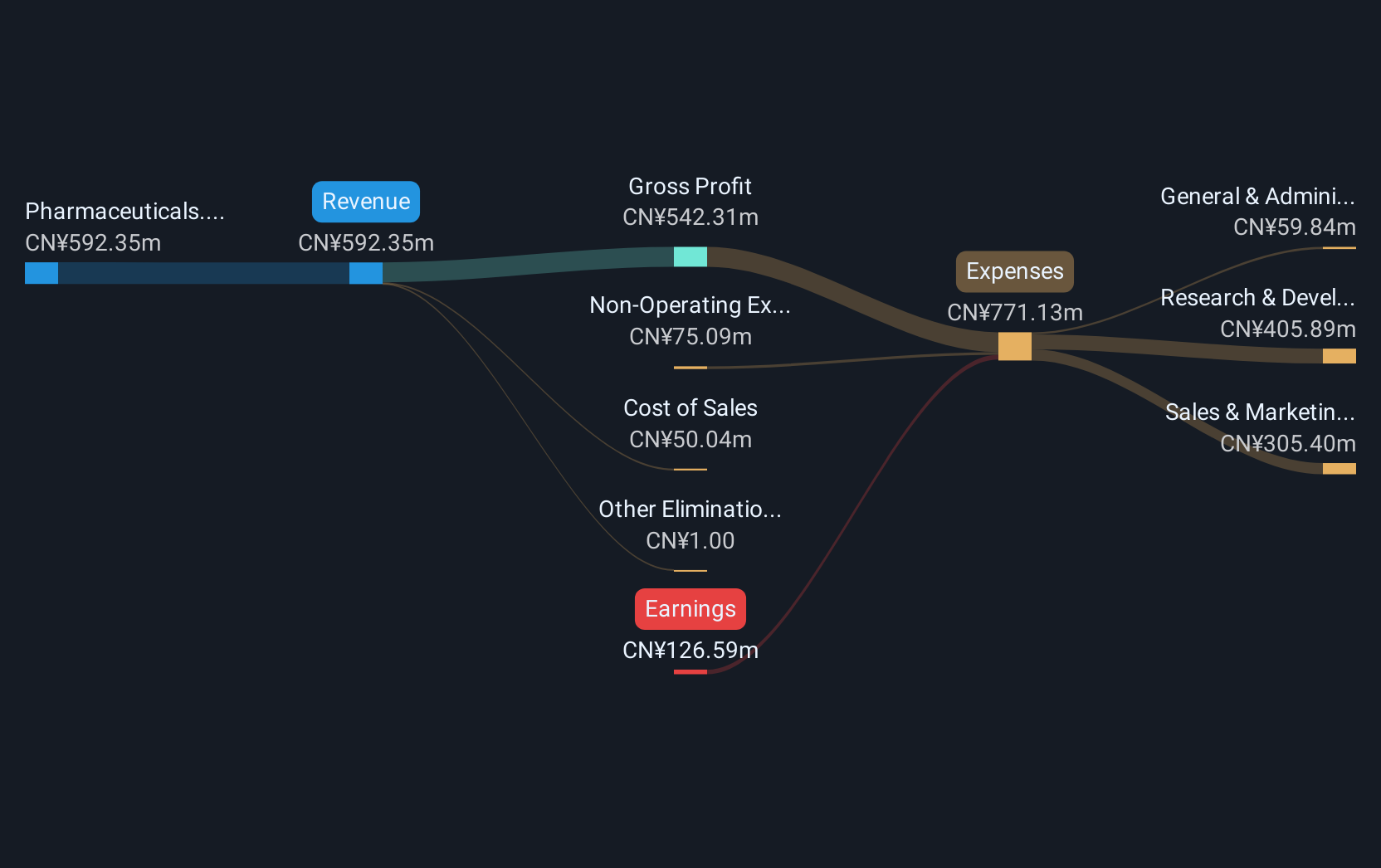

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company engaged in the development, manufacturing, and sale of biopharmaceutical products with a market cap of CN¥27.29 billion.

Operations: Zelgen Biopharmaceuticals focuses on the development, manufacturing, and sale of biopharmaceutical products. The company's revenue streams are primarily derived from its innovative drug portfolio.

Suzhou Zelgen Biopharmaceuticals has demonstrated a promising trajectory in the biotech industry, with its revenue surging by 45.6% annually, significantly outpacing the Chinese market's growth. Despite current unprofitability, recent earnings indicate a reduction in net loss from CNY 278.58 million to CNY 136.22 million year-over-year and an improvement in basic loss per share from CNY 1.09 to CNY 0.51, signaling potential for future profitability. The firm's aggressive R&D investment is pivotal, fostering innovations that could transition it from losses to gains, aligning with forecasts of becoming profitable within three years and an expected profit surge of 99.33% annually.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. is engaged in the manufacturing and sale of printed circuit boards (PCBs) both domestically in China and internationally, with a market capitalization of CN¥19.20 billion.

Operations: The company focuses on the production and distribution of printed circuit boards (PCBs) across both domestic and international markets. The business model generates revenue primarily from PCB sales, with a significant portion coming from international clients.

Shenzhen Fastprint Circuit Tech Ltd. is navigating a challenging landscape with its recent Q1 earnings revealing a dip in net income to CNY 9.37 million from CNY 24.82 million year-over-year, despite an increase in sales to CNY 1,579.6 million from CNY 1,388.47 million. This performance underscores the volatility in the tech sector but also highlights resilience given the firm's revenue growth of 19.7% annually, outpacing the Chinese market average of 12.6%. The company's commitment to R&D could be pivotal; however, details on specific expenditures were not disclosed in the latest reports, suggesting a potential area for strategic enhancement to foster future profitability and innovation within this high-stakes industry.

Seize The Opportunity

- Dive into all 735 of the Global High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688266

Suzhou Zelgen BiopharmaceuticalsLtd

Suzhou Zelgen Biopharmaceuticals Co.,Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives