In recent weeks, global markets have experienced a mix of highs and lows, with major indices such as the Nasdaq Composite and S&P MidCap 400 Index reaching record intraday highs before retreating sharply. Amidst this volatility, investors are closely watching earnings reports and economic data for signals on market direction, while cautious sentiment prevails due to mixed labor market indicators and ongoing manufacturing slumps. In such an environment, identifying undervalued stocks can be particularly appealing as they may offer potential opportunities for growth when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.27 | 49.9% |

| IMAGICA GROUP (TSE:6879) | ¥476.00 | ¥947.55 | 49.8% |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.60 | SEK349.53 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.63 | US$168.45 | 49.8% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| On the Beach Group (LSE:OTB) | £1.534 | £3.07 | 50% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.45 | CN¥22.90 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥3935.00 | ¥7851.33 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.67 | 49.8% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

We'll examine a selection from our screener results.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company specializing in the development and commercialization of innovative drugs, with a market cap of CN¥17.24 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, which generated CN¥488.45 million.

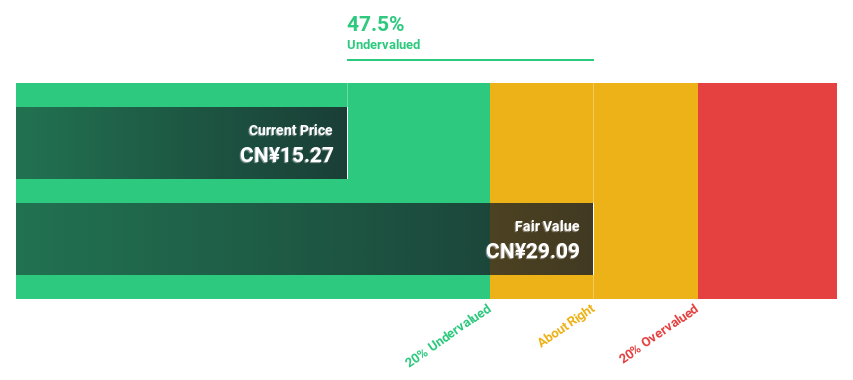

Estimated Discount To Fair Value: 48.6%

Suzhou Zelgen Biopharmaceuticals is trading significantly below its estimated fair value, with a current price of CN¥65.11 against a fair value estimate of CN¥126.75. The company has demonstrated strong revenue growth, reporting sales of CN¥384.12 million for the nine months ending September 2024, up from CN¥282.1 million the previous year, while reducing net losses from CN¥202.09 million to CN¥97.9 million over the same period. Despite low forecasted return on equity, earnings are expected to grow rapidly and surpass market averages in profitability within three years.

- Upon reviewing our latest growth report, Suzhou Zelgen BiopharmaceuticalsLtd's projected financial performance appears quite optimistic.

- Dive into the specifics of Suzhou Zelgen BiopharmaceuticalsLtd here with our thorough financial health report.

Wuhan Keqian BiologyLtd (SHSE:688526)

Overview: Wuhan Keqian Biology Co., Ltd specializes in the research, development, production, sales, and technical services for animal epidemic prevention through veterinary biological products in China, with a market cap of CN¥7.05 billion.

Operations: The company's revenue segments focus on veterinary biological products, encompassing research and development, production, sales, and technical services for animal epidemic prevention in China.

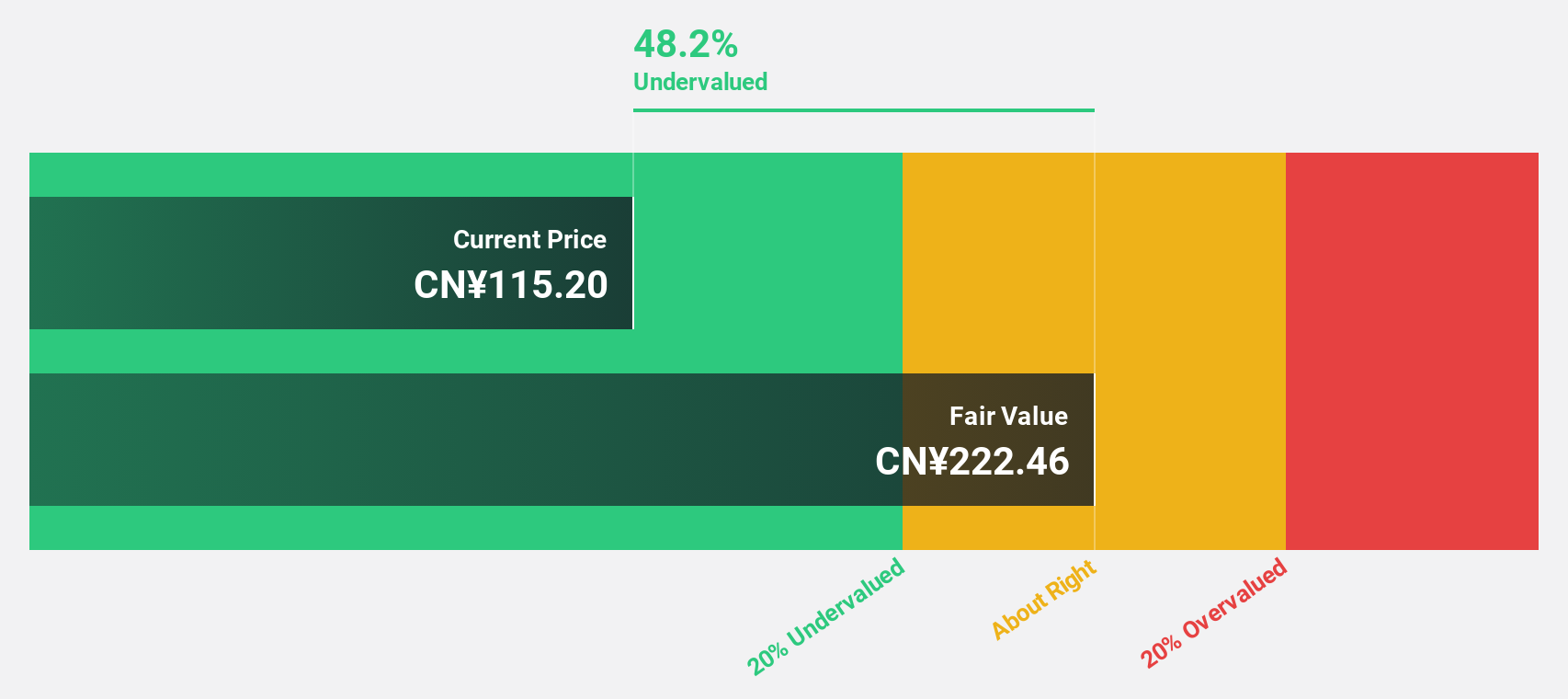

Estimated Discount To Fair Value: 47.7%

Wuhan Keqian Biology is trading at CN¥15.19, significantly below its estimated fair value of CN¥29.05, suggesting undervaluation based on cash flows. Despite a decline in sales and net income for the nine months ending September 2024 compared to the previous year, earnings are forecasted to grow annually by 25.06%. The company has completed a share buyback program worth CN¥31.62 million, reflecting confidence in its long-term prospects despite recent financial challenges.

- Our growth report here indicates Wuhan Keqian BiologyLtd may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Wuhan Keqian BiologyLtd's balance sheet health report.

Qi An Xin Technology Group (SHSE:688561)

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company offering products and services to government, enterprises, and other institutions in China and internationally, with a market cap of CN¥22.06 billion.

Operations: The company generates revenue primarily from the Information Security Industry, amounting to CN¥5.47 billion.

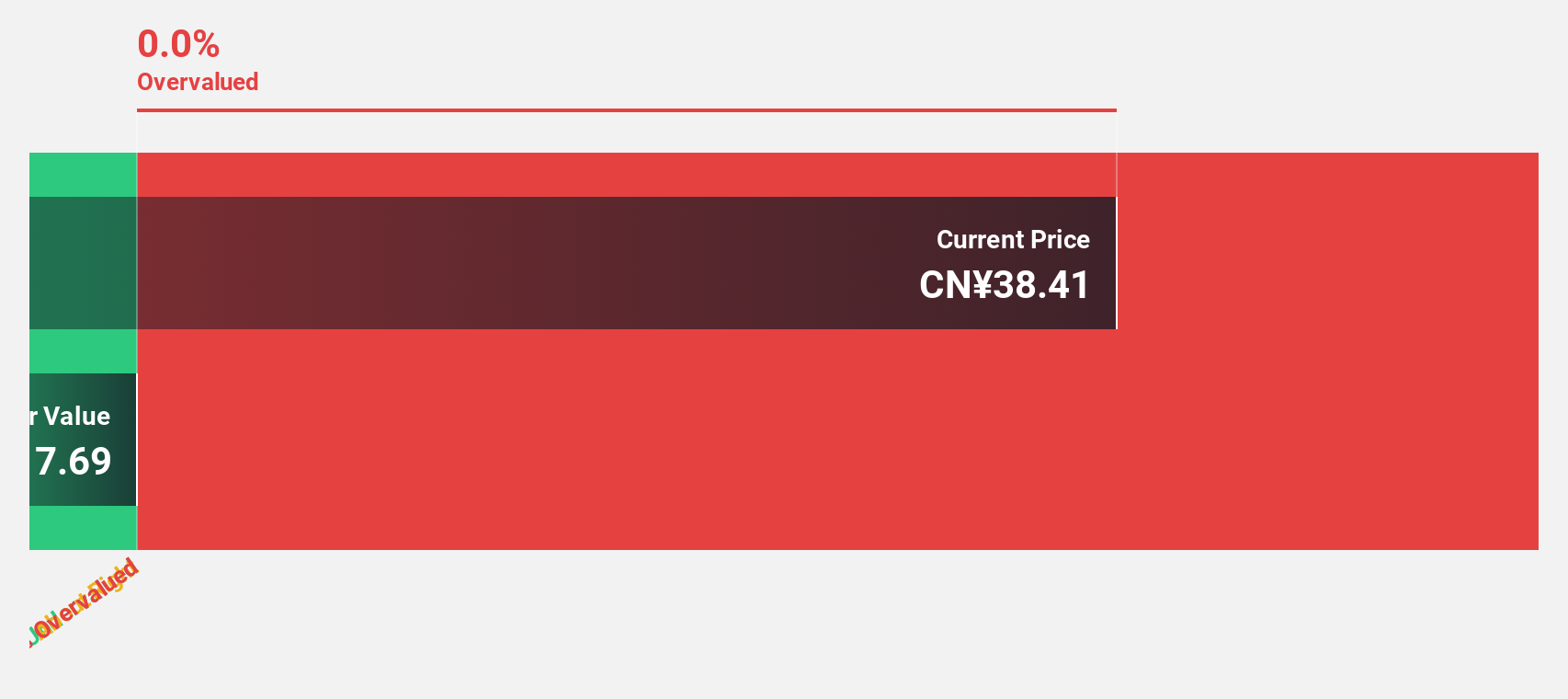

Estimated Discount To Fair Value: 25.9%

Qi An Xin Technology Group is trading at CN¥32.33, over 20% below its estimated fair value of CN¥43.61, indicating potential undervaluation based on cash flows. Despite a decrease in revenue to CN¥2.71 billion for the nine months ending September 2024 compared to the previous year, earnings are expected to grow significantly at 42.31% annually over the next three years, outpacing the broader Chinese market's growth rate of 25.9%.

- The analysis detailed in our Qi An Xin Technology Group growth report hints at robust future financial performance.

- Navigate through the intricacies of Qi An Xin Technology Group with our comprehensive financial health report here.

Turning Ideas Into Actions

- Investigate our full lineup of 963 Undervalued Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qi An Xin Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688561

Qi An Xin Technology Group

A cyber-security company, provides cybersecurity products and services for government, enterprises, and other institutions in China and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives