BrightGene Bio-Medical Technology Co., Ltd. (SHSE:688166) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Those holding BrightGene Bio-Medical Technology Co., Ltd. (SHSE:688166) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

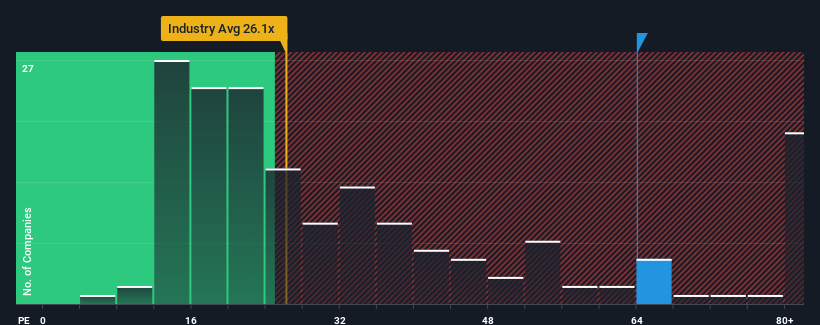

Since its price has surged higher, BrightGene Bio-Medical Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 64x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, BrightGene Bio-Medical Technology's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for BrightGene Bio-Medical Technology

Is There Enough Growth For BrightGene Bio-Medical Technology?

There's an inherent assumption that a company should far outperform the market for P/E ratios like BrightGene Bio-Medical Technology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that BrightGene Bio-Medical Technology is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

BrightGene Bio-Medical Technology's P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that BrightGene Bio-Medical Technology currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for BrightGene Bio-Medical Technology (of which 1 makes us a bit uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on BrightGene Bio-Medical Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade BrightGene Bio-Medical Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BrightGene Bio-Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688166

BrightGene Bio-Medical Technology

A pharmaceutical company, engages in the research and development, manufacture, and commercialization of pharmaceutical products in China.

High growth potential and slightly overvalued.

Market Insights

Community Narratives