There's Reason For Concern Over ChengDu ShengNuo Biotec Co.,Ltd.'s (SHSE:688117) Massive 27% Price Jump

ChengDu ShengNuo Biotec Co.,Ltd. (SHSE:688117) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

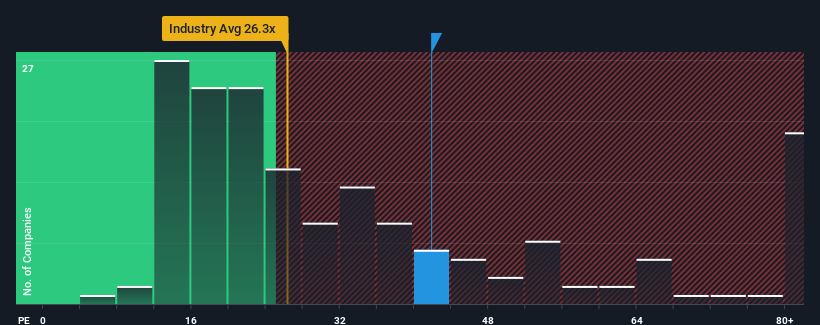

Following the firm bounce in price, ChengDu ShengNuo BiotecLtd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 41.9x, since almost half of all companies in China have P/E ratios under 30x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With its earnings growth in positive territory compared to the declining earnings of most other companies, ChengDu ShengNuo BiotecLtd has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for ChengDu ShengNuo BiotecLtd

Is There Enough Growth For ChengDu ShengNuo BiotecLtd?

ChengDu ShengNuo BiotecLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 8.9% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 12% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 41% as estimated by the sole analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is not materially different.

In light of this, it's curious that ChengDu ShengNuo BiotecLtd's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

The large bounce in ChengDu ShengNuo BiotecLtd's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of ChengDu ShengNuo BiotecLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - ChengDu ShengNuo BiotecLtd has 1 warning sign we think you should be aware of.

You might be able to find a better investment than ChengDu ShengNuo BiotecLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688117

ChengDu ShengNuo BiotecLtd

Engages in the research and development, production, sale, and export of peptide drugs.

High growth potential with solid track record.

Market Insights

Community Narratives