ChengDu ShengNuo Biotec Co.,Ltd. (SHSE:688117) Stocks Shoot Up 32% But Its P/E Still Looks Reasonable

ChengDu ShengNuo Biotec Co.,Ltd. (SHSE:688117) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

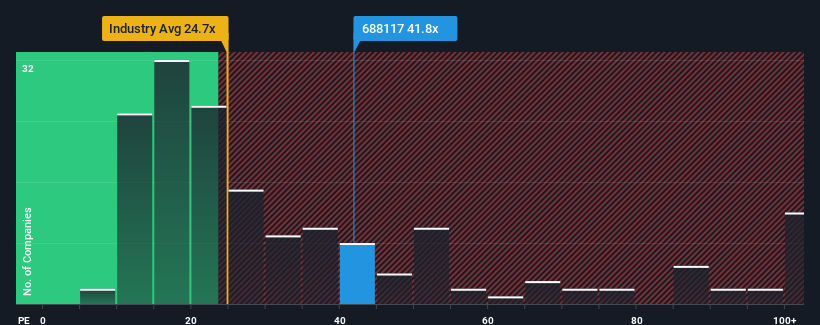

After such a large jump in price, ChengDu ShengNuo BiotecLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 41.8x, since almost half of all companies in China have P/E ratios under 26x and even P/E's lower than 15x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

ChengDu ShengNuo BiotecLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for ChengDu ShengNuo BiotecLtd

What Are Growth Metrics Telling Us About The High P/E?

ChengDu ShengNuo BiotecLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 8.4% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 41% per year as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 23% per year, which is noticeably less attractive.

In light of this, it's understandable that ChengDu ShengNuo BiotecLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On ChengDu ShengNuo BiotecLtd's P/E

The strong share price surge has got ChengDu ShengNuo BiotecLtd's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of ChengDu ShengNuo BiotecLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - ChengDu ShengNuo BiotecLtd has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If you're unsure about the strength of ChengDu ShengNuo BiotecLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688117

ChengDu ShengNuo BiotecLtd

Engages in the research and development, production, sale, and export of peptide drugs.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives