- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2368

Global Growth Companies With High Insider Ownership For May 2025

Reviewed by Simply Wall St

In the wake of a significant de-escalation in U.S.-China trade tensions, global markets have experienced a notable rally, with major indices such as the Nasdaq Composite and S&P 500 posting strong gains. As investors navigate this evolving landscape, growth companies with high insider ownership can offer unique insights into potential opportunities; their alignment of interests may provide an added layer of confidence in turbulent times.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.6% | 30.4% |

| Vow (OB:VOW) | 13.1% | 81% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 57.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

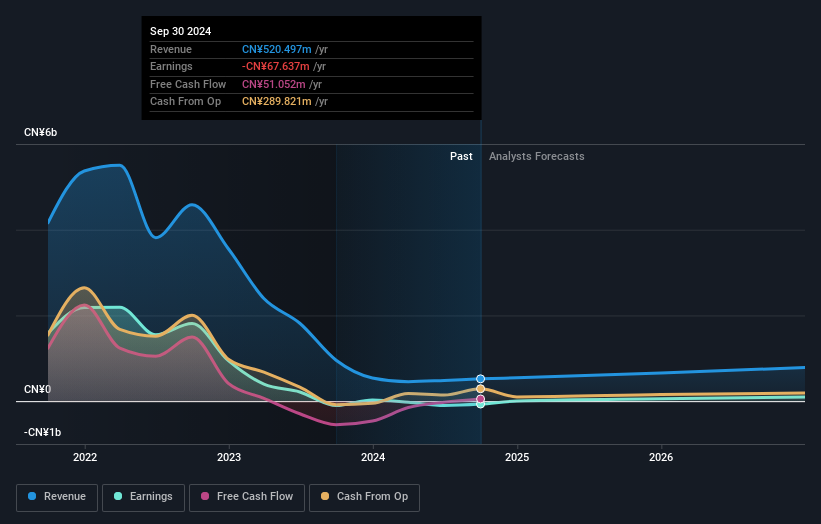

Beijing Hotgen Biotech (SHSE:688068)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Hotgen Biotech Co., Ltd. focuses on the research, development, manufacture, and sale of in-vitro diagnostic products for medical and public safety inspection within the biomedicine field, with a market cap of approximately CN¥10.19 billion.

Operations: The company generates revenue primarily from its Medical Labs & Research segment, which amounted to CN¥488.01 million.

Insider Ownership: 31.8%

Earnings Growth Forecast: 138.6% p.a.

Beijing Hotgen Biotech is poised for significant growth, with revenue forecasted to increase by 26.1% annually, outpacing the Chinese market's average. Despite recent financial setbacks, including a Q1 net loss of CNY 24.01 million and declining sales, the company is expected to become profitable within three years. While its share price has been volatile recently and lacks recent insider trading data, its growth prospects remain promising in the biotech sector.

- Dive into the specifics of Beijing Hotgen Biotech here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Beijing Hotgen Biotech's current price could be inflated.

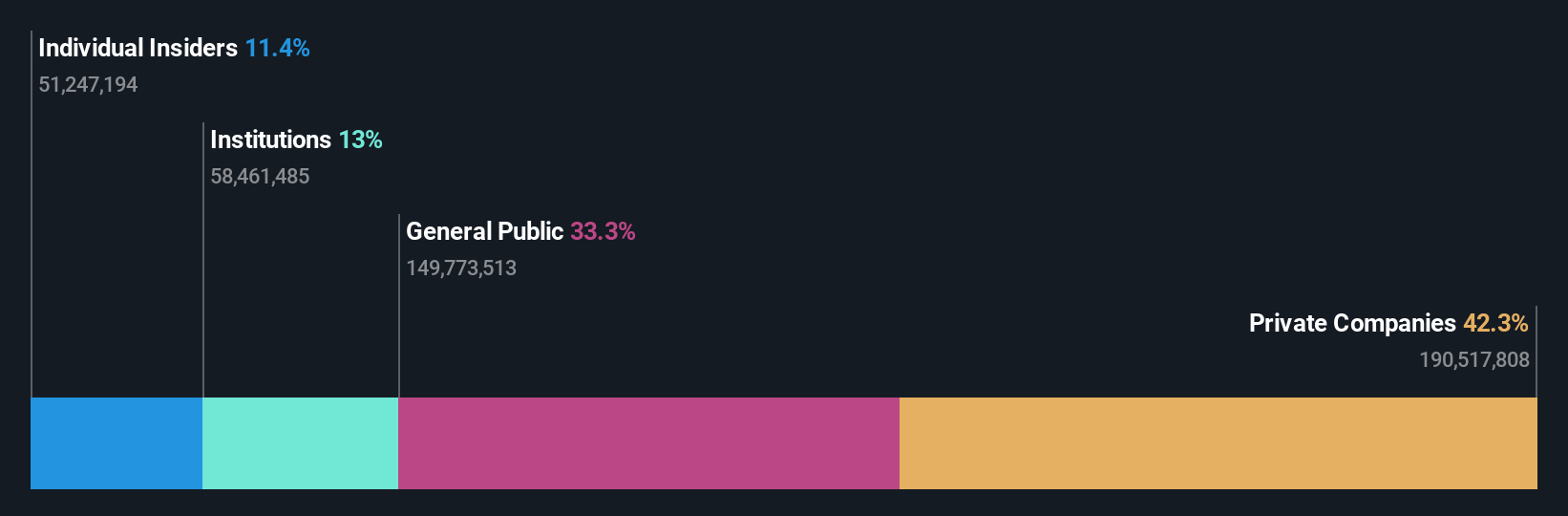

Shanghai Allist Pharmaceuticals (SHSE:688578)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Allist Pharmaceuticals Co., Ltd. (SHSE:688578) is a pharmaceutical company with a market cap of CN¥38.16 billion, focusing on the development and production of innovative drugs.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 11.4%

Earnings Growth Forecast: 18.9% p.a.

Shanghai Allist Pharmaceuticals demonstrates robust growth potential, with revenue expected to rise by 20.1% annually, surpassing the Chinese market's average. Recent Q1 earnings showed a substantial increase in sales and net income compared to last year. The strategic alliance with Abbisko Cayman Limited enhances its innovative drug pipeline for cancer treatment. Despite slower profit growth relative to the market, it trades at a good value compared to peers, with no recent insider trading activity reported.

- Navigate through the intricacies of Shanghai Allist Pharmaceuticals with our comprehensive analyst estimates report here.

- The analysis detailed in our Shanghai Allist Pharmaceuticals valuation report hints at an deflated share price compared to its estimated value.

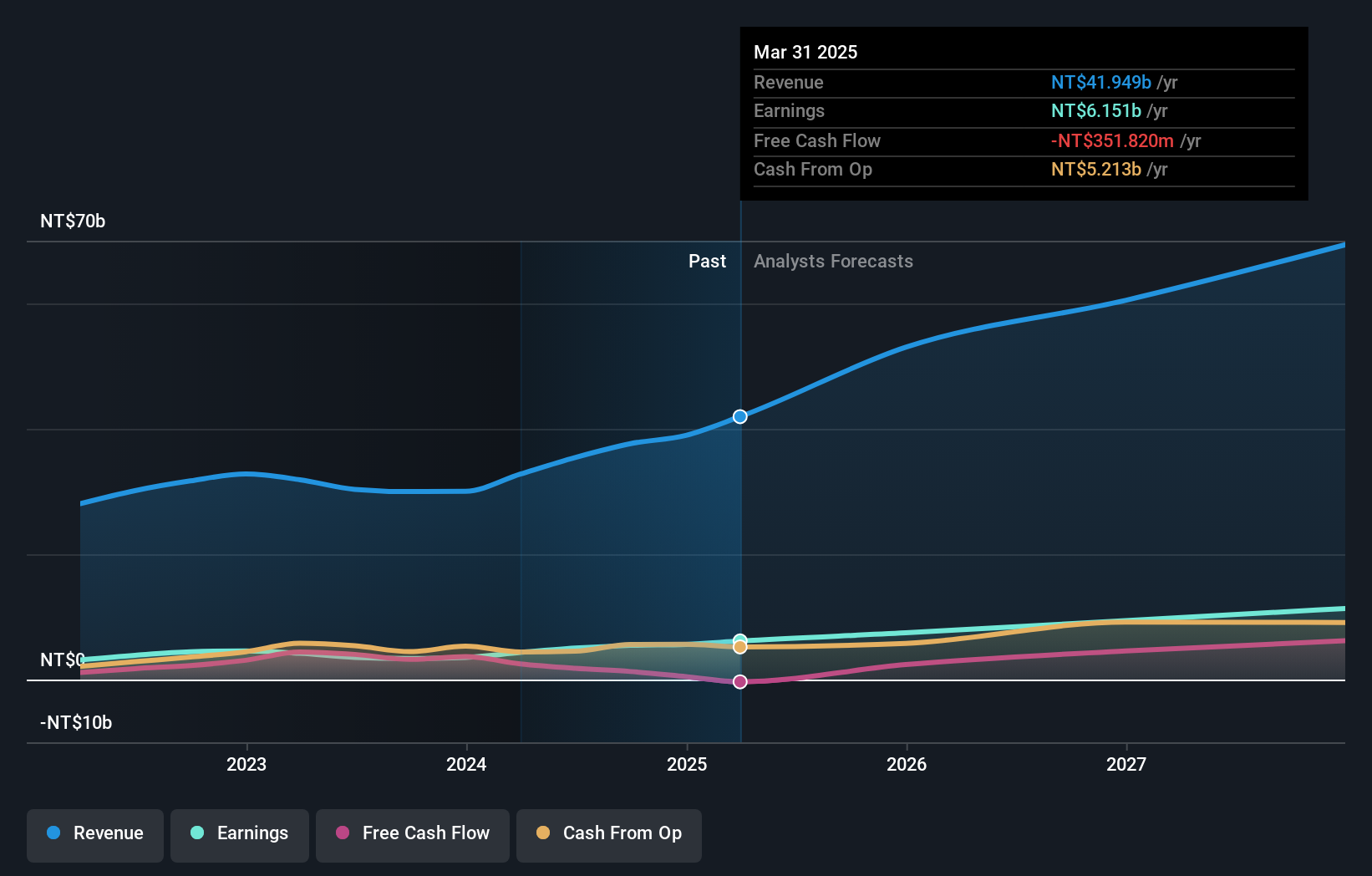

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gold Circuit Electronics Ltd. designs, manufactures, processes, and distributes printed circuit boards in Taiwan with a market cap of NT$108.04 billion.

Operations: Gold Circuit Electronics Ltd. generates revenue primarily through the design, manufacturing, processing, and distribution of printed circuit boards in Taiwan.

Insider Ownership: 31.4%

Earnings Growth Forecast: 21.6% p.a.

Gold Circuit Electronics shows strong growth potential, with earnings projected to rise 21.64% annually, outpacing the TW market. Recent Q1 results revealed a significant increase in sales and net income year-over-year. Although trading below fair value estimates by 24.6%, its high non-cash earnings quality is noteworthy. Despite a volatile share price and limited insider trading data, revenue growth forecasts exceed market averages, suggesting positive momentum for future performance.

- Unlock comprehensive insights into our analysis of Gold Circuit Electronics stock in this growth report.

- Upon reviewing our latest valuation report, Gold Circuit Electronics' share price might be too pessimistic.

Seize The Opportunity

- Access the full spectrum of 848 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Want To Explore Some Alternatives? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2368

Gold Circuit Electronics

Designs, manufactures, processes, and distributes printed circuit boards in Taiwan.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives