- China

- /

- Life Sciences

- /

- SHSE:688068

Despite shrinking by CN¥376m in the past week, Beijing Hotgen Biotech (SHSE:688068) shareholders are still up 140% over 1 year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Beijing Hotgen Biotech Co., Ltd. (SHSE:688068) share price has soared 138% return in just a single year. Also pleasing for shareholders was the 101% gain in the last three months. Zooming out, the stock is actually down 33% in the last three years.

Although Beijing Hotgen Biotech has shed CN¥376m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Beijing Hotgen Biotech

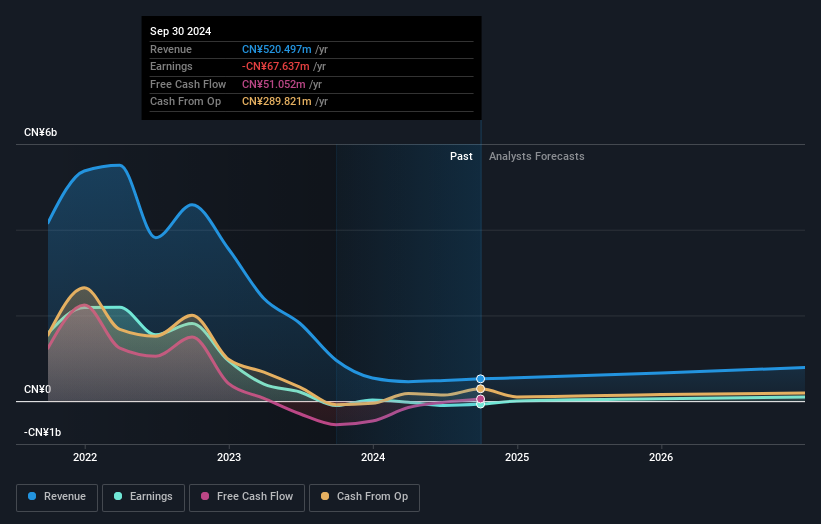

Because Beijing Hotgen Biotech made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Beijing Hotgen Biotech actually shrunk its revenue over the last year, with a reduction of 45%. We're a little surprised to see the share price pop 138% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Beijing Hotgen Biotech's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Beijing Hotgen Biotech shareholders have received a total shareholder return of 140% over one year. That's including the dividend. That's better than the annualised return of 7% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Beijing Hotgen Biotech better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Beijing Hotgen Biotech .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Hotgen Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688068

Beijing Hotgen Biotech

Engages in the research, development, manufacture, and sale of medical and public safety inspection products of in-vitro diagnostic products in the field of biomedicine.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives