Shanghai Hile Bio-Technology (SHSE:603718) shareholders are up 9.3% this past week, but still in the red over the last five years

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. To wit, the Shanghai Hile Bio-Technology Co., Ltd. (SHSE:603718) share price managed to fall 55% over five long years. That's an unpleasant experience for long term holders. But it's up 9.3% in the last week.

While the last five years has been tough for Shanghai Hile Bio-Technology shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Shanghai Hile Bio-Technology

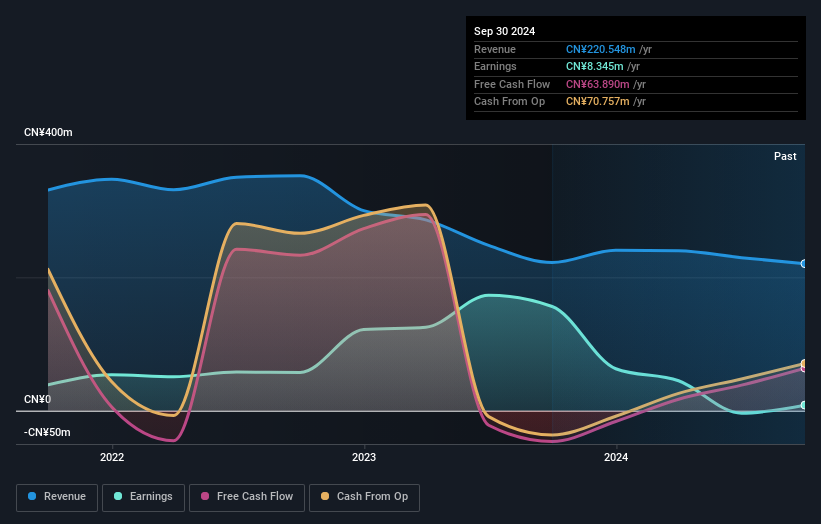

Given that Shanghai Hile Bio-Technology only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last five years Shanghai Hile Bio-Technology saw its revenue shrink by 2.8% per year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 9% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Shanghai Hile Bio-Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Shanghai Hile Bio-Technology shareholders are down 16% for the year (even including dividends), but the market itself is up 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Shanghai Hile Bio-Technology .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603718

Shanghai Hile Bio-Technology

Researches, develops, produces, and sells veterinary biological products for livestock and poultry in China.

Adequate balance sheet very low.

Market Insights

Community Narratives