Market Might Still Lack Some Conviction On Zhejiang Starry Pharmaceutical Co.,Ltd. (SHSE:603520) Even After 31% Share Price Boost

Those holding Zhejiang Starry Pharmaceutical Co.,Ltd. (SHSE:603520) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

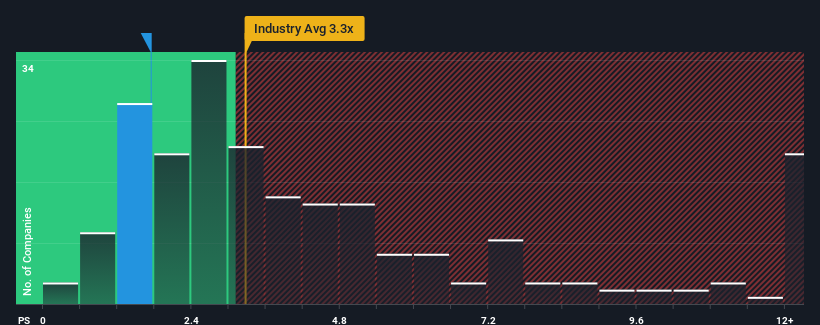

In spite of the firm bounce in price, Zhejiang Starry PharmaceuticalLtd's price-to-sales (or "P/S") ratio of 1.7x might still make it look like a buy right now compared to the Pharmaceuticals industry in China, where around half of the companies have P/S ratios above 3.3x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Zhejiang Starry PharmaceuticalLtd

How Zhejiang Starry PharmaceuticalLtd Has Been Performing

With revenue growth that's inferior to most other companies of late, Zhejiang Starry PharmaceuticalLtd has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Starry PharmaceuticalLtd.Is There Any Revenue Growth Forecasted For Zhejiang Starry PharmaceuticalLtd?

The only time you'd be truly comfortable seeing a P/S as low as Zhejiang Starry PharmaceuticalLtd's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen an excellent 74% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 19% as estimated by the six analysts watching the company. That's shaping up to be similar to the 18% growth forecast for the broader industry.

With this information, we find it odd that Zhejiang Starry PharmaceuticalLtd is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Despite Zhejiang Starry PharmaceuticalLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Zhejiang Starry PharmaceuticalLtd's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Zhejiang Starry PharmaceuticalLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Zhejiang Starry PharmaceuticalLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Starry PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603520

Zhejiang Starry PharmaceuticalLtd

Engages in the research and development, production, and sale of X-CT non-ionic contrast agents and fluoroquinolones drugs and intermediates in China and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives