- Taiwan

- /

- Entertainment

- /

- TPEX:3293

3 Global Growth Stocks With Insider Ownership Up To 27%

Reviewed by Simply Wall St

In the current global market landscape, investors are closely watching trade developments and monetary policy decisions as key drivers of economic momentum. With major indexes showing mixed results amid hopes for tariff de-escalation and steady interest rates, identifying growth companies with substantial insider ownership can be a strategic approach to navigating these uncertain times. Stocks with high insider ownership often indicate confidence from those who know the company best, making them potentially attractive in an environment where market participants seek stability and long-term value amidst volatility.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

Let's dive into some prime choices out of the screener.

Beijing Wantai Biological Pharmacy Enterprise (SHSE:603392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. operates in the biotechnology sector, focusing on the development and production of diagnostic reagents and vaccines, with a market cap of CN¥86.70 billion.

Operations: The company's revenue primarily stems from its activities in the biotechnology sector, specifically through the development and production of diagnostic reagents and vaccines.

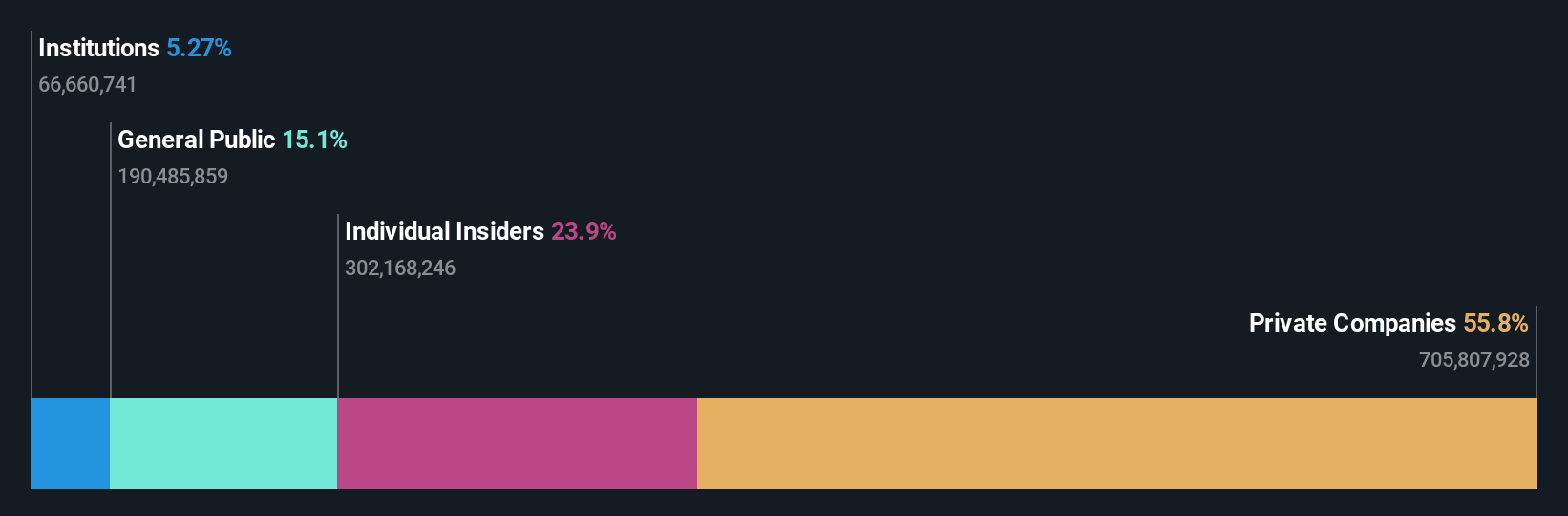

Insider Ownership: 23.9%

Beijing Wantai Biological Pharmacy Enterprise is poised for significant growth, with revenue expected to increase by 72.8% annually, outpacing the Chinese market's 12.5%. Despite a recent net loss of CNY 52.78 million in Q1 2025 and declining sales from CNY 752.51 million to CNY 400.63 million year-on-year, its forecasted profitability within three years highlights potential for recovery and expansion in the high-growth sector of biological pharmaceuticals.

- Click here to discover the nuances of Beijing Wantai Biological Pharmacy Enterprise with our detailed analytical future growth report.

- Our valuation report unveils the possibility Beijing Wantai Biological Pharmacy Enterprise's shares may be trading at a premium.

Jiangsu Gian Technology (SZSE:300709)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Gian Technology Co., Ltd. specializes in the manufacturing and sale of metal injection molding products both in China and internationally, with a market cap of CN¥6.73 billion.

Operations: Jiangsu Gian Technology's revenue primarily comes from its operations in manufacturing and selling metal injection molding products across domestic and international markets.

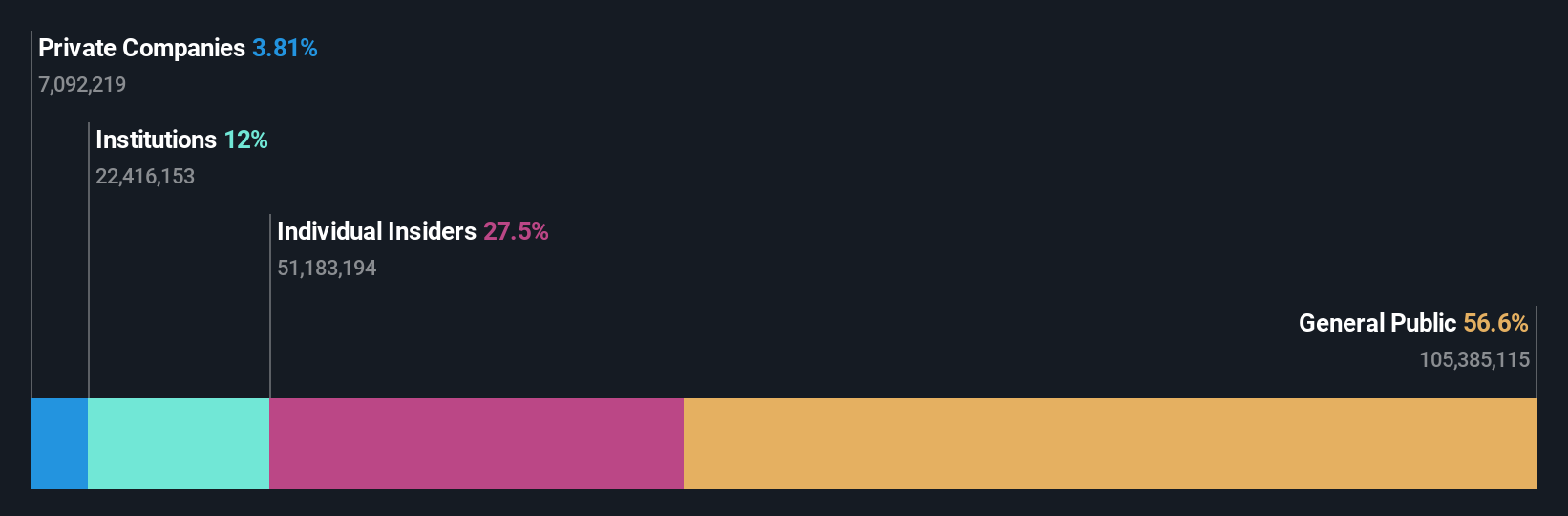

Insider Ownership: 27.5%

Jiangsu Gian Technology is positioned for growth, with revenue projected to rise by 31.8% annually, surpassing the Chinese market's average. Despite a Q1 2025 net loss of CNY 17.5 million and a dividend decrease, its earnings are anticipated to grow significantly at 49.9% per year over the next three years. Although recent share price volatility exists and Return on Equity forecasts are modest, no substantial insider trading has been reported recently.

- Take a closer look at Jiangsu Gian Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Jiangsu Gian Technology's current price could be inflated.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Games System Co., Ltd. engages in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$243.19 billion.

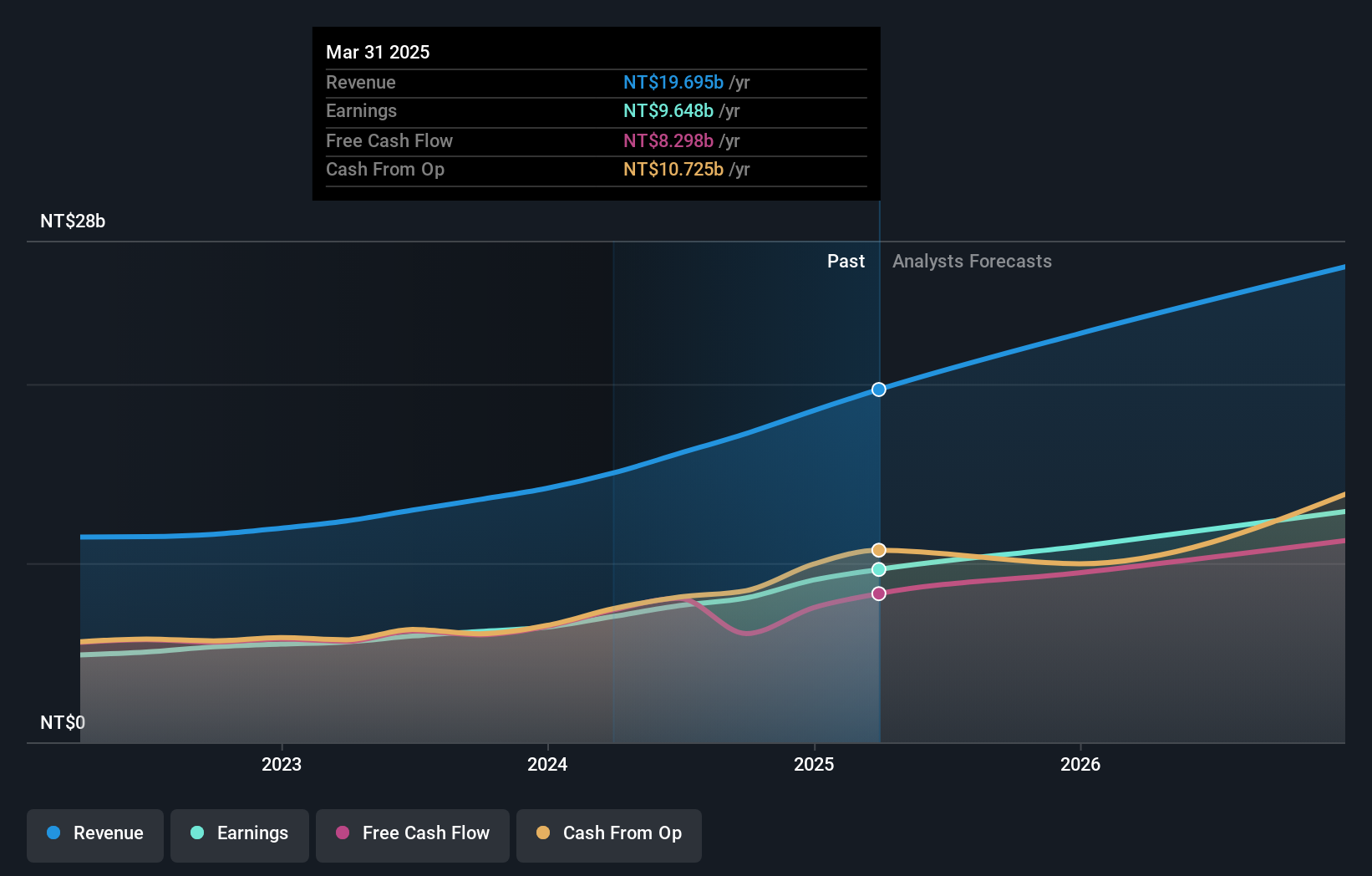

Operations: International Games System Co., Ltd. generates revenue primarily through its Online Games Division, contributing NT$11.51 billion, and its Business Game Division, which adds NT$7.01 billion.

Insider Ownership: 11.3%

International Games System Ltd. demonstrates strong growth potential with earnings forecasted to grow faster than the Taiwan market at 17.5% annually, despite revenue growth trailing the 20% benchmark. The company reported significant profit increases in 2024, with net income rising to TWD 9.06 billion from TWD 6.43 billion and basic EPS improving notably. However, its dividend yield of 3.26% is not well covered by earnings or free cash flows, indicating potential sustainability concerns amidst high insider ownership levels.

- Click here and access our complete growth analysis report to understand the dynamics of International Games SystemLtd.

- In light of our recent valuation report, it seems possible that International Games SystemLtd is trading beyond its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 846 Fast Growing Global Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3293

International Games SystemLtd

Plans, designs, researches, develops, manufactures, markets, services, and licenses arcade, online, and mobile games in Taiwan, the United Kingdom, Curacao, and Malta.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)