3 Asian Growth Companies With High Insider Ownership Growing Revenues At 59%

Reviewed by Simply Wall St

As global markets grapple with trade uncertainties and inflation concerns, Asian economies like Japan and China are showing resilience, with modest stock market gains and strategic economic initiatives aimed at boosting consumption. In this environment, companies that demonstrate strong revenue growth alongside significant insider ownership can be particularly appealing to investors seeking stability and potential upside in a challenging market landscape.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 44.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| Techwing (KOSDAQ:A089030) | 18.8% | 64.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 61.1% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Let's take a closer look at a couple of our picks from the screened companies.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★★

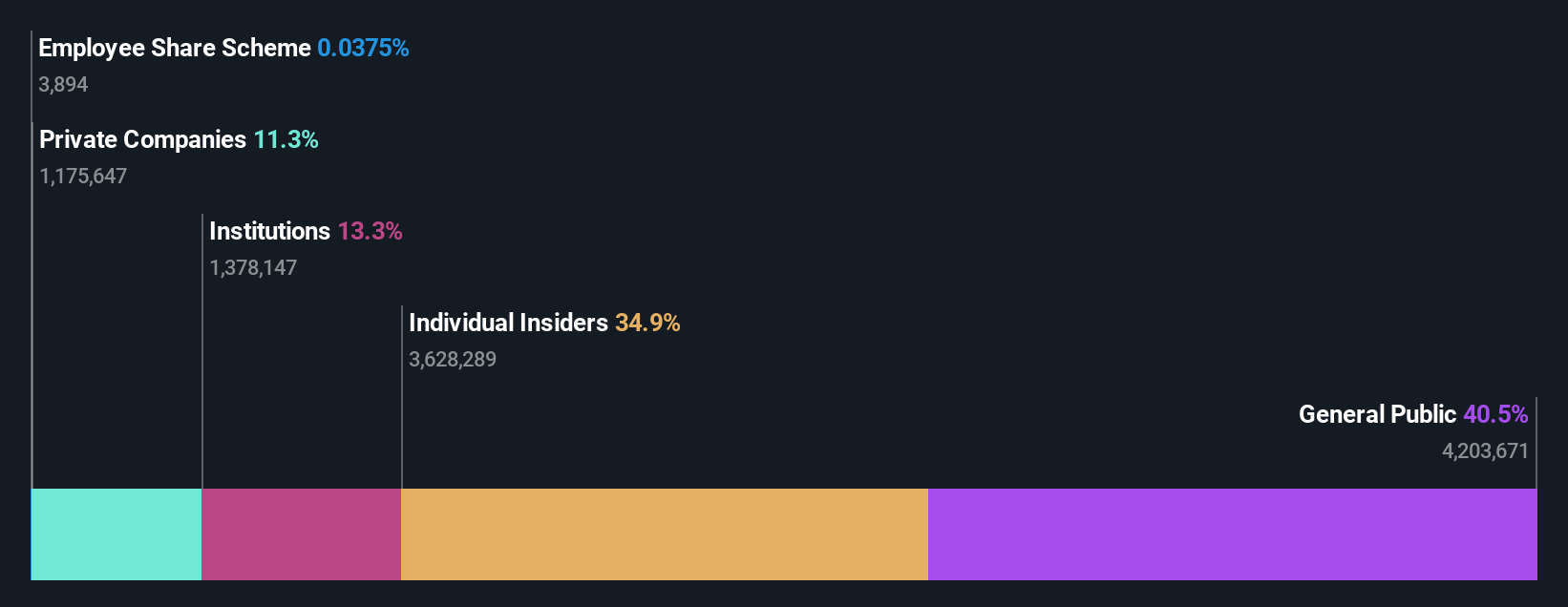

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea with a market cap of ₩3.49 trillion.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, amounting to ₩317.00 billion.

Insider Ownership: 38.6%

Revenue Growth Forecast: 23.4% p.a.

PharmaResearch demonstrates strong growth potential, with revenue anticipated to increase by 23.4% annually, outpacing the Korean market's 8.7%. Earnings are also expected to grow significantly at 26.4% per year over the next three years. The company trades at a discount of 15.2% below its estimated fair value, indicating potential for capital appreciation. Recent dividend announcements highlight shareholder returns, though no substantial insider trading activity has been observed in recent months.

- Unlock comprehensive insights into our analysis of PharmaResearch stock in this growth report.

- Our comprehensive valuation report raises the possibility that PharmaResearch is priced higher than what may be justified by its financials.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

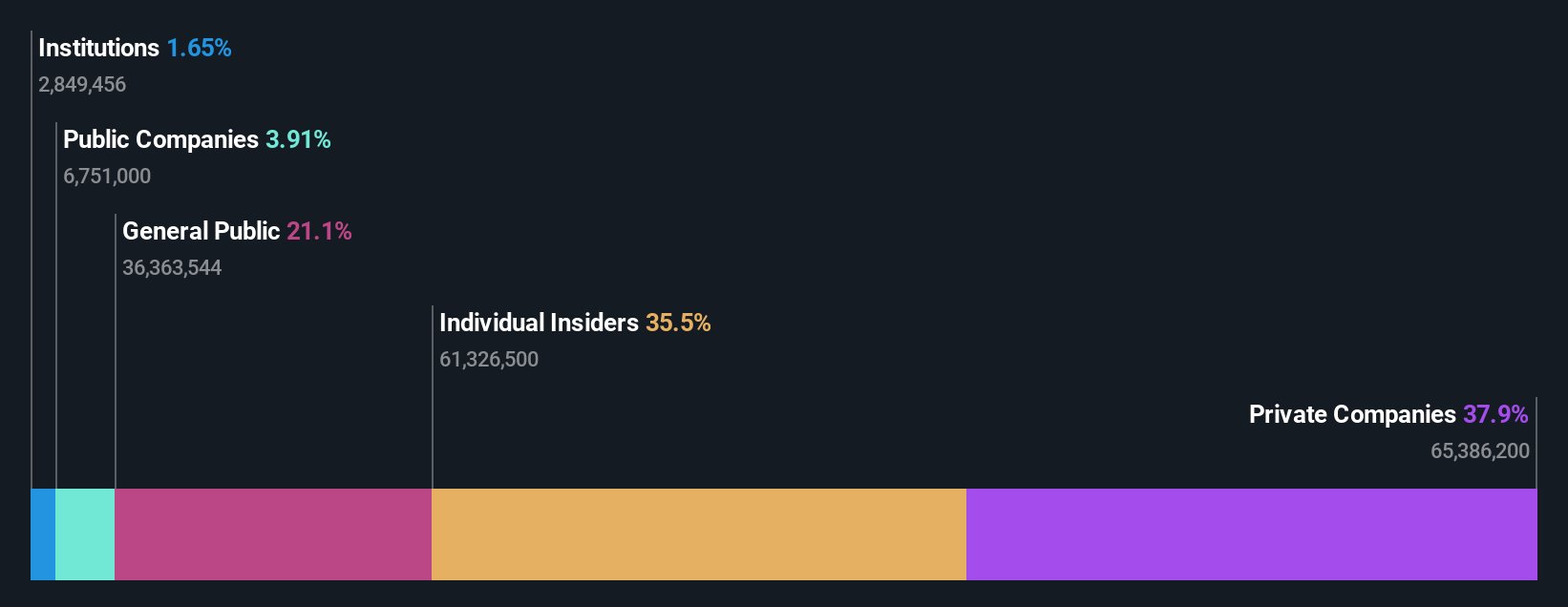

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of approximately HK$114.83 billion.

Operations: The company generates revenue of CN¥5.28 billion from its Jewelry & Watches segment.

Insider Ownership: 36.4%

Revenue Growth Forecast: 43.9% p.a.

Laopu Gold's earnings are forecast to grow significantly at 44.7% annually, surpassing the Hong Kong market's 11.6%. Revenue growth is also strong, projected at 43.9% per year. Recent guidance indicates a net profit increase of up to 260% for 2024, driven by brand expansion and new boutique openings, contributing to revenue gains. The company's return on equity is expected to reach a very high level of 41.3%, though no recent insider trading activity has been reported.

- Click here to discover the nuances of Laopu Gold with our detailed analytical future growth report.

- The analysis detailed in our Laopu Gold valuation report hints at an inflated share price compared to its estimated value.

Beijing Wantai Biological Pharmacy Enterprise (SHSE:603392)

Simply Wall St Growth Rating: ★★★★★☆

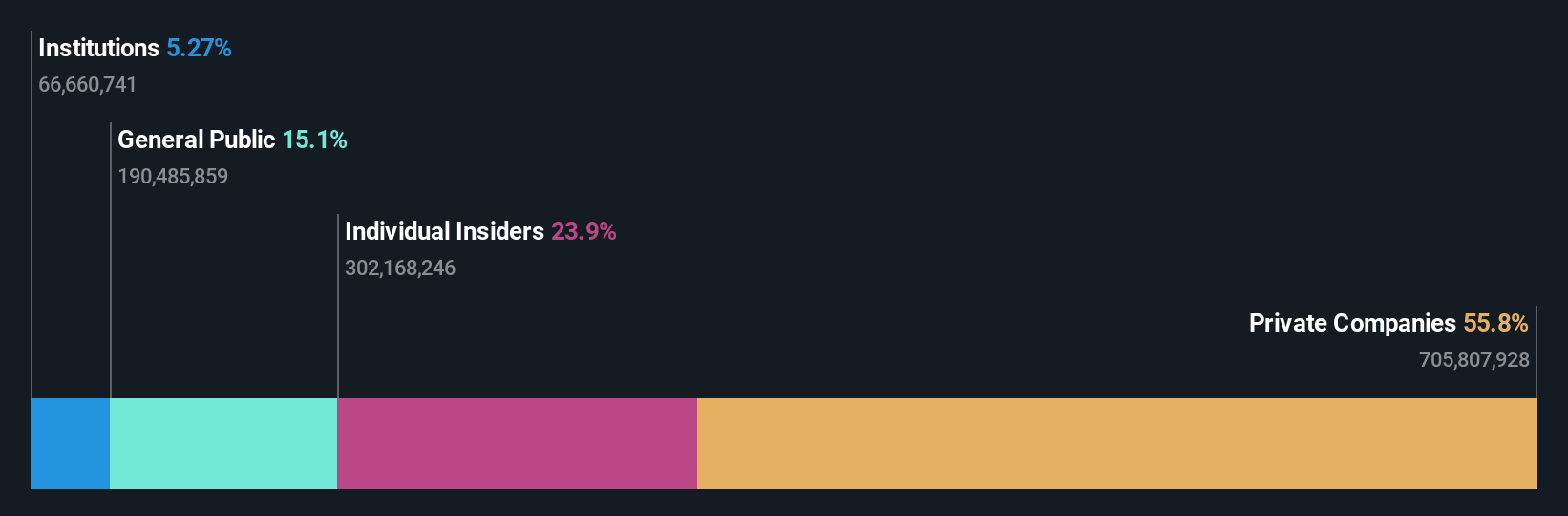

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. operates in the biotechnology sector, focusing on the development and production of diagnostic products and vaccines, with a market cap of CN¥86.91 billion.

Operations: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. generates revenue primarily from its biotechnology operations, specifically through the development and production of diagnostic products and vaccines.

Insider Ownership: 24.1%

Revenue Growth Forecast: 59.4% p.a.

Beijing Wantai Biological Pharmacy Enterprise is set for robust growth, with revenue forecasted to increase by 59.4% annually, outpacing the Chinese market's 13.1%. Despite a projected low return on equity of 17.9% in three years, the company is expected to become profitable during this period, exceeding average market growth rates. There has been no significant insider trading activity recently, which may suggest stability in insider sentiment amidst these growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing Wantai Biological Pharmacy Enterprise.

- Upon reviewing our latest valuation report, Beijing Wantai Biological Pharmacy Enterprise's share price might be too optimistic.

Turning Ideas Into Actions

- Discover the full array of 640 Fast Growing Asian Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Beijing Wantai Biological Pharmacy Enterprise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Wantai Biological Pharmacy Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603392

Beijing Wantai Biological Pharmacy Enterprise

Beijing Wantai Biological Pharmacy Enterprise Co., Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives