- China

- /

- Life Sciences

- /

- SHSE:603259

We Think Some Shareholders May Hesitate To Increase WuXi AppTec Co., Ltd.'s (SHSE:603259) CEO Compensation

Key Insights

- WuXi AppTec to hold its Annual General Meeting on 12th of June

- CEO Ge Li's total compensation includes salary of CN¥30.3m

- The overall pay is comparable to the industry average

- WuXi AppTec's EPS grew by 30% over the past three years while total shareholder loss over the past three years was 70%

Shareholders of WuXi AppTec Co., Ltd. (SHSE:603259) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 12th of June could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for WuXi AppTec

How Does Total Compensation For Ge Li Compare With Other Companies In The Industry?

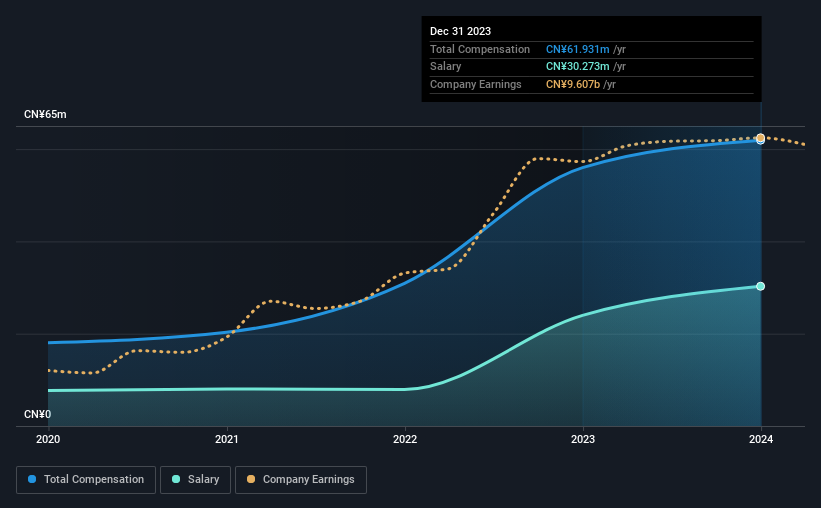

According to our data, WuXi AppTec Co., Ltd. has a market capitalization of CN¥121b, and paid its CEO total annual compensation worth CN¥62m over the year to December 2023. That's a notable increase of 11% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥30m.

On comparing similar companies in the Chinese Life Sciences industry with market capitalizations above CN¥58b, we found that the median total CEO compensation was CN¥53m. This suggests that WuXi AppTec remunerates its CEO largely in line with the industry average. Moreover, Ge Li also holds CN¥6.5b worth of WuXi AppTec stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥30m | CN¥24m | 49% |

| Other | CN¥32m | CN¥32m | 51% |

| Total Compensation | CN¥62m | CN¥56m | 100% |

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. WuXi AppTec sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at WuXi AppTec Co., Ltd.'s Growth Numbers

WuXi AppTec Co., Ltd. has seen its earnings per share (EPS) increase by 30% a year over the past three years. Its revenue is down 1.2% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has WuXi AppTec Co., Ltd. Been A Good Investment?

With a total shareholder return of -70% over three years, WuXi AppTec Co., Ltd. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for WuXi AppTec that investors should look into moving forward.

Important note: WuXi AppTec is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking to trade WuXi AppTec, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WuXi AppTec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603259

WuXi AppTec

An investment holding company, provides research and manufacturing services to discover, develop, and manufacture spectrum for small molecule drugs and advanced therapies in the People’s Republic of China, the United States, Europe, and internationally.

Flawless balance sheet and undervalued.