Even after rising 14% this past week, Chimin Health Management (SHSE:603222) shareholders are still down 80% over the past five years

Chimin Health Management Co., Ltd. (SHSE:603222) shareholders should be happy to see the share price up 19% in the last month. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 80% lower after that period. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The million dollar question is whether the company can justify a long term recovery.

On a more encouraging note the company has added CN¥426m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Check out our latest analysis for Chimin Health Management

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

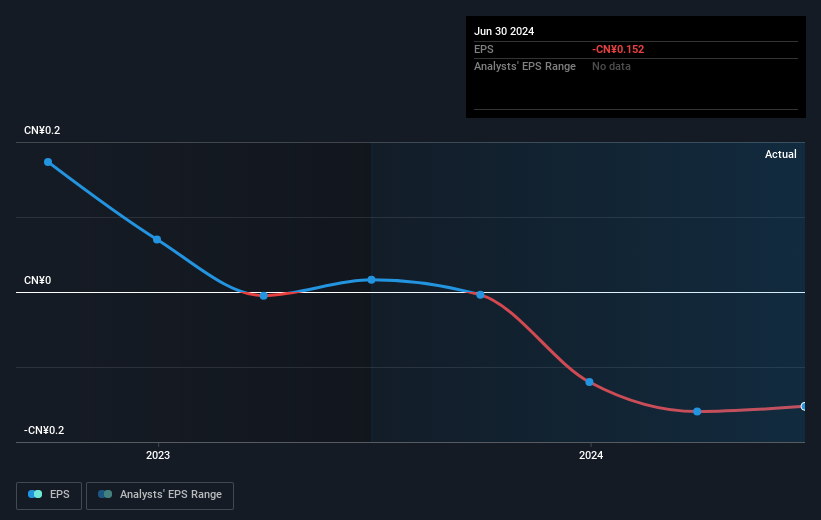

In the last half decade Chimin Health Management saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Chimin Health Management's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Chimin Health Management had a tough year, with a total loss of 34%, against a market gain of about 3.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Chimin Health Management you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603222

Chimin Health Management

Researches, develops, produces, and sells human medicines and medical devices in China and internationally.

Excellent balance sheet and overvalued.