- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A006400

Exploring Three High Growth Tech Stocks for Potential Portfolio Enhancement

Reviewed by Simply Wall St

In recent weeks, global markets have faced volatility, with U.S. stocks declining amid Treasury market fluctuations and renewed tariff threats, particularly impacting small- and mid-cap indexes more than their larger counterparts. In this environment of uncertainty and shifting economic indicators, identifying high-growth tech stocks that can potentially enhance a portfolio involves looking for companies with robust innovation capabilities and resilience to external pressures such as trade tensions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Intellego Technologies | 31.55% | 51.31% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.03% | 43.09% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| CD Projekt | 33.21% | 37.35% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 45.22% | 78.07% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Samsung SDI (KOSE:A006400)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samsung SDI Co., Ltd. is a company that focuses on manufacturing and selling batteries across various regions including South Korea, Europe, China, North America, and Southeast Asia with a market capitalization of ₩10.62 trillion.

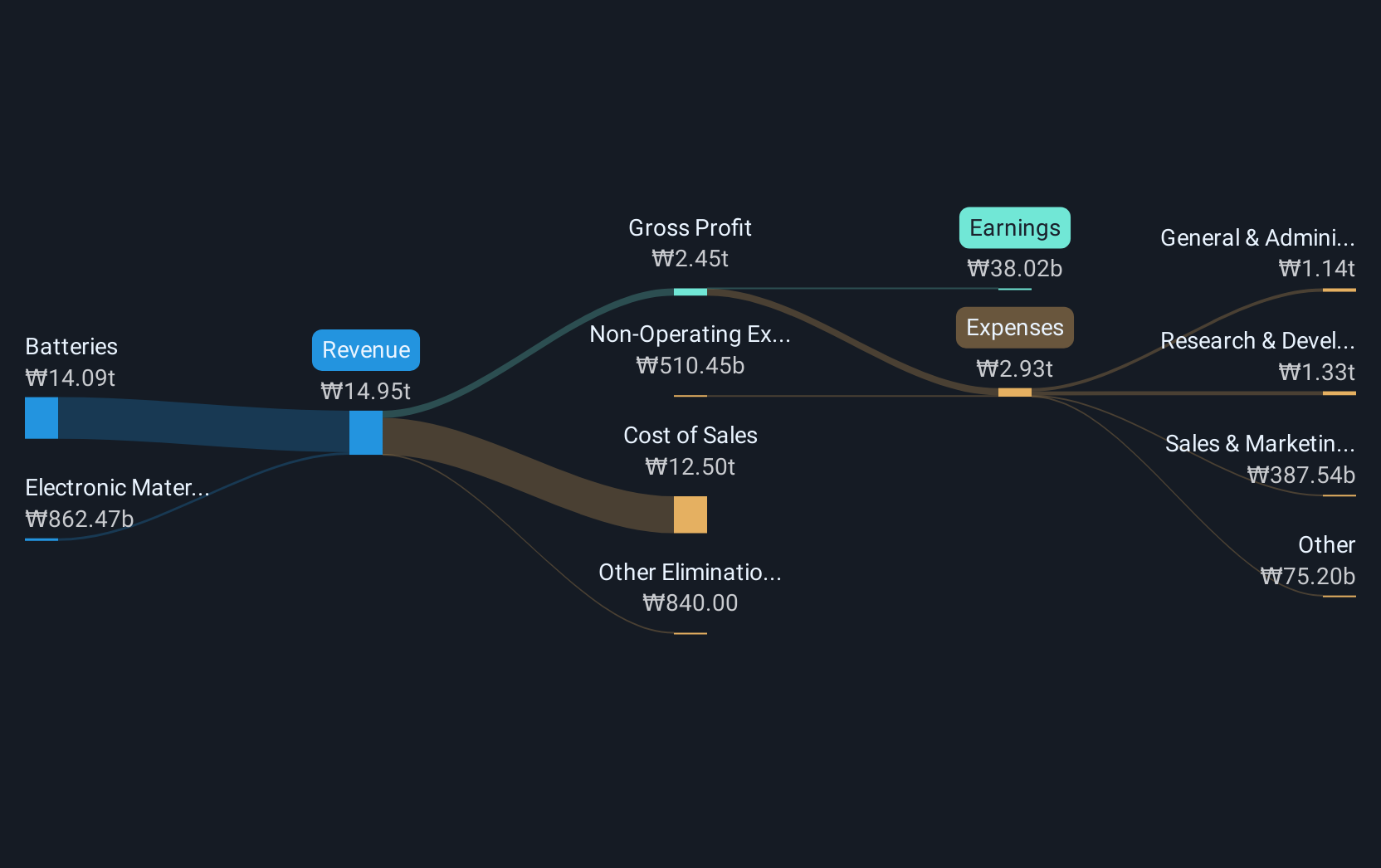

Operations: The company's primary revenue stream comes from its battery manufacturing segment, generating ₩14.09 trillion, while the electronic material segment contributes ₩862.47 billion.

Samsung SDI's recent strategic moves, including a significant follow-on equity offering and private placements totaling over KRW 2 trillion, underscore its aggressive expansion in the high-tech battery sector. This financial influx supports its pioneering production of 46-series cylindrical batteries, aimed at revolutionizing energy solutions for micro-mobility and electric vehicles. Despite a challenging quarter with sales dropping to KRW 3.18 billion from KRW 4.82 billion year-over-year and swinging to a net loss of KRW 216 million, the company is poised for recovery. Innovations like the tabless design in batteries that reduce internal resistance by 90% highlight Samsung SDI’s commitment to technological leadership and market adaptation, setting a robust foundation for future growth in an increasingly electrified world.

- Click here and access our complete health analysis report to understand the dynamics of Samsung SDI.

Assess Samsung SDI's past performance with our detailed historical performance reports.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China, with a market cap of CN¥30.86 billion.

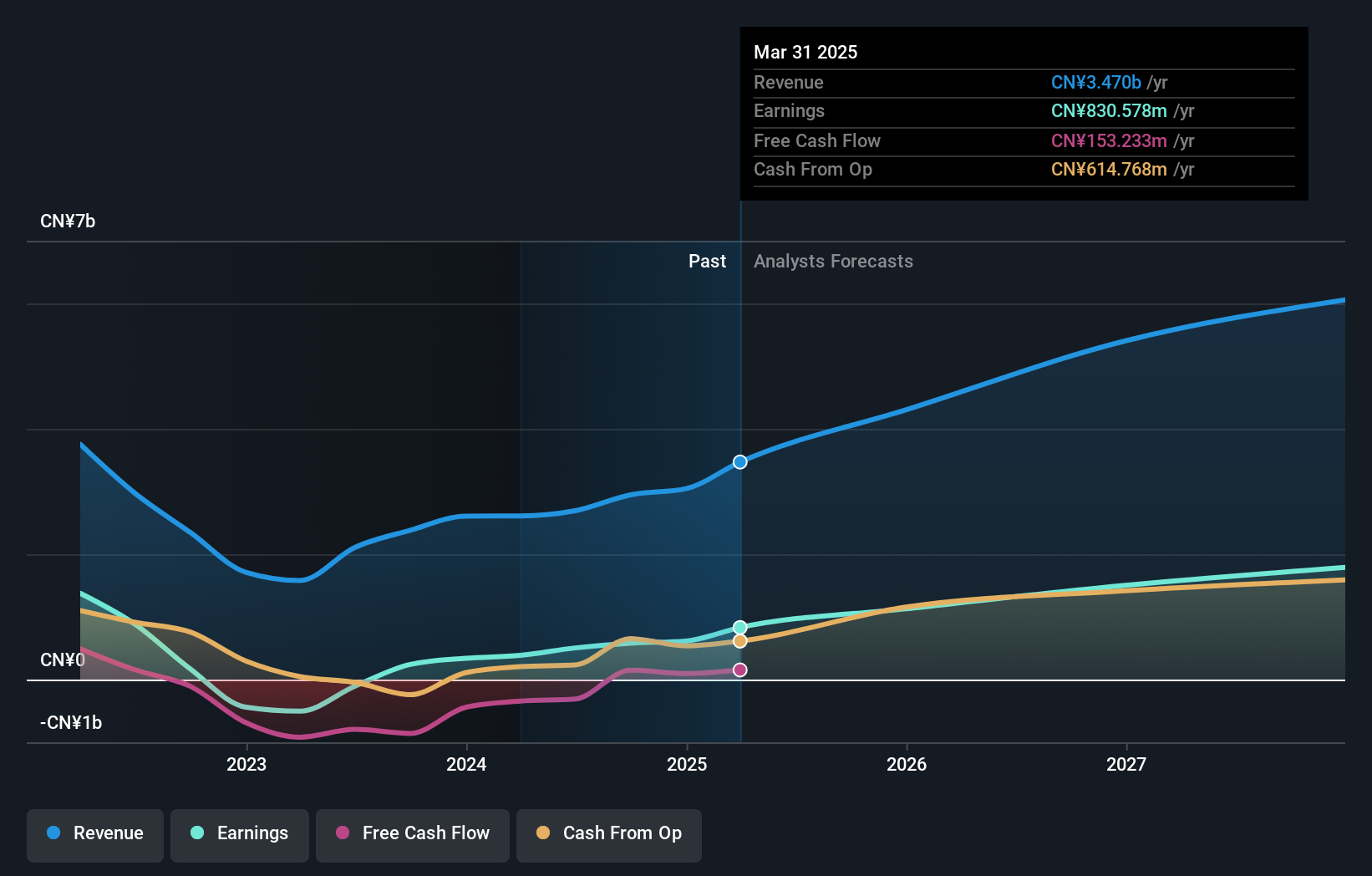

Operations: The company generates revenue primarily from the development, production, and sales of insulin and related products, amounting to CN¥3.47 billion. It operates within China's biopharmaceutical sector with a focus on insulin analog APIs and injections.

Gan & Lee Pharmaceuticals has demonstrated robust growth, with a notable increase in Q1 sales to CNY 984.87 million from CNY 560.33 million the previous year, and net income surging to CNY 311.92 million from CNY 96 million. This performance is underpinned by aggressive R&D efforts, as evidenced by their recent significant investment in the Phase 2 clinical trial of bofanglutide, an innovative GLP-1 receptor agonist aimed at weight management. The company's commitment to expanding its product pipeline through research has also been reflected in their strategic share repurchases totaling CNY 89.92 million this year, reinforcing their financial confidence and operational focus on delivering cutting-edge medical solutions.

- Click to explore a detailed breakdown of our findings in Gan & Lee Pharmaceuticals' health report.

Evaluate Gan & Lee Pharmaceuticals' historical performance by accessing our past performance report.

Glory View Technology (SZSE:301396)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Glory View Technology Co., Ltd. offers smart city services in China and has a market cap of CN¥10.10 billion.

Operations: Glory View Technology Co., Ltd. specializes in providing smart city services across China, focusing on integrating technology solutions to enhance urban infrastructure and management. The company operates within a market valued at CN¥10.10 billion, reflecting its significant role in the smart city sector.

Despite recent volatility, Glory View Technology has shown promising signs of recovery with a significant jump in Q1 2025 sales to CNY 488.63 million from CNY 46.17 million the previous year, marking a substantial revenue increase. This growth is complemented by a turnaround to a net income of CNY 21.65 million, contrasting sharply with the prior year's loss of CNY 9.25 million. The company's aggressive pursuit of innovation is evident from its R&D spending trends which consistently align with its revenue growth, underscoring a commitment to advancing its technological offerings in an ever-evolving market.

- Unlock comprehensive insights into our analysis of Glory View Technology stock in this health report.

Understand Glory View Technology's track record by examining our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 749 Global High Growth Tech and AI Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A006400

Samsung SDI

Manufactures and sells batteries in South Korea, Europe, China, North America, Southeast Asia, and internationally.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives