Getting In Cheap On GuangYuYuan Chinese Herbal Medicine Co., Ltd. (SHSE:600771) Is Unlikely

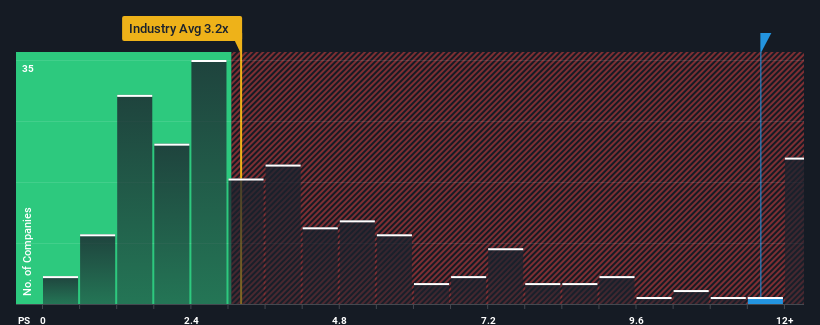

GuangYuYuan Chinese Herbal Medicine Co., Ltd.'s (SHSE:600771) price-to-sales (or "P/S") ratio of 11.6x may look like a poor investment opportunity when you consider close to half the companies in the Pharmaceuticals industry in China have P/S ratios below 3.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for GuangYuYuan Chinese Herbal Medicine

How Has GuangYuYuan Chinese Herbal Medicine Performed Recently?

The recent revenue growth at GuangYuYuan Chinese Herbal Medicine would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on GuangYuYuan Chinese Herbal Medicine's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as GuangYuYuan Chinese Herbal Medicine's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 2.8%. The solid recent performance means it was also able to grow revenue by 5.8% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that GuangYuYuan Chinese Herbal Medicine's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of GuangYuYuan Chinese Herbal Medicine revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for GuangYuYuan Chinese Herbal Medicine you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600771

GuangYuYuan Chinese Herbal Medicine

GuangYuYuan Chinese Herbal Medicine Co., Ltd.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives