The Price Is Right For Xinjiang Bai Hua Cun Pharma Tech Co.,Ltd (SHSE:600721) Even After Diving 26%

The Xinjiang Bai Hua Cun Pharma Tech Co.,Ltd (SHSE:600721) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

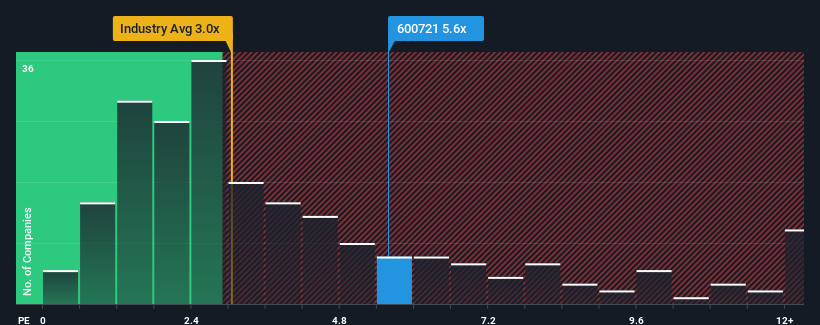

In spite of the heavy fall in price, you could still be forgiven for thinking Xinjiang Bai Hua Cun Pharma TechLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.6x, considering almost half the companies in China's Pharmaceuticals industry have P/S ratios below 3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Xinjiang Bai Hua Cun Pharma TechLtd

How Has Xinjiang Bai Hua Cun Pharma TechLtd Performed Recently?

The revenue growth achieved at Xinjiang Bai Hua Cun Pharma TechLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xinjiang Bai Hua Cun Pharma TechLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xinjiang Bai Hua Cun Pharma TechLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. This was backed up an excellent period prior to see revenue up by 278% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 18% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Xinjiang Bai Hua Cun Pharma TechLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Xinjiang Bai Hua Cun Pharma TechLtd's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Xinjiang Bai Hua Cun Pharma TechLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Xinjiang Bai Hua Cun Pharma TechLtd, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600721

Xinjiang Bai Hua Cun Pharma TechLtd

Engages in the pharmaceutical research and development, clinical trials, biomedicine, commercial properties, and other businesses.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives