Global markets have recently experienced a boost, with U.S. equities rallying on the back of a temporary tariff suspension between the U.S. and China, leading to notable gains across major indices like the Nasdaq Composite and S&P 500. Amid these shifting dynamics, investors are increasingly considering diverse opportunities beyond traditional large-cap stocks. Though often seen as relics of past trading days, penny stocks remain relevant for their potential to uncover hidden value in smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.405 | SGD164.14M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.17 | SGD8.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.72 | SEK278.94M | ✅ 4 ⚠️ 2 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.99 | MYR1.55B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.38 | MYR1.1B | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.28 | HK$2.07B | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.955 | £445.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.88 | A$628.18M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,627 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Qinghai Huading Industrial (SHSE:600243)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Huading Industrial Co., Ltd. focuses on the research, development, production, and sale of CNC machine tools and elevator accessories in China with a market cap of CN¥1.30 billion.

Operations: The company's revenue is derived entirely from the Chinese market, amounting to CN¥230.77 million.

Market Cap: CN¥1.3B

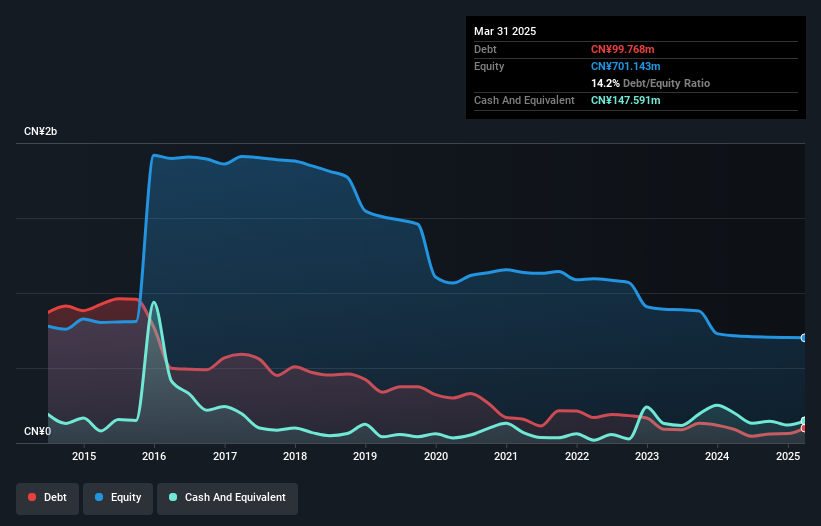

Qinghai Huading Industrial Co., Ltd. has shown a reduction in losses over the past five years, decreasing at an annual rate of 10.8%. Despite being unprofitable, the company maintains a strong financial position with short-term assets of CN¥600.6 million exceeding both its short and long-term liabilities. The debt to equity ratio has improved significantly, dropping from 28.1% to 14.2%. Recent earnings reports highlight a decrease in sales to CN¥236.6 million for 2024 compared to the previous year, but net loss reductions indicate some operational improvements despite ongoing challenges in profitability and share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Qinghai Huading Industrial.

- Examine Qinghai Huading Industrial's past performance report to understand how it has performed in prior years.

Guizhou Yibai Pharmaceutical (SHSE:600594)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guizhou Yibai Pharmaceutical Co., Ltd. is engaged in the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥3.04 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥2.10 billion.

Market Cap: CN¥3.04B

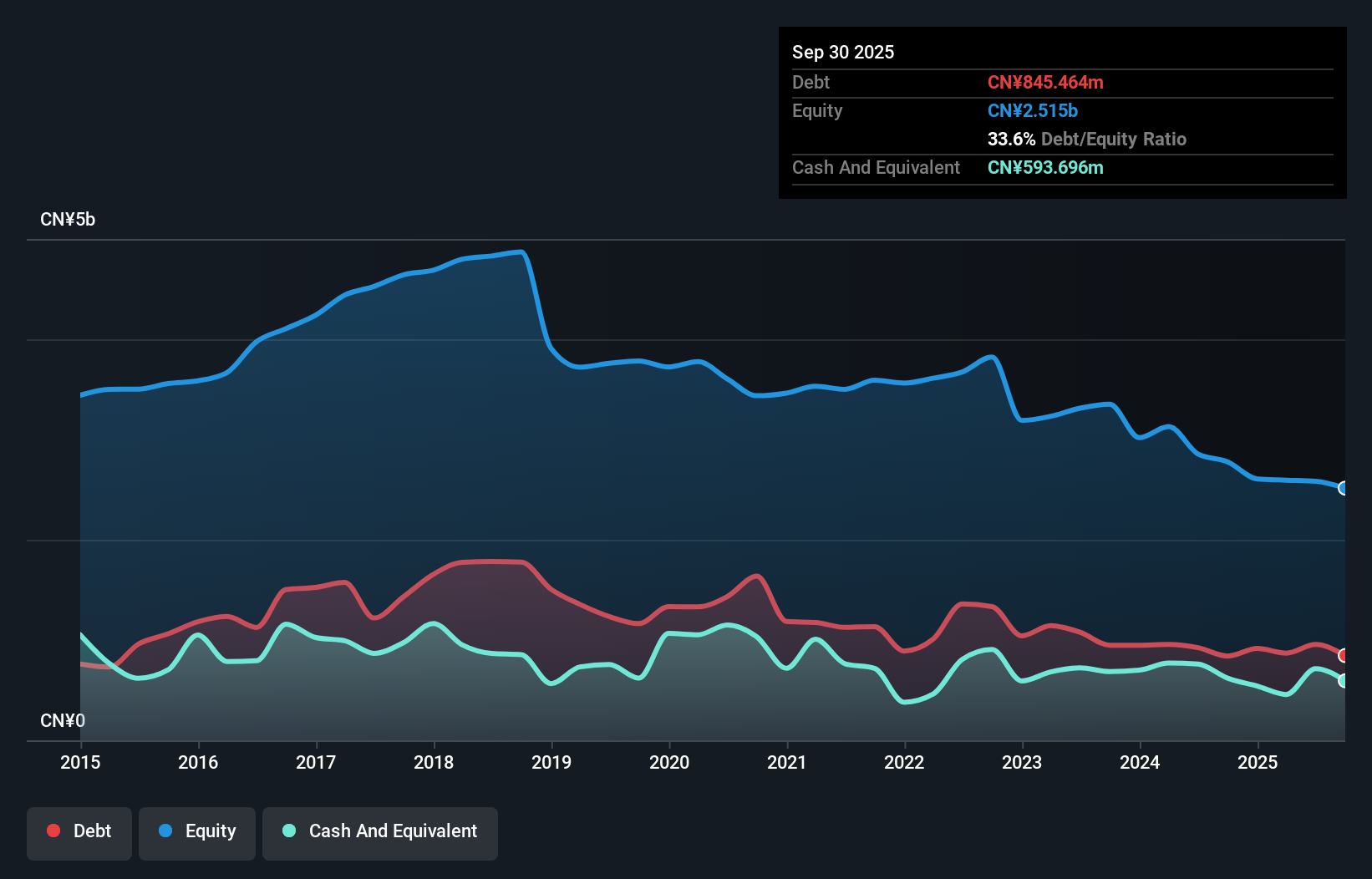

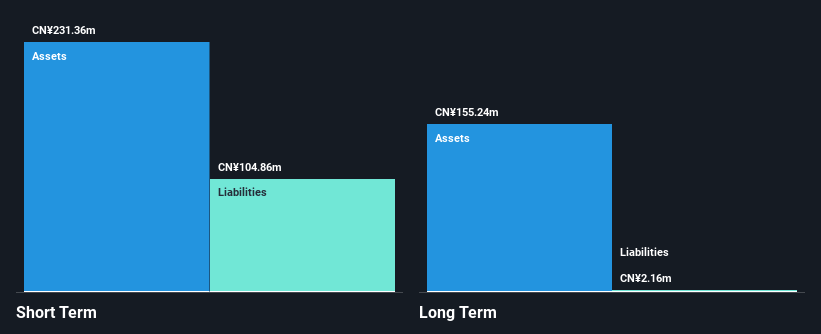

Guizhou Yibai Pharmaceutical Co., Ltd. remains unprofitable, with a net loss of CN¥9.39 million for Q1 2025, though this is an improvement from the previous year's larger losses. Despite declining sales from CN¥572.65 million to CN¥501.48 million year-over-year, the company benefits from a stable financial structure; its short-term assets significantly exceed both short and long-term liabilities, and it maintains a satisfactory net debt to equity ratio of 15.9%. The board's extensive experience adds stability amid challenges in profitability and earnings volatility has remained stable over the past year at 6%.

- Navigate through the intricacies of Guizhou Yibai Pharmaceutical with our comprehensive balance sheet health report here.

- Learn about Guizhou Yibai Pharmaceutical's historical performance here.

Suzhou Goldengreen Technologies (SZSE:002808)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suzhou Goldengreen Technologies Ltd. and its subsidiaries focus on the research, development, manufacture, and sale of laser organic photo-conductor drum products in China, with a market cap of CN¥1.11 billion.

Operations: No revenue segments are reported for Suzhou Goldengreen Technologies.

Market Cap: CN¥1.11B

Suzhou Goldengreen Technologies Ltd., with a market cap of CN¥1.11 billion, has shown some revenue growth, reporting sales of CN¥39.56 million for Q1 2025 compared to CN¥33.49 million a year ago. Despite this, the company remains unprofitable, with net losses increasing over recent years and a negative return on equity of -16.19%. The management team is seasoned with an average tenure of 12.7 years, providing stability as the company navigates financial challenges. While short-term assets exceed liabilities and debt levels have reduced over time, continued cash runway depends on managing free cash flow effectively amidst ongoing losses.

- Click here to discover the nuances of Suzhou Goldengreen Technologies with our detailed analytical financial health report.

- Understand Suzhou Goldengreen Technologies' track record by examining our performance history report.

Key Takeaways

- Unlock our comprehensive list of 5,627 Global Penny Stocks by clicking here.

- Seeking Other Investments? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600594

Guizhou Yibai Pharmaceutical

Researches, develops, produces, and sells pharmaceutical products in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives