Earnings are growing at Jiangsu Kanion PharmaceuticalLtd (SHSE:600557) but shareholders still don't like its prospects

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Jiangsu Kanion Pharmaceutical Co.,Ltd. (SHSE:600557) shareholders over the last year, as the share price declined 31%. That contrasts poorly with the market decline of 19%. Longer term investors have fared much better, since the share price is up 20% in three years. The falls have accelerated recently, with the share price down 28% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 12% in the same timeframe.

If the past week is anything to go by, investor sentiment for Jiangsu Kanion PharmaceuticalLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Jiangsu Kanion PharmaceuticalLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Jiangsu Kanion PharmaceuticalLtd share price fell, it actually saw its earnings per share (EPS) improve by 8.2%. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

In contrast, the 4.8% drop in revenue is a real concern. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

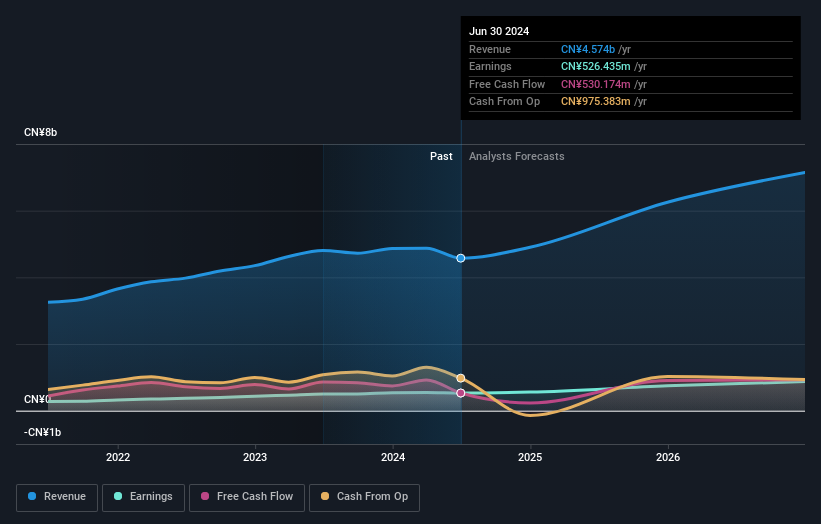

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Jiangsu Kanion PharmaceuticalLtd shareholders are down 30% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 19%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Jiangsu Kanion PharmaceuticalLtd , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600557

Jiangsu Kanion PharmaceuticalLtd

Researches and develops, produces, and sells Chinese medicines.

Flawless balance sheet established dividend payer.