- China

- /

- Electronic Equipment and Components

- /

- SHSE:688003

Spotlight On Lianlian DigiTech And 2 High Growth Insider Picks

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and strong bank earnings propelling U.S. stocks higher, investors are keenly observing the performance of growth companies amidst fluctuating economic indicators. In this environment, companies with high insider ownership often capture attention as they can indicate confidence from those closest to the business, potentially aligning management interests with shareholders and suggesting a commitment to long-term growth strategies.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 30.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Underneath we present a selection of stocks filtered out by our screen.

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lianlian DigiTech Co., Ltd., along with its subsidiaries, offers digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of approximately HK$9.30 billion.

Operations: The company's revenue segments include CN¥722.95 million from global payment services, CN¥309.92 million from domestic payment services, and CN¥153.01 million from value-added services.

Insider Ownership: 19.7%

Earnings Growth Forecast: 94.3% p.a.

Lianlian DigiTech is poised for significant growth, with earnings projected to increase by 94.34% annually and revenue expected to outpace the Hong Kong market at 17.3% per year. Analysts agree on a potential stock price rise of 21.8%. While there is no recent substantial insider trading activity, the company plans to discuss a First Award and Trust Scheme in an upcoming shareholder meeting, potentially impacting future strategic decisions.

- Take a closer look at Lianlian DigiTech's potential here in our earnings growth report.

- Our expertly prepared valuation report Lianlian DigiTech implies its share price may be too high.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China, with a market cap of CN¥8.17 billion.

Operations: Revenue segments (in millions of CN¥):

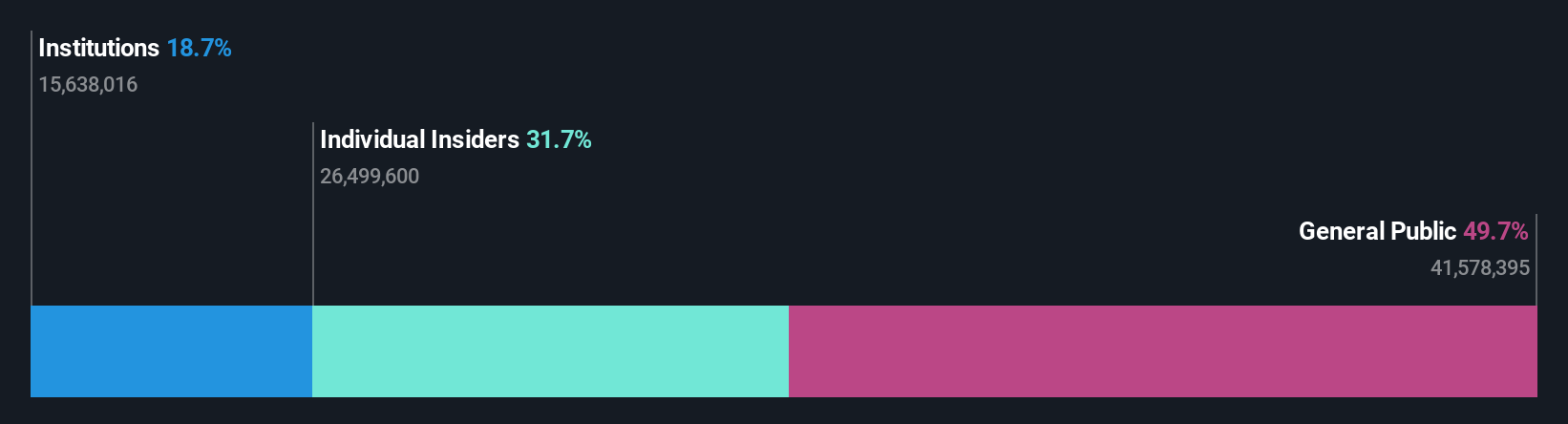

Insider Ownership: 15.3%

Earnings Growth Forecast: 35.4% p.a.

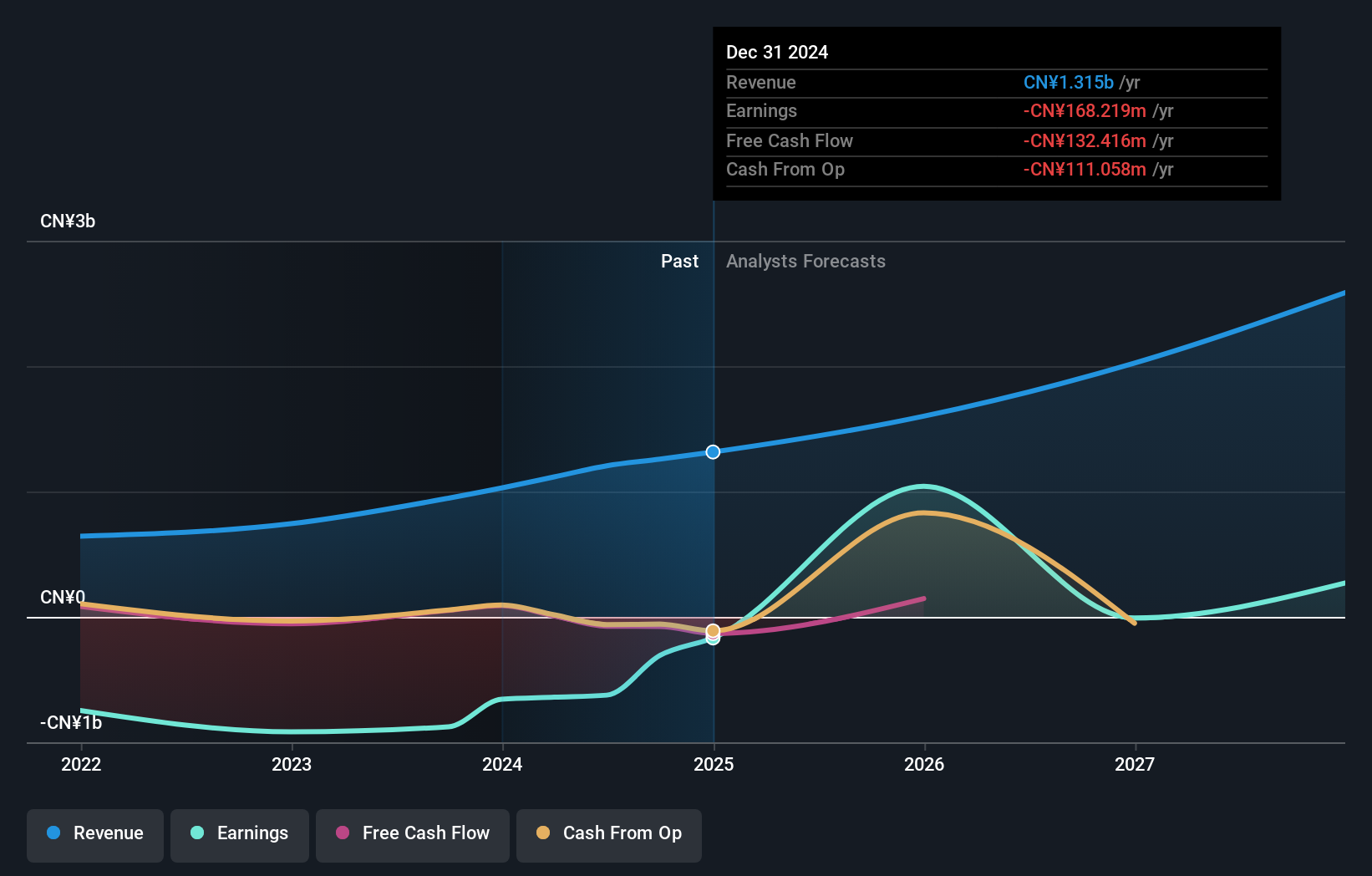

Suzhou TZTEK Technology anticipates robust growth, with earnings projected to rise 35.42% annually and revenue expected to grow at 22.3% per year, outpacing the Chinese market's average. Despite a recent net loss of CNY 13.67 million for nine months ending September 2024, insider ownership remains strong without significant trading activity in the last three months. The company's dividend coverage is weak, and share price has shown high volatility recently.

- Get an in-depth perspective on Suzhou TZTEK Technology's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Suzhou TZTEK Technology's share price might be too optimistic.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan, with a market cap of ¥228.65 billion.

Operations: The company's revenue is primarily derived from its Domestic Real Estate Fund Business at ¥75.09 billion, followed by the Lease Fund Business at ¥29.28 billion and the Overseas Real Estate Fund Business at ¥2.73 billion.

Insider Ownership: 31.5%

Earnings Growth Forecast: 14.4% p.a.

Financial Partners Group Ltd. is poised for growth with earnings projected to increase by 14.4% annually, surpassing the JP market average. The company has a favorable Price-To-Earnings ratio of 11.3x compared to the market's 13.4x, indicating potential value for investors despite its dividend not being well-covered by free cash flows. Recent strategic moves include a share buyback program aimed at enhancing shareholder value and an amendment to expand operational objectives, reflecting plans for future business expansion.

- Click here and access our complete growth analysis report to understand the dynamics of Financial Partners GroupLtd.

- The analysis detailed in our Financial Partners GroupLtd valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Click through to start exploring the rest of the 1462 Fast Growing Companies With High Insider Ownership now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688003

Suzhou TZTEK Technology

Engages in the design, development, assembly, and debugging of the industrial vision equipment in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives