Not Many Are Piling Into Chongqing Taiji Industry(Group) Co.,Ltd (SHSE:600129) Stock Yet As It Plummets 25%

Chongqing Taiji Industry(Group) Co.,Ltd (SHSE:600129) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

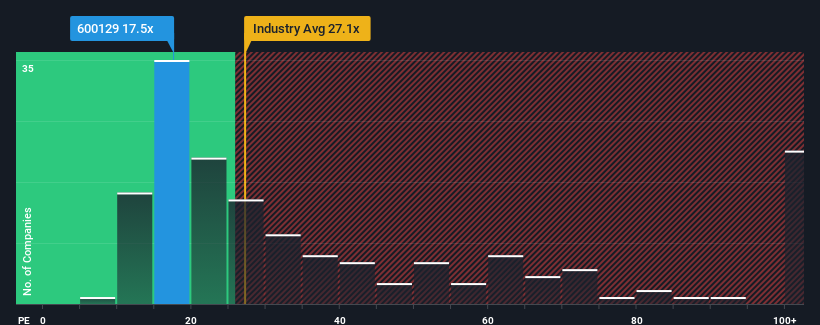

Since its price has dipped substantially, Chongqing Taiji Industry(Group)Ltd's price-to-earnings (or "P/E") ratio of 17.5x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 35x and even P/E's above 68x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Chongqing Taiji Industry(Group)Ltd has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Chongqing Taiji Industry(Group)Ltd

Is There Any Growth For Chongqing Taiji Industry(Group)Ltd?

Chongqing Taiji Industry(Group)Ltd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 105% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 78% during the coming year according to the five analysts following the company. With the market only predicted to deliver 38%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Chongqing Taiji Industry(Group)Ltd's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Chongqing Taiji Industry(Group)Ltd's P/E?

Chongqing Taiji Industry(Group)Ltd's P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Chongqing Taiji Industry(Group)Ltd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You need to take note of risks, for example - Chongqing Taiji Industry(Group)Ltd has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of Chongqing Taiji Industry(Group)Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600129

Chongqing Taiji Industry(Group)Ltd

Develops, produces, and sells traditional Chinese and modern medicine products in China and internationally.

Undervalued slight.

Market Insights

Community Narratives