As U.S.-China trade tensions reignite and global markets experience volatility, Asian tech stocks are drawing attention due to their potential for high growth amid shifting economic landscapes. In this environment, a good stock may be characterized by its resilience to geopolitical uncertainties and its strategic positioning in emerging technologies that align with current market trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 24.08% | 28.54% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Eoptolink Technology | 38.08% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Hangzhou Onechance Tech Crop (SZSE:300792)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Onechance Tech Crop. specializes in brand online marketing and management services, with a market cap of CN¥8.16 billion.

Operations: The company's primary revenue stream is derived from its advertising segment, generating CN¥1.15 billion.

Despite a challenging year with earnings growth lagging at -9%, Hangzhou Onechance Tech Crop. is poised for a significant turnaround, forecasting an earnings surge of 29.7% annually, outpacing the Chinese market's average of 26.3%. This growth is underpinned by robust revenue projections that also exceed local market trends (13.8% vs. 13.7%). Recent strategic moves, including amendments to company bylaws and expansion plans discussed in upcoming shareholder meetings, signal a proactive approach to scaling operations and refining corporate governance—elements that could enhance its competitive stance in Asia's tech landscape.

- Click to explore a detailed breakdown of our findings in Hangzhou Onechance Tech Crop's health report.

Understand Hangzhou Onechance Tech Crop's track record by examining our Past report.

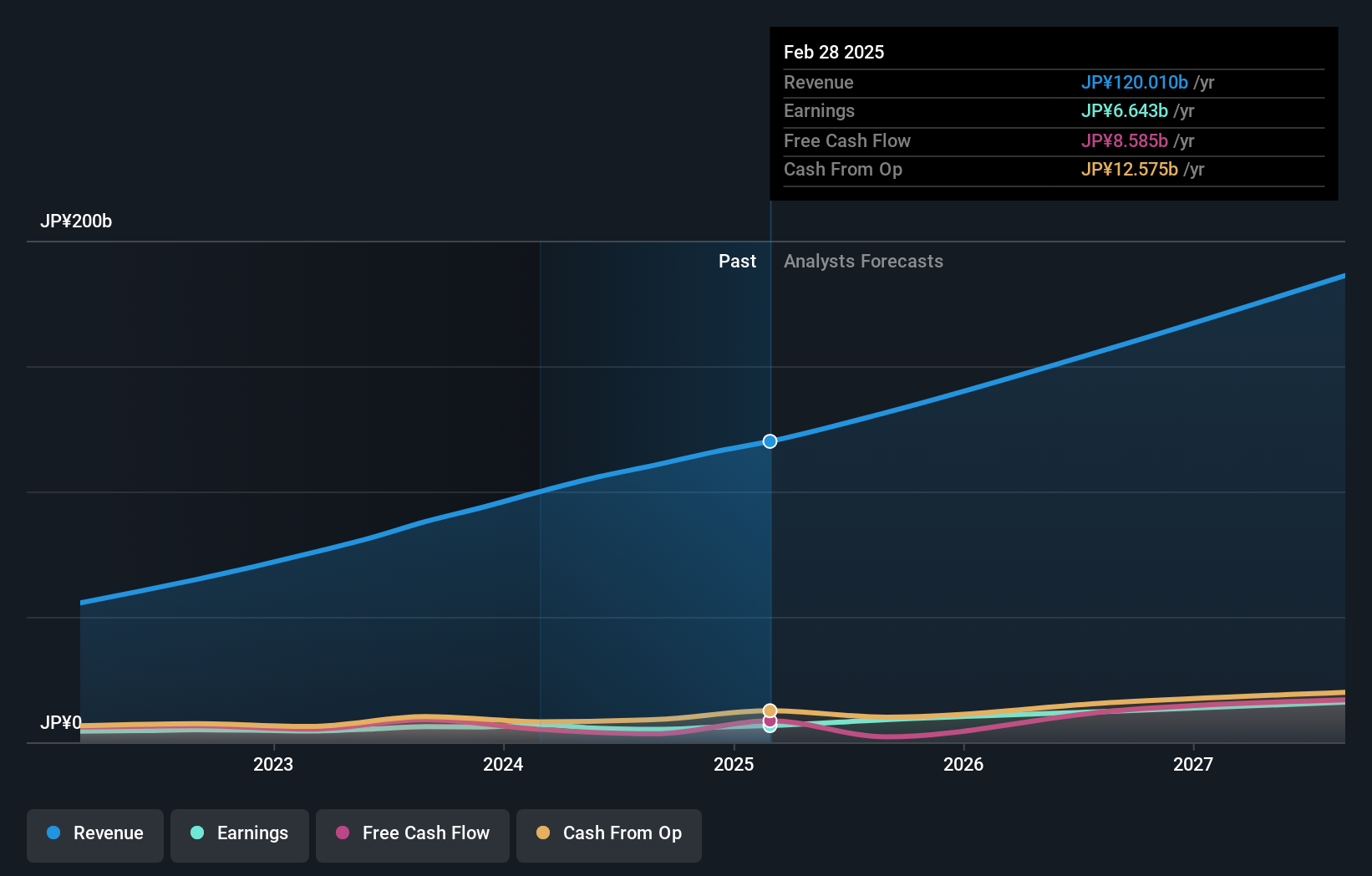

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan with a market cap of ¥324.50 billion.

Operations: The company specializes in software quality assurance and testing services within Japan. With a market cap of ¥324.50 billion, it focuses on delivering solutions that enhance software reliability and performance.

SHIFT Inc. has recently realigned its business structure, focusing on technology consulting and AI utilization to propel towards its ambitious SHIFT3000 target of ¥300 billion in net sales. This strategic pivot is supported by a robust 20.51% forecasted annual earnings growth and an impressive past year revenue increase of 74.3%, significantly outpacing the IT industry's growth rate of 17.1%. Additionally, the inclusion in the Nikkei 225 Index underscores SHIFT's growing influence and potential in Asia's tech sector, while their expansion into the Middle East with SHIFT Arabia W.L.L aims to tap into a burgeoning market for Japanese entertainment content, leveraging local nuances to enhance market penetration.

- Get an in-depth perspective on SHIFT's performance by reading our health report here.

Assess SHIFT's past performance with our detailed historical performance reports.

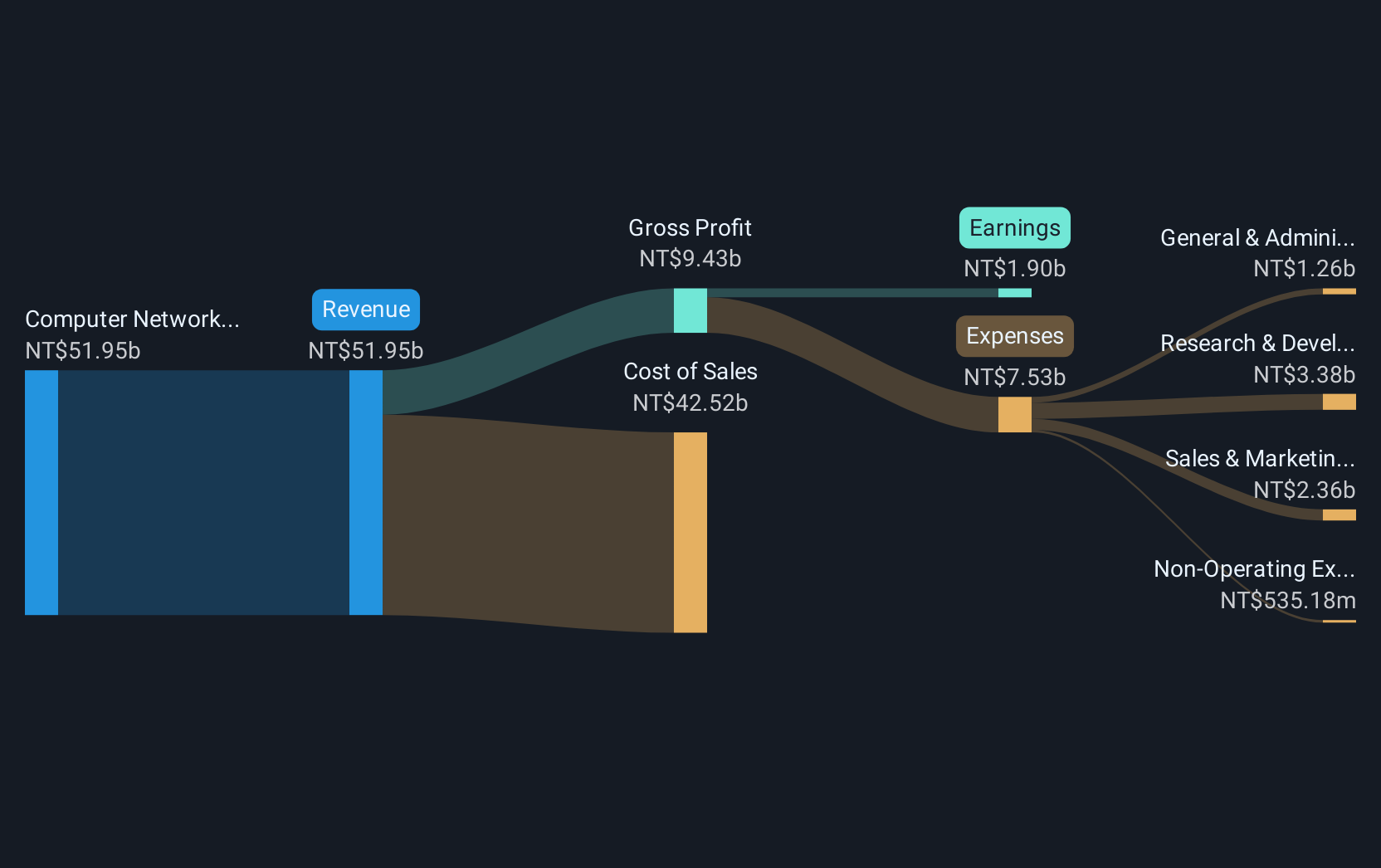

Sercomm (TWSE:5388)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sercomm Corporation engages in the research, development, manufacturing, and sale of networking communication software and equipment across North America, Europe, and the Asia Pacific with a market capitalization of NT$28.77 billion.

Operations: The company's revenue is primarily derived from its Computer Networks segment, which generated NT$50.45 billion.

Sercomm's recent strategic initiatives underscore its agility and foresight in the tech industry, particularly with its Denver Test House enhancing product testing capabilities. This facility not only reflects a commitment to innovation but also positions Sercomm as a pivotal partner in evolving connectivity solutions. Despite a challenging financial year with earnings dropping by 34.3% and revenue down to TWD 23.57 billion from TWD 29.90 billion, the company's forward-looking projects like the RDK Video Accelerator suggest a focus on reclaiming growth momentum through advanced technology deployments and market adaptability.

Where To Now?

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Asian High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Onechance Tech Crop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300792

Hangzhou Onechance Tech Crop

Provides brand online marketing and management services.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives