- China

- /

- Interactive Media and Services

- /

- SZSE:300418

Revenues Not Telling The Story For Kunlun Tech Co., Ltd. (SZSE:300418) After Shares Rise 38%

Kunlun Tech Co., Ltd. (SZSE:300418) shares have had a really impressive month, gaining 38% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.1% in the last twelve months.

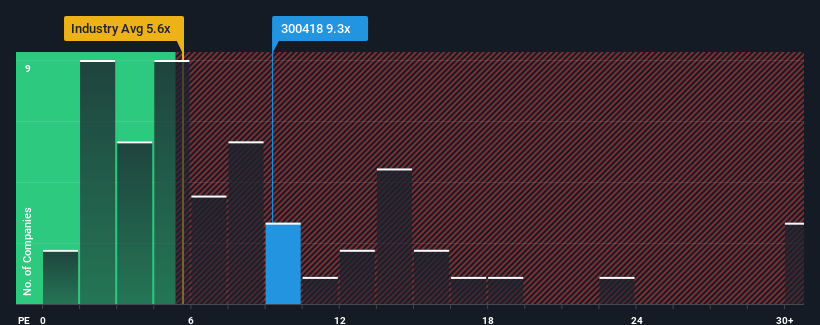

After such a large jump in price, given around half the companies in China's Entertainment industry have price-to-sales ratios (or "P/S") below 5.6x, you may consider Kunlun Tech as a stock to avoid entirely with its 9.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Kunlun Tech

What Does Kunlun Tech's P/S Mean For Shareholders?

Recent times haven't been great for Kunlun Tech as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Kunlun Tech's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Kunlun Tech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 13% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 17% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

In light of this, it's alarming that Kunlun Tech's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Kunlun Tech's P/S

Kunlun Tech's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Kunlun Tech trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Kunlun Tech that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kunlun Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300418

Kunlun Tech

Engages in the business of gaming and social entertainment platforms in China, Southeast Asia, Africa, the Middle East, North America, South America, Europe and, internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives